- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- CA tax return - "Interest & Dividend Adjustments" and "Adjustment for Investment Income Expenses"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA tax return - "Interest & Dividend Adjustments" and "Adjustment for Investment Income Expenses"

This is my 1st time doing my tax returns using Turbo Tax. In doing CA return - in the section "Adjustment for Investment Income Expenses" - do I put the same amount of fees charged by my Financial Advisor organization that I entered in my Federal return? Or am i misunderstanding this question.

Also - in the "Interest & Dividend Adjustments" section, there are 3 items that had "(in Federal income)" at the end of it. What does that mean? Do I need to put a number in there? I thought that CA taxable income is transferred from Federal taxable income already.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA tax return - "Interest & Dividend Adjustments" and "Adjustment for Investment Income Expenses"

All of the income and deduction items that you entered in the Federal return flow through to the California return. The interview questions in the California return allow you to enter adjustments for items that are treated differently for California than they are for the Federal return.

At the screen, "Here's the income that California handles differently", go over each item in the list that appears on your return and answer the questions. TurboTax will then make any needed adjustments.

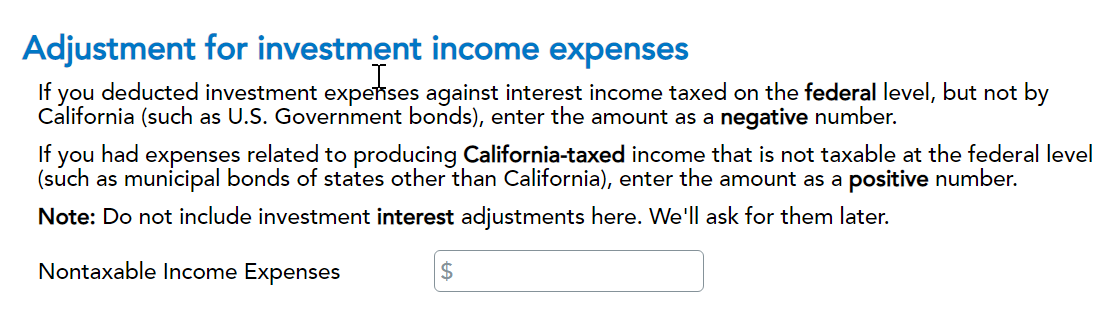

See the screenshot below of the interview question about investment income expenses.

If the expenses were for income that is taxed on the federal return but not taxed on the California return, this question is asking you to put the expense amount in as a negative number (with a minus in front of the number). If the income for which you had expenses is taxable on both the federal return and California, then you do not need to enter anything.

You can look at California Schedule CA to find all of the additions and subtractions TurboTax has made to your Federal income and deductions for your California return.

If you have a Desktop version of TurboTax, go to Forms and look at Schedule CA under the list of California forms.

In Online versions, you can preview your return before filing to find out how your taxes were calculated. See here for details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.