- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- cannot add a commercial real estate on desktop version

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

cannot add a commercial real estate on desktop version

When within a particular schedule E property, I can view the existing assets... structure, improvement 1, improvement 2, etc. I click on "Add and Asset" and the next page allows for selection of "rental real estate", "computer...", "tools,...", and "intangibles...". I select "rental real estate property". Next page only offers "residential...", "Appliances", and "land improvements". I need to add a commercial asset with 39 yrs depreciation. The residential option results in 27 years and the improvements option results in 15 years. What happened to the commercial option? Is this a bug? Just updated to the 8/24/23 version. Seems buggy since the page would at times show multiple radio buttons selected.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

cannot add a commercial real estate on desktop version

What is the asset for which you would like to choose a 39-year recovery period?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

cannot add a commercial real estate on desktop version

Thank you for your response. In that instance I was trying to add a structural repair (non-qualified) asset to an existing commercial property. Also have a new water service and new sewer service to add. In a different file I need to enter multiple 39 year assets for commercial structures on what will be a new schedule E. Have not tried that one yet but I imagine I will encounter the same obstacle. The only option the software is showing now is for residential realestate at 27.5 years. I'm suspecting a bug with the latest software update.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

cannot add a commercial real estate on desktop version

There is no bug in the program for this scenario.

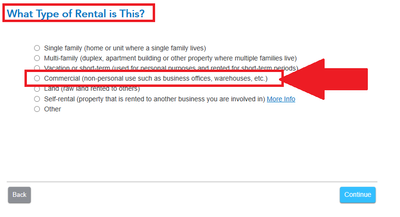

I suspect the wrong choice might have been made initially (see the screenshot below).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

cannot add a commercial real estate on desktop version

This is a previously established schedule E from years ago within which the primary asset is listed as an asset tyle "J1-Nonresidential real estate". Details show a depreciation period of 39 years. The option you indicate does not appear. This is desktop turbotax. From the "Rental and Royalty Summary" I select "edit" for the subject property. This takes me to "Review your XXX Main Street Rental Summary" where I select "Update" for "Assets/Depreciation" and proceed to "Your Property Assets". At the bottom of the list is the button "Add and Asset". This presents with 4 options, none of which are for non-residential. I select "Rental Real Estate Property" which then presents with three options... "Residential Rental Real Estate", "Appliances, carpet, furniture", and "Land Improvements". Exploring these options traps me into the wrong depreciation periods. I've been a TurboTax user for a long time (30 years perhaps?). I've not encountered this before. Thank you for your help but something seems to have changed. Where to from here?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

redmoose

Returning Member

Suffering in So Cal

Level 1

glavender-comcas

New Member

Johnny265

Returning Member

dlif2

Returning Member