- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Calculating the mortgage interest rate deduction for cash out refinance (not all funds used for home) over the years

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating the mortgage interest rate deduction for cash out refinance (not all funds used for home) over the years

Using simplified numbers for ease of understanding, but the general questions apply.

I took out a cash-out refi in 2020, and did not use all cash for my home. For instance, 300,000 mortgage got cash-out refi'd to a 400,000 loan, and used the extra 100,000 for non home related stuff (funding 529s, investments..etc). So at the time of the cash-out refinance as I understand it, 75% of my mortgage balance was related to my home acquisition debt and tax-deductible, the other 25% was not. My assumptions I'm trying to clarify are:

1. Assuming nothing changes from this starting situation, does this 75% ratio persist every year? For instance, continuing this example, if the following interest amounts were paid according my 1098s, would the actual tax-deductible proportions I need to verify on my tax form (according to the starting ratio) need to be:

2020: 32,000 total interest paid - 24,000 tax deductible

...

2022: 24,000 total interest paid - 18,000 tax deductible

2023: 20,000 total interest paid - 15,000 tax deductible

2. As I'm paying off my loan balance year after year, I assume that 75% ratio must still hold with each payment, or is there a rule that the principal payoff applies to the home acquisition debt first or the non-home acquisition debt first...etc.?

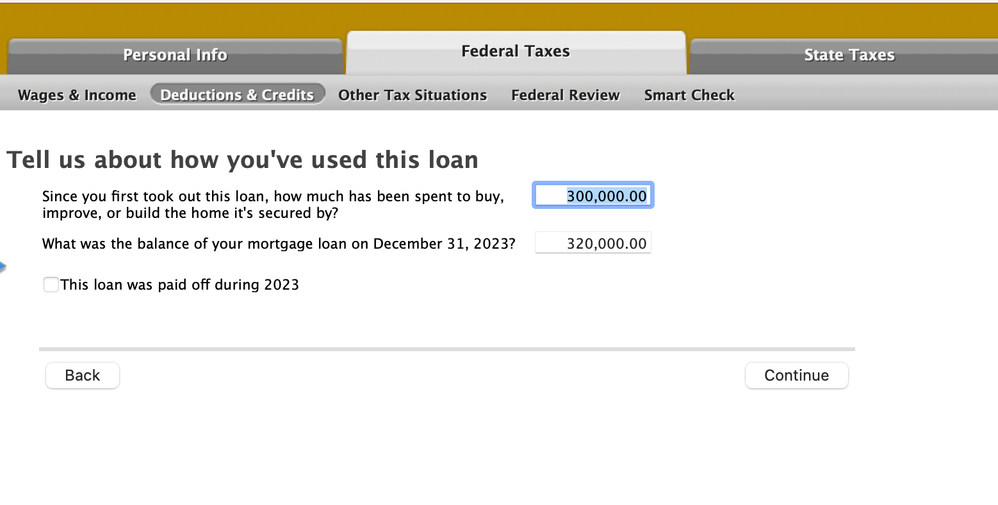

Basically, it's not clear to me in this "Tell us about how you've used this loan" screen what to enter in the first highlighted box, either the starting amount as the home acquisition debt as a constant essentially over time, or should it be changing as a ratio (in this case 75%, which in this particular example would be 240,000?) of the "balance of your mortgage loan" in the box below?

Any expert clarification would be most appreciated!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating the mortgage interest rate deduction for cash out refinance (not all funds used for home) over the years

You have a mixed use loan consisting of both acquisition and non-acquisition (equity) debt. In accordance with Pub 936, principal payments are applied to the non-acquisition balance first until it is paid down before applying any principal to the acquisition balance. The ratio of the acquisition balance over the total mortgage balance increases from 75% to 100% as the non-acquisition balance is paid down.

The amount in the 'Since you first took out this loan' box is always the total amount spent to build, buy, or substantially improve the home associated with the original mortgage and any refinance. In your case, it remains constant at $300,000.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Calculating the mortgage interest rate deduction for cash out refinance (not all funds used for home) over the years

You have a mixed use loan consisting of both acquisition and non-acquisition (equity) debt. In accordance with Pub 936, principal payments are applied to the non-acquisition balance first until it is paid down before applying any principal to the acquisition balance. The ratio of the acquisition balance over the total mortgage balance increases from 75% to 100% as the non-acquisition balance is paid down.

The amount in the 'Since you first took out this loan' box is always the total amount spent to build, buy, or substantially improve the home associated with the original mortgage and any refinance. In your case, it remains constant at $300,000.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

svetpetrov99

New Member

smitharines

New Member

mshell

Level 1

Joan2k

New Member

zomboo

Level 6