- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-NEC services refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC services refund

Hello,

Last year I sold my primary residence and due to my real estate agent not performing services promised, they refunded me $4,400 of the commissions paid for the sale of my house. I received a 1099-NEC with $4,400 in box 1. Please confirm if a refund of fees paid to a real estate agency should be considered taxable income to me on a 1099-NEC.

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC services refund

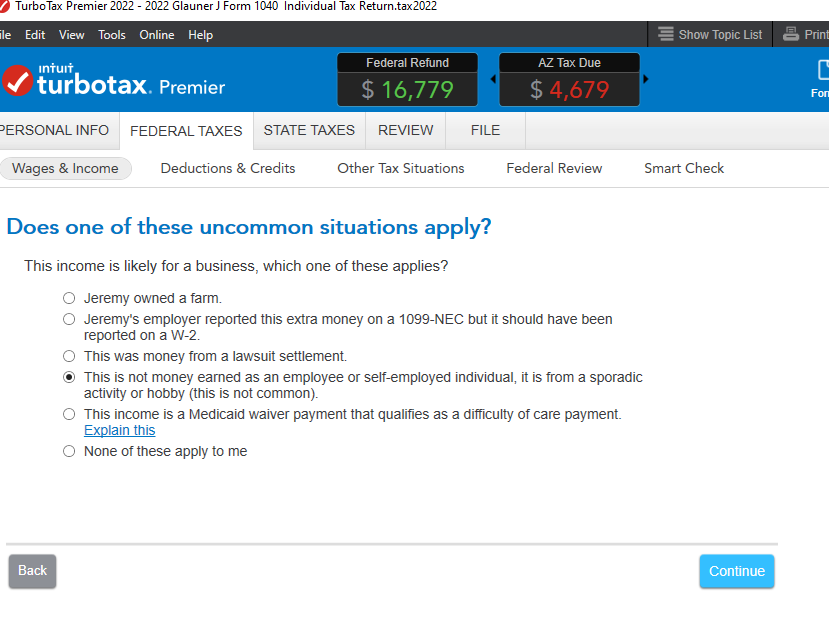

Yes, the amount reported on the 1099-NEC will be reported as income to you. However, the 1099-NEC is usually issued to report self-employment income, so you will have to indicate that in your entry.

Enter the info from your form, and on the next screen, indicate that 'this is not money earned from employment...'

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC services refund

Thank you, I was hoping a refund of money I paid for a service a month prior wouldn't be taxable income, but it sounds like it is.

Thank you

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

aaron-m-soto1

New Member

user17520162976

New Member

Dumbahoe

New Member

Dumbahoe

New Member

Dumbahoe

New Member