- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: TurboTax would not include attorney fees in my itemized deduction although it is more than 2%...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax would not include attorney fees in my itemized deduction although it is more than 2% of AGI.

We have attorney fees and damage reported on 1099-misc for employment dispute. I entered the attorney fee, which is greater than 2% of our AGI, but TurboTax won't include the attorney fees in our itemized deduction. After I entered the attorney fees, the next screen says "While your legal fees didn't affect your federal or state return, you now have a record of your info for future reference, which is smart."

Isn't attorney fees related to employment dispute deductible?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax would not include attorney fees in my itemized deduction although it is more than 2% of AGI.

"Above the line" employment discrimination fees cannot be entered as Miscellaneous income (that goes on Schedule 1 line 8 and is for income received from lawsuits not for attorneys fees) but must be entered on Schedule 1 line 22 and identified as "UDC".

This is not supported by TurboTax but can be done with direct form entry but only in the forms mode with the desktop versions.

That is a calculation the TurboTax does not support. See this TurboTax article:

19. Legal Fees for Unlawful Discrimination Lawsuits: This is not supported in TurboTax.

IRS form 1040 Schedule 1 line 22 instructions.

• Attorney fees and court costs for

actions involving certain unlawful discrimination

claims, but only to the extent

of gross income from such actions

(see Pub. 525). Identify as “UDC.”

Pub 525 page 30 says:

https://www.irs.gov/pub/irs-pdf/p525.pdf

discrimination suits. You may be able to de-duct attorney fees and court costs paid to re-cover a judgment or settlement for a claim of unlawful discrimination under various provisions of federal, state, and local law listed in section 62(e), a claim against the U.S. Government, or a claim under section 1862(b)(3)(A) of the Social Security Act. You can claim this deduction as an adjustment to income on Schedule 1 (Form 1040 or 1040-SR), line 22. The following rules apply.

•

The attorney fees and court costs may be paid by you or on your behalf in connection with the claim for unlawful discrimination, the claim against the U.S. Government, or the claim under section 1862(b)(3)(A) of the Social Security Act.

•

The deduction you're claiming can't be more than the amount of the judgment or settlement you're including in income for the tax year.

•

The judgment or settlement to which your attorney fees and court costs apply must occur after October 22, 2004.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax would not include attorney fees in my itemized deduction although it is more than 2% of AGI.

Some attorney fees used to be deductible as miscellaneous itemized deductions, but that deduction has been suspended for several years as a part of the new tax laws that went into effect in 2018.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax would not include attorney fees in my itemized deduction although it is more than 2% of AGI.

Were these attorneys fees something that was deducted from the settlement you received that is being reported as income? Or did you pay attorney fees in order to defend yourself from a lawsuit for a business that you are reporting on schedule C?

You can’t deduct attorneys fees as a personal itemized deduction any longer, but that does not effect your ability to deduct legitimate business expenses if this was business related. In that case, you are putting the fees in the wrong place.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax would not include attorney fees in my itemized deduction although it is more than 2% of AGI.

Under the Tax Cuts and Jobs Act (TCJA) that Congress signed into law on December 22, 2017, the deduction for the 2% miscellaneous expenses has been suspended in tax years 2018 through 2025

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax would not include attorney fees in my itemized deduction although it is more than 2% of AGI.

its an employment lawsuit and settlement was divided into attorney fees and damages. we received 1099-misc with both the attorney fee and damages report on it. although the new tax law removed claiming personal lawsuit, isn't employment lawsuit an exception?

thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax would not include attorney fees in my itemized deduction although it is more than 2% of AGI.

Yes, it is.

To enter your qualifying legal fees from an employment discrimination suit in TurboTax Online,

- Click Federal in the left pane

- Click the Wages & Income tab near the top

- Scroll down to Less Common Income, then Show more

- Next to Miscellaneous Income, click Start/Revisit

- Select Start next to Other reportable income

- Enter your information on the Other Taxable Income screen, with the description "Qualifying Legal Fees," and enter the amount as a negative number.

The deduction will appear as an “above the line” deduction, and will be deducted from your gross income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax would not include attorney fees in my itemized deduction although it is more than 2% of AGI.

Thank you for guiding the steps.

Do we need to include any document to support the claim of "Qualifying Legal Fees" in our return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax would not include attorney fees in my itemized deduction although it is more than 2% of AGI.

If you are paper-filing, it wouldn't hurt to staple a copy of relevant documentation to your return.

You can't attach anything if e-filing, though.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax would not include attorney fees in my itemized deduction although it is more than 2% of AGI.

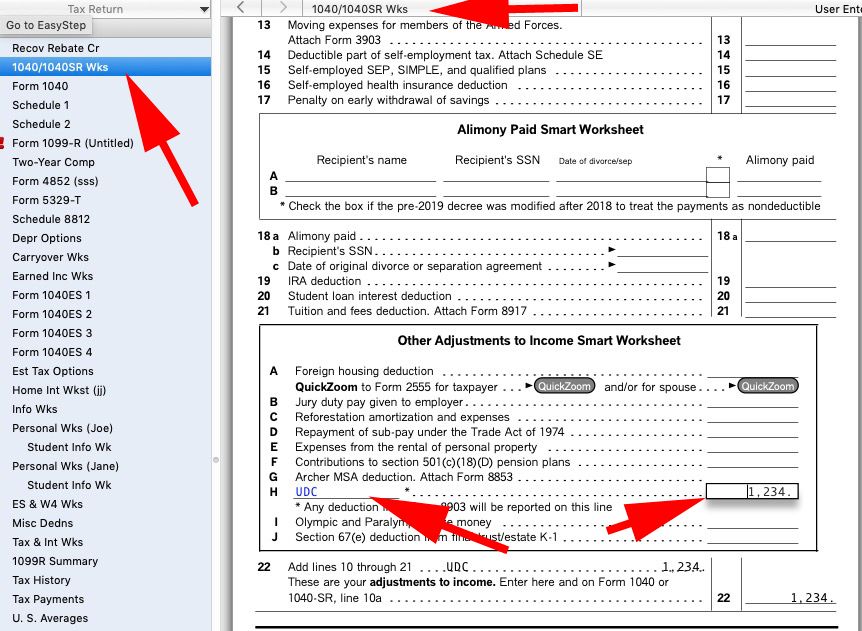

"Above the line" employment discrimination fees cannot be entered as Miscellaneous income (that goes on Schedule 1 line 8 and is for income received from lawsuits not for attorneys fees) but must be entered on Schedule 1 line 22 and identified as "UDC".

This is not supported by TurboTax but can be done with direct form entry but only in the forms mode with the desktop versions.

That is a calculation the TurboTax does not support. See this TurboTax article:

19. Legal Fees for Unlawful Discrimination Lawsuits: This is not supported in TurboTax.

IRS form 1040 Schedule 1 line 22 instructions.

• Attorney fees and court costs for

actions involving certain unlawful discrimination

claims, but only to the extent

of gross income from such actions

(see Pub. 525). Identify as “UDC.”

Pub 525 page 30 says:

https://www.irs.gov/pub/irs-pdf/p525.pdf

discrimination suits. You may be able to de-duct attorney fees and court costs paid to re-cover a judgment or settlement for a claim of unlawful discrimination under various provisions of federal, state, and local law listed in section 62(e), a claim against the U.S. Government, or a claim under section 1862(b)(3)(A) of the Social Security Act. You can claim this deduction as an adjustment to income on Schedule 1 (Form 1040 or 1040-SR), line 22. The following rules apply.

•

The attorney fees and court costs may be paid by you or on your behalf in connection with the claim for unlawful discrimination, the claim against the U.S. Government, or the claim under section 1862(b)(3)(A) of the Social Security Act.

•

The deduction you're claiming can't be more than the amount of the judgment or settlement you're including in income for the tax year.

•

The judgment or settlement to which your attorney fees and court costs apply must occur after October 22, 2004.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax would not include attorney fees in my itemized deduction although it is more than 2% of AGI.

I concur. The correct procedures to make a manual entry using forms mode on the desktop product.

Although adding a negative income amount will get you the same result, it will also most likely get you a letter from the IRS. While you have an explanation, it would be better to do it properly in the first place and not get the letter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax would not include attorney fees in my itemized deduction although it is more than 2% of AGI.

Would this actually be entered under "H" in "Other Adjustment to Income Smart Worksheet"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax would not include attorney fees in my itemized deduction although it is more than 2% of AGI.

Yes, it will be on line H as UDC "Unsupported Calculations document " Click here: Attorney fees

The above the line legal fees deduction is very limited. TurboTax online does not support this entry. You will need to use TurboTax desktop and manually enter the info. For more information, continue to read:

With the TCJA, it eliminates miscellaneous itemized deductions including the legal fees. Prior to the 2017 Act, you could deduct legal fees that were greater than 2% of your adjusted gross income as a miscellaneous expense. However, not anymore after 2017. However, there are still some legal fees that might qualify for an above-the-line deduction against your gross income like discrimination or Trade & Business related. To see deductible legal fees, click here: https://www.irs.gov/pub/irs-pdf/i1040gi.pdf ( Page 90 line 22)

@shahrkster

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax would not include attorney fees in my itemized deduction although it is more than 2% of AGI.

Good morning. Have a question about attorneys fees.. I did as mentioned above on line 22 but i get this message "deductible self emplyment tax" and an amount of $253. I reaserched online and it says because I entered a 1099misc this will show. I was not self employed and the 1099misc was from a lawsuit. Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax would not include attorney fees in my itemized deduction although it is more than 2% of AGI.

@spawnaor1 wrote:

Good morning. Have a question about attorneys fees.. I did as mentioned above on line 22 but i get this message "deductible self emplyment tax" and an amount of $253. I reaserched online and it says because I entered a 1099misc this will show. I was not self employed and the 1099misc was from a lawsuit. Thank you

Then you entered in the wrong place.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax would not include attorney fees in my itemized deduction although it is more than 2% of AGI.

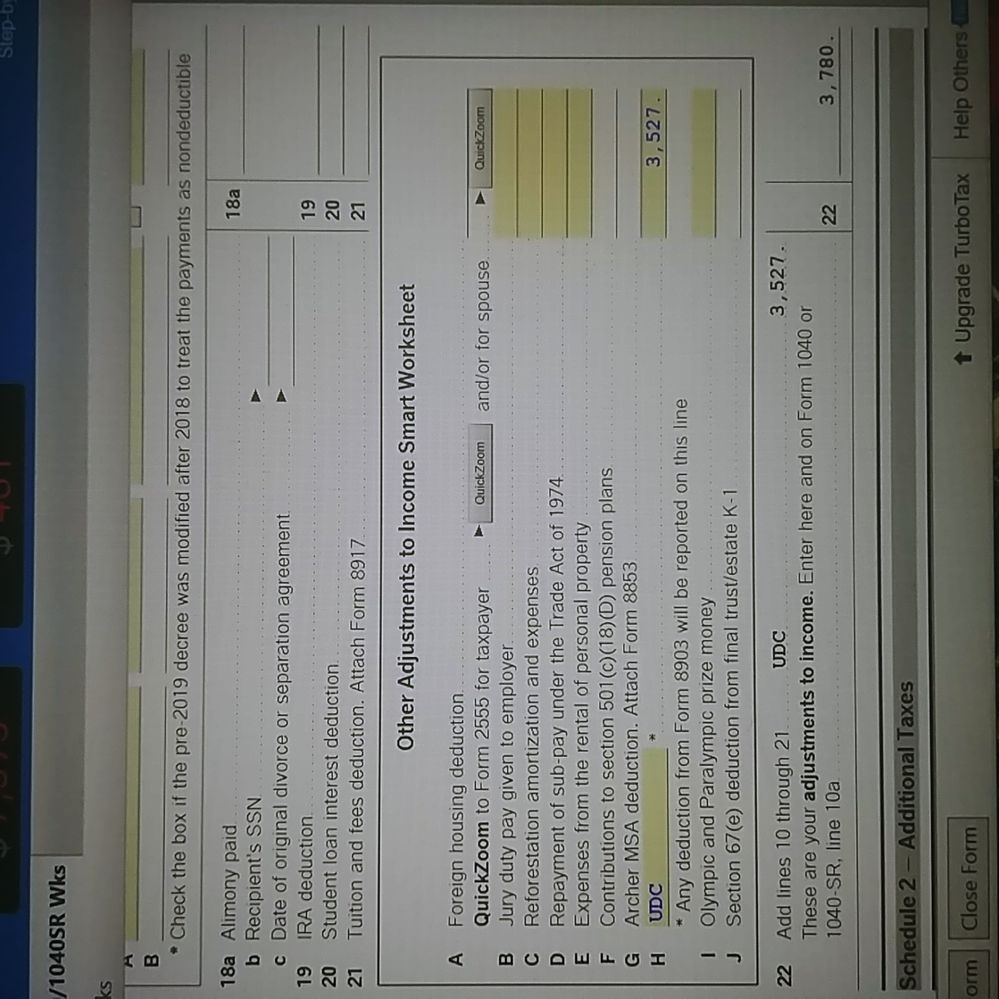

Everything is were it needs to be. The aecond photo shows the amount in question

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

mpiseter

New Member

David267

New Member

curtisd2

New Member

llpiii

New Member

ngrav4

New Member