- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- am I an NR or a resident?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

am I an NR or a resident?

I have a question. I worked as a J1 trainee from Feb 2021 to Aug2022. Since then, I have been on a student visa F1 from Sep 2022 to Feb 2024. Then, I got a green card in February 2024.

I worked with a work permit from September 2023 and have to report my 2023 taxes. In this case, am I an NR or a resident? I filed as an NR for 2021/22.

Additionally, do i have to file FBAR? Is it okay not to do it if it's NR based on 2023? Should I start next year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

am I an NR or a resident?

Yes, since you were on a F-1 Visa status in 2023, you will file a 1040 NR return for tax year 2023. Since you are not considered a US person for tax purposes in 2023, you do not have a FBAR requirement. You will have one in 2024 since you received your green card in February.

As an FYI, Turbo Tax does not prepare 1040 NR returns but our affiliate at Sprint Tax does. Contact them for further information regarding the preparation of your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

am I an NR or a resident?

Thank you so much for your response. It was really helpful. Can I ask one more question?

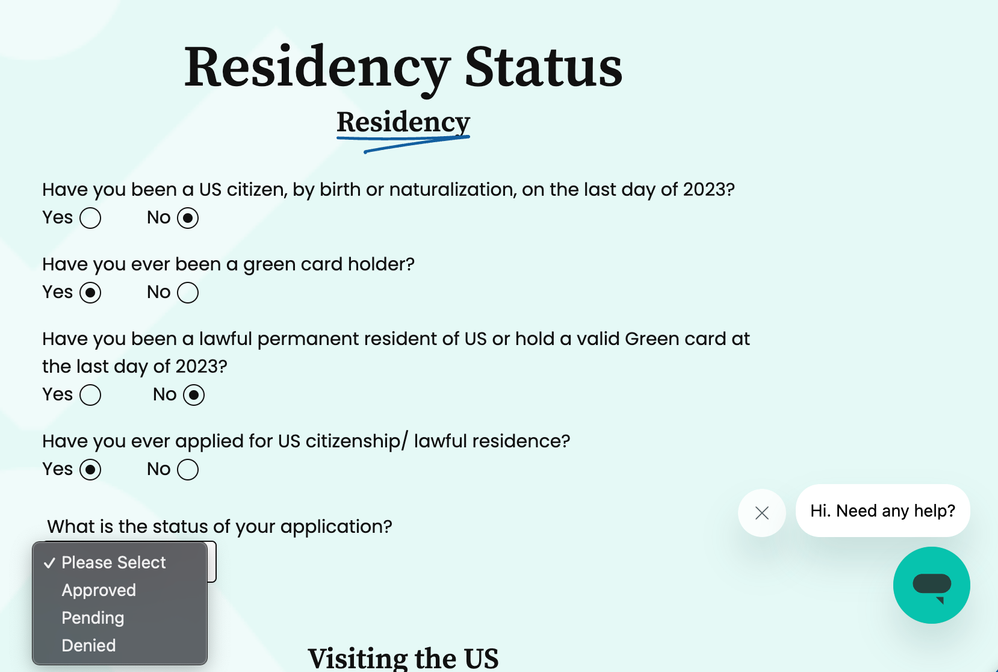

When I entered my information on Sprintex to verify my residency status, I encountered a query regarding whether I had ever applied for US citizenship or lawful permanent residency.

("Have you ever applied for US citizenship/lawful resistance?")

Subsequently, they prompted me to indicate if my application was pending, approved, or denied. As of 2023, I had not yet received my green card, and I was still awaiting a decision. Should I select 'pending' in this case?

Recently, I received approval for my green card, and I indicated that I am approved. However, I am now a resident and no longer eligible to use Sprintax. Should the standard for answering this question be based on the approval date of my green card?

In addition, Since September of last year, I have been working under a work permit obtained through green card. I did not work under a student visa OPT/CPT, but I was still attending school concurrently with my employment. I'm F1 visa holder, but I was asking because I was wondering if it was under NR or not, using the green card work permit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

am I an NR or a resident?

The green card test is for the year received. If you did not have a green card in 2023, you would file NR. Congratulations on getting the green card!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

canadaguy

New Member

swa737dude

New Member

mdsaronson

New Member

abhaynsaxena

New Member

Dan1116

New Member