- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- TurboTax Premier Not Deducting Mortgage Interest on Refinanced Mortgage

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier Not Deducting Mortgage Interest on Refinanced Mortgage

My TurboTax Premier software is not deducting mortgage interest on an under $750k mortgage. I refinanced the mortgage and have 3 1098s, 1 from the original, 1 from the new, and 1 from the mortgage servicing company holding it until it was sold. Turbotax will not include mortgage interest at all. I've deleted all the 1098s and re-entered them. I've forced itemized deductions. It does not allow edits to Schedule A. What is wrong with the software?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier Not Deducting Mortgage Interest on Refinanced Mortgage

If anyone is having an issue where mortgage interest isn’t being deducted. Go to the “Forms” section by clicking the button in the top right. Then go to the “Tax & Int Wks” and go 3/4 way down to “Mortgage Interest Limited Smart Worksheet” and make sure “Does your mortgage interest need to be limited:” is set to no.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier Not Deducting Mortgage Interest on Refinanced Mortgage

When you are entering the 1098 information on the refinance mortgage you will come to one screen that ask about what you did with the funds from the refinance. If you designated that you selected that you used some or all of this loan on a different home or something other than a home, you will not be able to deduct the mortgage interest.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier Not Deducting Mortgage Interest on Refinanced Mortgage

this did not work for me. I did not withdraw any funds. When I enter each 1098, it shows the deduction but then once I hit save, the refund goes back down. Why is it deducting the interest even though it should be itemized?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier Not Deducting Mortgage Interest on Refinanced Mortgage

this is how I answered the question but it still removes the deduction from my itemized deductions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier Not Deducting Mortgage Interest on Refinanced Mortgage

Turbo tax is doin the same on my return I refinanced a mortgage that is under $750000 and didn't take any money out. It isn't allowing any interest deduction and then says standard deduction is better

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier Not Deducting Mortgage Interest on Refinanced Mortgage

Review the entries for you mortgage loan for the refinanced loan. The amount in Box 2 for the refinanced loan should be $0. The program is asking for the balance due as of 01/01/2019 for the refinanced loan the amount is $0. Once you make this change it will resolve the issue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier Not Deducting Mortgage Interest on Refinanced Mortgage

Turbo tax won't allow a $0 in box 2. I get an error message.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier Not Deducting Mortgage Interest on Refinanced Mortgage

For box 2 enter $1 that should resolve the issue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier Not Deducting Mortgage Interest on Refinanced Mortgage

If anyone is having an issue where mortgage interest isn’t being deducted. Go to the “Forms” section by clicking the button in the top right. Then go to the “Tax & Int Wks” and go 3/4 way down to “Mortgage Interest Limited Smart Worksheet” and make sure “Does your mortgage interest need to be limited:” is set to no.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier Not Deducting Mortgage Interest on Refinanced Mortgage

I had a complicated year with my mortgage:

I refinanced and combined 2 previous loans into 1 in March

-so I have 2 1098 forms from previous loans and 1 from new lender

That loan was sold, so I have another 1098 from that lender

I refinanced again, so I have a 5th 1098 from that lender

If I enter $0 in box 2 of all of them, except for the 2 loans I had in the beginning of the year, when I do my federal review check, it says I must enter the "amount borrowed this year" for each of the other 1098 forms.

But if I do that - it thinks I have more than $750k in mortgage balance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier Not Deducting Mortgage Interest on Refinanced Mortgage

Enter the 1098(s) as reported. Box 2 should not be blank. Box 2 is the balance of the loan on 01-01-2019 OR the balance on the day the loan was taken out in 2019. Answer the interview questions carefully.

If you get an error concerning the balance, please follow these directions:

ONLINE USERS:

Please go back to the Home Mortgage Interest section:

Click Federal on the left side-bar

Click Deductions & Credits along the top

Scroll down to “Mortgage Interest and Refinancing (Form 1098)” Click Edit/Add

Scroll down the “Here’s your 1098 info” screen and click Done.

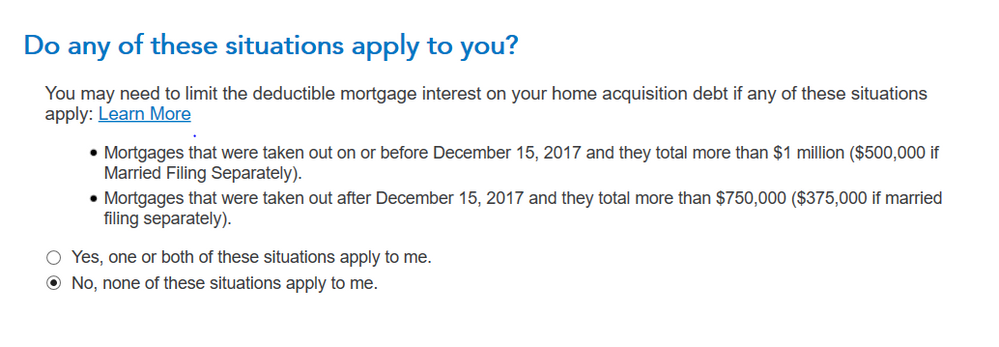

Next screen asks “Do any of these situations apply to you?” Select “Yes, one or all of these situations apply to me.” and Continue.

On the following screen, you will see the “Original amount”.

Enter the amount you can claim as a Home Mortgage Interest deduction in the “Adjusted amount” box. The Adjusted amount cannot be larger than the original amount or you will receive an error when trying to file. Instructions on who needs to adjust interest and how to calculate are available by clicking the blue “Help me figure this out” link.

DESKTOP USERS:

Go into Forms (top right)

Enter the amount on Tax & Int Wks

Mortgage Interest Limited Smart Worksheet section

Line A2

OR

Step by Step

Federal

Deductions & Credits

Mortgage Interest, Refinancing and Insurance Click Update

Click Done

Click Yes, one or both of these situations apply to me. And Continue

Enter the Adjusted amount and Continue

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier Not Deducting Mortgage Interest on Refinanced Mortgage

@KrisD15 - So, I've tried what you've suggested - the only place I see to adjust the mortgage interest amount is in the CA State filing section. So I adjusted the amount to zero (because had a -$8k amount in there which should be deductible) This made my amount due much less, but the worksheet for the Mortgage Interest still has my Average Balance of home debt at over $1.4M (because it's adding up all of my refinanced balances, even though I only had 1 mortgage at at time around $600k) and therefore the worksheet doesn't match what I've changed in the system. I feel like these numbers should be accurate. How do I fix them?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier Not Deducting Mortgage Interest on Refinanced Mortgage

Are you getting the correct interest reported on the federal Schedule A?

The worksheet is a TurboTax worksheet. It is not transmitted as part of your return to the IRS. If you made an adjustment, you should keep record of how you determined that adjustment with your tax file.

The worksheet uses the numbers from the 1098, but the 1098 does not tell the whole story.

If the interest is being reported properly on your return, there is nothing for you to adjust.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier Not Deducting Mortgage Interest on Refinanced Mortgage

This worked!! I spent hours re-entering info only to have the software automatically apply the standard deduction when it shouldn't have. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Premier Not Deducting Mortgage Interest on Refinanced Mortgage

This is spot on! I don't know why Turbo Tax changed it. I wasn't even working on that portion and all of the sudden my return dropped by thousands. This was the problem. Great answer and Thanks!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

eshwar_s

New Member

jrW9A8dBAY

New Member

larko33139

New Member

yysegedin

Level 1

qshtax

Returning Member