- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Refinanced mortgage 1098 messing up deduction from original loan

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced mortgage 1098 messing up deduction from original loan

Perhaps these steps will be helpful.

In TurboTax Online Deluxe, I was able to enter a home loan on an IRS form 1098 and the second IRS form 1098 for the refinanced loan. For the refinanced loan, I used the balance of the loan at the time of loan pay-off.

I was given the full mortgage interest deduction and the Home Mortgage Interest Limitation Worksheet did not add the two mortgage balances together.

The entries were made at Federal / Deductions & Credits / Mortgage Interest (Form 1098).

Entries for the original loan

Do any of these uncommon situations, I entered None of these apply.

Did you pay points, I entered I’ve already deducted.

Was this loan paid off or refinanced, I entered Yes.

Is this loan a home equity, I entered No, this is the original loan.

Entries for the second loan

Do any of these uncommon situations, I entered None of these apply.

Did you pay points, I entered I didn’t pay points.

Was this loan paid off or refinanced, I entered No.

Is this loan a home equity, I entered Yes, this is a loan I’ve refinanced.

So what type of loan is it? I entered A mortgage loan that I’ve refinanced.

Have you ever pulled cash? I entered No.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced mortgage 1098 messing up deduction from original loan

I face the same issue but related to the sale of my primary home and purchase of a new one. What is the guidance in this case? The guidance so far only covers a simple refi scenario.

Should i combine the 1098 from the now sold home with the 1098 of the new primary residence?

Example:

Old Home Mortgage 800K

New Home Mortgage 800K

Turbo Tax assumes a Total of the Average Mortgage Balances of 1.6 million even though both mortgages were not active at the same time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced mortgage 1098 messing up deduction from original loan

It depends if the old home was used to finance the new one.

The following answer was given by KrisD15 on this thread:

Be aware that in order to deduct the Home Mortgage Interest, the loan needs to be secured by the home. Since you combined the loans, only the portion attributed to the house that secures the loan counts.

For example, say you bought a house for 200,000 and a second for 100,000.

When you have a balance of 150,00 and 75,000 the first house is worth more, so you take a new mortgage out for 225,000 on the first house and pay off the original 2 loans.

You can only claim interest on part of your new loan. The new loan is on your first home which you paid 200,000 for, but only had a balance of 150,000 when you refinanced; Therefore the amount of debt you can claim interest on for that loan is 150,000.

The interest on the 75,000 is not deductible because it is not on a loan secured by the second house.

In this example, only 67% of the interest is considered Home Mortgage Interest.

According to the IRS:

“Refinanced home acquisition debt.

Any secured debt you use to refinance home acquisition debt is treated as home acquisition debt. However, the new debt will qualify as home acquisition debt only up to the amount of the balance of the old mortgage principal just before the refinancing. Any additional debt not used to buy, build, or substantially improve a qualified home isn't home acquisition debt.”

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced mortgage 1098 messing up deduction from original loan

Thank you for your help. Let me add some additional details.

Old Primary Residence had 2 mortgages (1st 550k, 2nd 150K) Total 700K. I have 2 1098s, one from each loan. Loans were secured by the residence.

This was sold in Sept 2020 and a new Primary residence was purchased in Sept 2020 with a single mortgage. Proceeds of the sale of the old home were used to purchase the new home.

New Primary Residence now has one mortgage totaling 732k, I have one 1098 from this mortgage. New mortgage total is greater than the total of the old 2 mortgages. Loan is secured by the residence.

If I understand you correctly you are saying that I should combine these 3 1098 into a single entry in Easy Step?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced mortgage 1098 messing up deduction from original loan

Yes, here are the steps:

How do I handle multiple 1098 mortgage forms?

If you have multiple 1098 mortgage forms, you’ll enter them one at a time. After going through the steps with the first one, you can add a lender when you get to the Mortgage deduction summary screen. (In the case of a refinance, it's best to enter the 1098 from your original loan before the 1098 from your refinance.)

But, if they're both from the same lender, and one of them has the “Corrected” checkbox marked at the top, enter the corrected 1098 and discard or shred the other one.

What do I do if I have multiple 1098s from refinancing my home debt?

If your total home debt is under $375,000 ($250,000 for married filing separate) there is nothing new for you to do in 2020. Enter each 1098 as you normally would.

Home Debt Over $375,000

Under tax law, you are limited on the amount of home interest you can deduct. The limit is based on the loan amount and date of the origination of debt. We want to make sure we calculate this correctly for you.

If you refinanced last year, you’ll have a Form 1098 from your previous lender and one from the lender you refinanced with. You’ll need both forms.

Follow these steps to enter your mortgage information:

- Gather all of your 1098 forms related to your refinance (the form from your original lender and the form from your new lender)

- Grab a calculator and add together the box 1 amount from each form. Enter the total in TurboTax as Box 1 Mortgage interest.

- Add the Box 5 amount from each form and enter the total as Box 5 Mortgage insurance premiums. (If you weren’t required to pay mortgage interest, these boxes will be blank on your forms and you won’t enter anything.)

- Add the property tax paid from each form and enter it in the Property (real estate) taxes box.

Next, finish adding info for boxes 2, 3, 7, and 11 using Form 1098 for the original loan.

What if I have more than two 1098s?

You should combine all of the 1098s directly related to the refinance and enter it as one 1098. An example of this is if you refinanced two loans into one loan. Any 1098s not directly related to the refinance should get entered separately.

What if I paid points?

Points on Loans Paid Off in 2020: Enter the points on your 1098 you have started and mark you paid off the loan when promoted.

Points on Loans on New Loans: You will want to enter a separate 1098 to cover these points paid. When prompted, enter 0.00 for Boxes 1, 2, 5, and the Property (real estate) taxes box, and checkbox 7, as you’ve already entered the details on your first 1098. For Box 3, add the date in 2020 when the loan originated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced mortgage 1098 messing up deduction from original loan

Very serious calculation error. I refinanced my home in 2020. Original Loan with PHH; Broker for refinance was NFM; then NFM sold loan back to PHH. I have three 1098s with $19327 interest paid but Turbotax is limiting my mortgage interest deduction to only $5641. Real problem. Please tell me there is a fix in the works!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced mortgage 1098 messing up deduction from original loan

Here is an alternative solution.

If you've refinanced or had your mortgage lender changed, the outstanding mortgage principal listed in the combined total of them on Line 2 of the 1098 will be too large.

When you put an outstanding balance in both forms, then the program adds them together and if that number is greater than $750k, then it puts you in the category to "limit interest".

To get that to go away, you need to go back to the deductions section and click on "edit" mortgage interest statement. Enter both 1098's.

Change the line 2 of the mortgage that you no longer owe on (like the one that you refinanced and paid off) to a 0 (zero) because you have refinanced out of that loan and no longer have an "outstanding mortgage principal".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced mortgage 1098 messing up deduction from original loan

This method does not work - there is an error prompt saying that "outstanding mortgage principal" must be greater than 0.

I entered $1 and it worked.

Please advise which method is more correct: Entering a $0-1 mortgage principal on refinanced loans or entering all loan data on one combined entry as previous reps have suggested.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced mortgage 1098 messing up deduction from original loan

Entering all of the loan data on one combined form is a better option, especially if the mortgage amounts are high. If they are lower amounts, it probably won't matter, but if the amounts are high (and maybe limited) entering multiple forms can create a limitation higher than required. And this causes you not to get as high of a mortgage interest deduction as you qualify for.

If you see the total amount of mortgage interest on Schedule A, you can leave it as is. But if your interest is limited, make sure that you are getting the full amount of your interest deduction. Mortgage amounts over 750K may be limited. And if you have multiple 1098 forms, sometimes the balances are added together instead of averaged. If totaled instead of averaged, the deduction may be understated. @Toggleme

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced mortgage 1098 messing up deduction from original loan

Just enter a number smaller than 0.5 and it will round up to 0 without an error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced mortgage 1098 messing up deduction from original loan

I'm having the same issue here… tens of thousands of dollars. what's up turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced mortgage 1098 messing up deduction from original loan

There is a known problem with Home Mortgage Deduction. TurboTax is working to fix the problem and the many other issues. There are many changes due to the CARES Act that require software upgrades. We have not been given an expected date for the fix yet. Please check back often to see if you can file your return.

OR

In the meantime, you can try this work around. You did not provide the details of your Mortgage situation and therefore I am giving you a general work around that might help. Please try this.

If there is a refi and there was an outstanding mortgage principal listed in both of them on Line 2 on the 1098. When you do put an outstanding balance in both forms, then the program adds them together and if that number is greater than $750k, then it puts you in the category to "limit interest". To get that to go away, you need to go back to the deductions section and click on "edit" mortgage interest statement. Change the line 2 of the mortgage that you no longer owe on (like the one that you refinanced and paid off) to a 0 (zero) because you have refinanced out of that loan and no longer have an "outstanding mortgage principal". Once you change one of them to zero (the one that was paid off by the refinance) then it should no longer pop up with that error at the end when you go to file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced mortgage 1098 messing up deduction from original loan

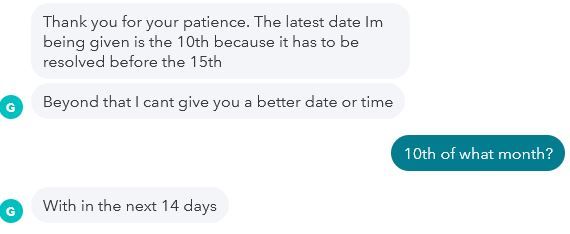

I was told through chat that this would be resolved by April 10th, is that accurate? Will this solution be for online and desktop? I am not about to re-return everything into an online version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced mortgage 1098 messing up deduction from original loan

Is there a fix available for this issue? Today is 11th April and need to file the taxes !!!!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinanced mortgage 1098 messing up deduction from original loan

TurboTax is using an oversimplified method for calculating average loan balance for the year, that only comes close to the correct average balance value when the loan is held for the whole year and roughly equal size principal payments are made, roughly evenly spaced throughout the year:

Avg Balance = (starting balance + ending balance) / 2

where the starting balance is the first balance > 0 and the ending balance is the last balance > 0 during the year.

It is grossly inaccurate for ANY loan that is not held for the entire year (the shorter the portion of the year the loan is outstanding, the more inaccurate the estimate for the average balance), and it always overestimates the average loan balance if the other two assumptions (roughly equal loan principal payments, roughly equally spaced while the loan is outstanding) are true.

When this is usually noticed is in a refinance situation, when you have TWO or more such loans, and adding them up puts you over the qualified loan limit for the deduction.

The correct modification to this formula, for a loan that only has a nonzero balance for part of the year, is:

Avg Balance = ((# of months with positive loan balance) / 12) * (starting balance + ending balance) / 2

***

***

Intuit most likely haven't considered this a bug for the past THREE years, because it IS an average mortgage balance calculation formula that the IRS suggests as an option (the first option, actually) in Pub 936. The other options the IRS suggests include:

1. Avg Balance = interest paid / annual interest rate

TurboTax doesn't ask for your interest rate. This formula assumes you make regular interest payments for the duration of time you hold the loan so there is no compounding of interest.

2. Avg Balance = (sum of all principal balances on monthly statements from the lender) / (# of months loan is secured by your qualified home)

TurboTax doesn't ask for loan balances on all of your monthly statements. As described in Pub 936, this formula, like the (beginning bal + ending bal) / 2 formula, calculates the average balance during the time that the loan is outstanding; it only gives a reasonable estimate of average balance for the year if the loan is held for the whole year, and it assumes statements are received monthly. In that case only, it gives a reasonable estimate that is more accomodating of variations in the size of your monthly principal payment than the (beginning bal + ending bal) / 2 formula. To correct this "sum of monthly loan balances" formula to get a reasonable average balance when the loan is only outstanding for part of the year, divide by 12, not the number of months with a positive loan balance.

3. Avg Balance = average balance for the year reported to you by your lender

TurboTax doesn't ask for this. If your lender provides it (and hopefully they calculated it correctly for the whole year, and not just for the months when there was an outstanding balance), then you could use this.

4. A variation of method 2 for "Mixed-use mortgages" that are a mixture of grandfathered debt (from before 1987), home acquisition debt, and home equity debt. Here, principal payments are allocated to different types of debt in the loan for each month; in both of the examples given, the resulting monthly balances for each type of dept are added up, and divided by 12. This method should yield the right answer for a home acquisition debt loan that is outstanding for only part of the year.

If you have the Desktop version of TurboTax, you can click Forms at top right of the screen to go into the Home Mortgage Interest Worksheet for the lender, scroll down to the Home Mortgage Interest Limitation Smart Worksheet section, and override line F7, the "Average loan balance", by clicking Ctrl-D. Enter one of the estimates above.

Rebeccah

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Hardway

Level 2

zbchristy501

Returning Member

elahoo

Level 2

mamamids

New Member

nrp13

Level 1