- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Asked to input "2021 Schedule D for AMT" Values

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Asked to input "2021 Schedule D for AMT" Values

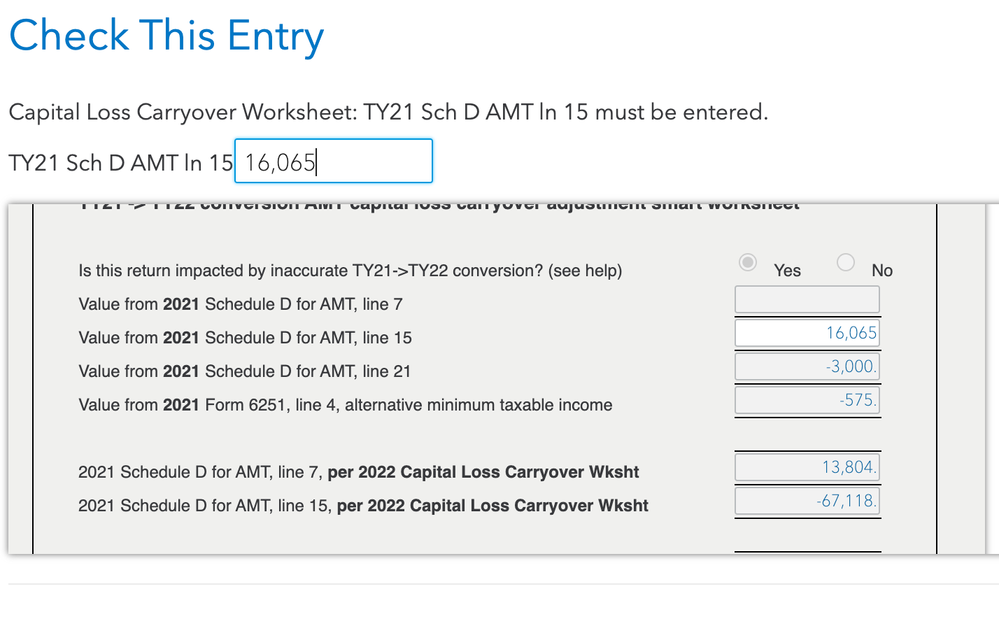

During the "Federal Review" section of my 2023 return I was asked to "Check This Entry" and enter two values from a previous 2021 return:

Value from 2021 Schedule D for AMT, Line 7

Value from 2021 Schedule D for AMT, Line 15

I couldn't find anything related to "AMT" in my 2021 Return so simply entered the Line 7 and Line 15 values from my 2021 Schedule D. Is this correct?

I have attached a screenshot below:

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Asked to input "2021 Schedule D for AMT" Values

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Asked to input "2021 Schedule D for AMT" Values

Yes, that is correct.

If you didn't have a Form 6251, and there aren't any alternate numbers for AMT listed on your capital loss carryover worksheet, that means you didn't have any AMT adjustments to your transactions.

In that case, your AMT carryover figures would be the same as the ones on your Schedule D.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

obeteta

New Member

osgood53

New Member

NeUnhappy

New Member

samT5

New Member

mizzkitty79

New Member