- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-R ISSUE WITH ROLLOVER IRA AND SUBSEQUENT ROTH CONVERSION

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R ISSUE WITH ROLLOVER IRA AND SUBSEQUENT ROTH CONVERSION

I am sorry for this long post. I wanted to give as much details before I ask my question

Background:

I used to work for company A in 2022 which I left in 2022. In early 2023, I did 2 things:

- Did a direct rollover of the 401k money from Empower to Fidelity

- Did a Roth conversion of the rollover money at Fidelity.

Soon after Empower sent a letter in 2023 that they did some compliance testing and found that an amount of $2130.22 was excess or ineligible contribution.

----------------------------------------------------------------------------------------------------------------------------------------------------

Letter from Empower:

Qualified retirement savings plans are periodically tested to ensure that contributions made by, or on behalf of the plan's participants comply with statutory, non-discrimination and plan level rules. In order for Company A, to remain in compliance with these rules we have been instructed to distribute to you, or forfeit back to the plan, any excess or ineligible contributions. However, our records indicate that in 2023 a rollover of your account balance was taken from one or more of this employer's qualified plan accounts before this correction could be made. As a result all, or a portion of your rollover reported on form 1099-R has been corrected by an amount equal to the excess or ineligible amount(s) which we were unable to process including any attributed earnings. We have reported the total corrective amount to the IRS on a separate Form(s) 1099-R.

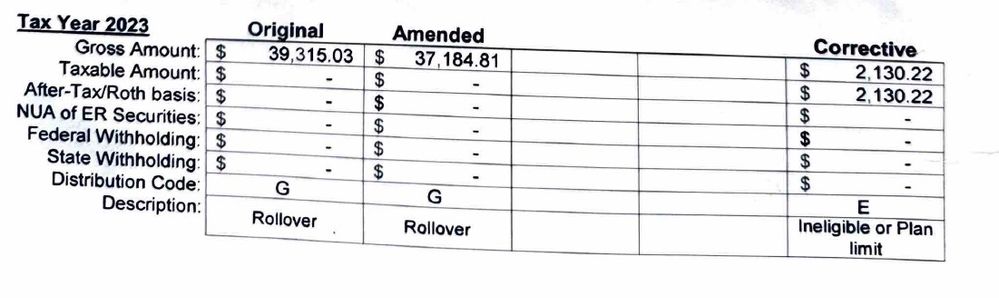

Below is a summary of the amounts reported on the original, amended and corrective Forms 1099-R including applicable earnings or losses for each test.

The corrected Tax Forms will be sent to you by January 31st of 2024. If the original amount above represents a rollover to either an IRA or other eligible retirement plan then the amount of total excess or ineligible not paid directly to you was not eligible to be rolled over. You should contact the IRA Custodian or the administrator of the receiving plan to determine if you will need to take a corrective distribution from that account. For more information regarding rollovers to an IRA refer to publication 590 Individual Retirement Arrangements (IRA's). Please contact your tax advisor for additional information.

Amount that is not eligible for rollover: $2130.22

Some or all employer contributions deemed to be excess or ineligible may be considered protected plan assets and therefore not vested. Please contact the administrator' of Company A regarding the return of these monies to the plan's forfeiture account.

Amount which may be owed to the plan : $2130.22

-----------------------------------------------------------------------------------------------------------------------------------------------------

Action I took after this letter in 2023:

I contacted Fidelity and explained the situation and they withdrew $2129.61 from my Roth and moved it to my brokerage account ( Not IRA).

In 2024, I got 4 1099-Rs - 2 from Empower and 2 from Fidelity for my rollover actions.

Empower-1099-R-Form1:

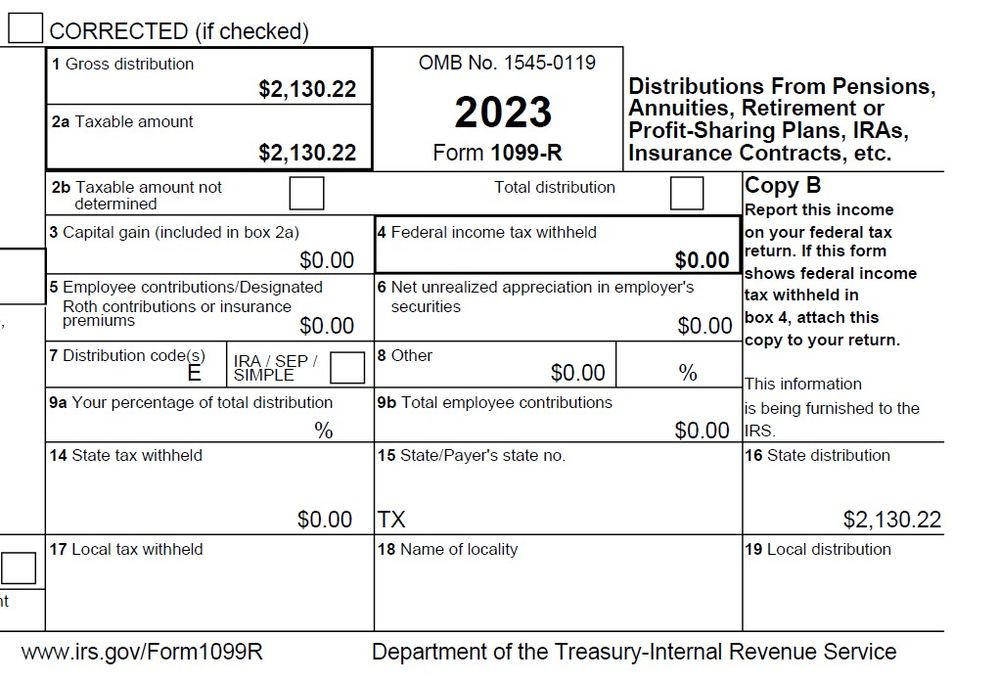

Empower-1099-R-Form2:

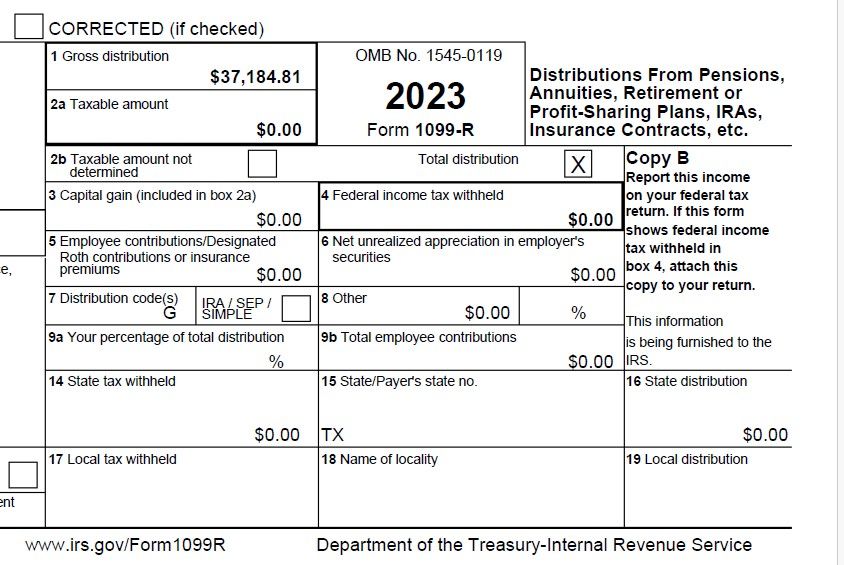

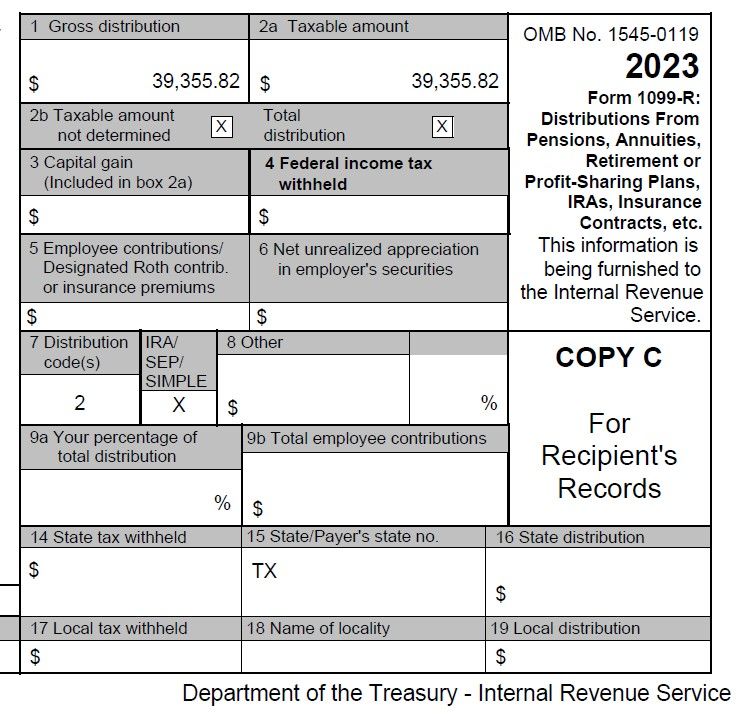

Fidelity-1099-R-Form1:

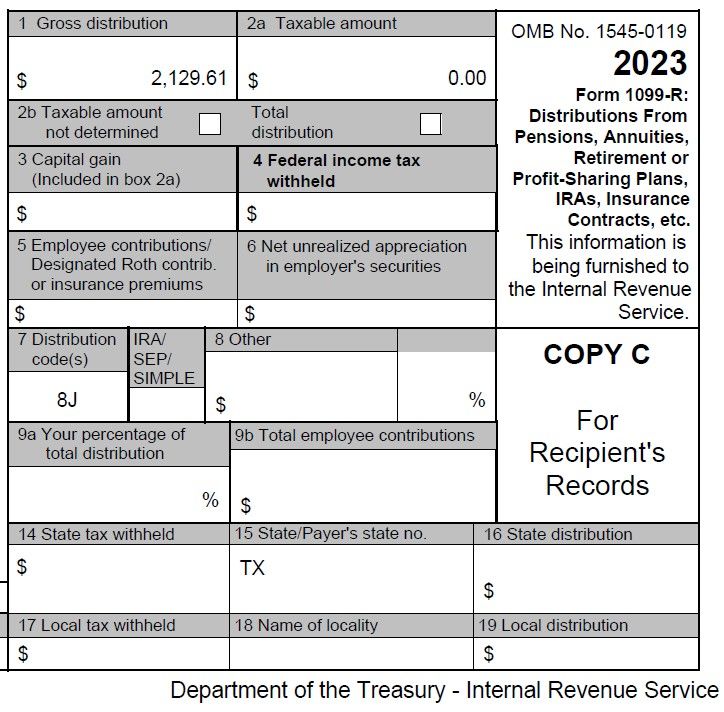

Fidelity-1099-R-Form2:

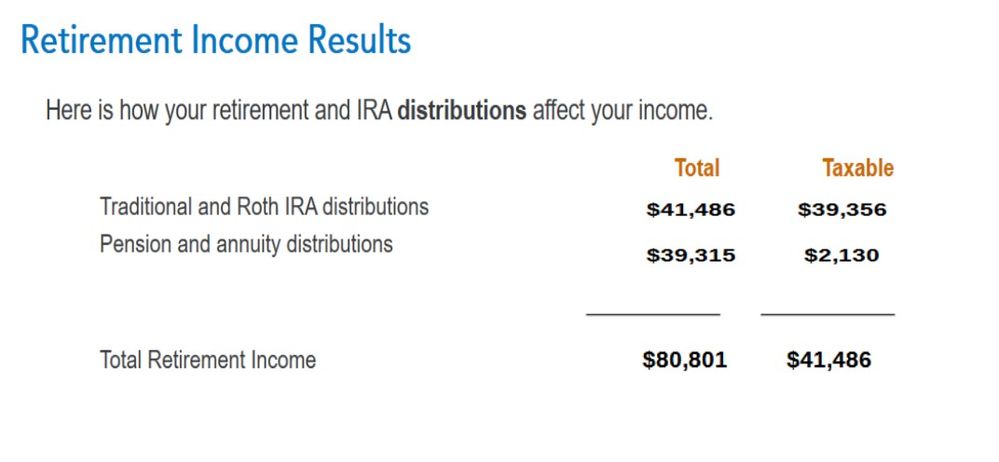

When I enter all this information in TT Premier, it is double counting the $2130. Please see below:

Box 7 distribution codes definitions:

Empower-1099-R-Form1::G - Direct rollover of a distribution to a qualified plan

Empower-1099-R-Form2::E - Distributions under Employee Plans Compliance Resolution System (EPCRS).

Fideli-1099-R-Form1::2 - Early distribution ,exception applies (under age 59 1/2)

Fideli-1099-R-Form2::8 - Excess contributions plus earnings/excess deferrals (and/or earnings) taxable in 2023

Fideli-1099-R-Form2::J - Early distribution from a Roth IRA, no known exception (in most cases, under age 59 1/2).

Question:

How do I get rid of one of the $2130 ? I should be paying taxes on $39356 but $2130 seems to be in the IRA distributions as well as Pension distributions ? Anyway to show its duplicated ?

Thanks for your help ( I am really sorry for this very long post)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R ISSUE WITH ROLLOVER IRA AND SUBSEQUENT ROTH CONVERSION

All of the reporting of the Forms 1099-R is correct. If TurboTax is reporting an early-distribution penalty on the distribution from the Roth IRA, claim an exception to the penalty on $2,129.61 for a corrective distribution made on or after December 29, 2022.

If you repay the $2,130.22 to the plan, you would make a claim of right on this amount on the tax return for the year in which the repayment is made. Being less than $3,000, the claim of right would have to be taken as an Other Itemized Deduction on Schedule A of that tax return. However, if your itemized deductions are less than your standard deduction, there won't be any benefit to claiming this deduction.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

user41124

New Member

venks24

New Member

CMontana

New Member

clarineted

Level 2

albertlin

Returning Member