- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Rental and Personal Use Limiting Loss

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

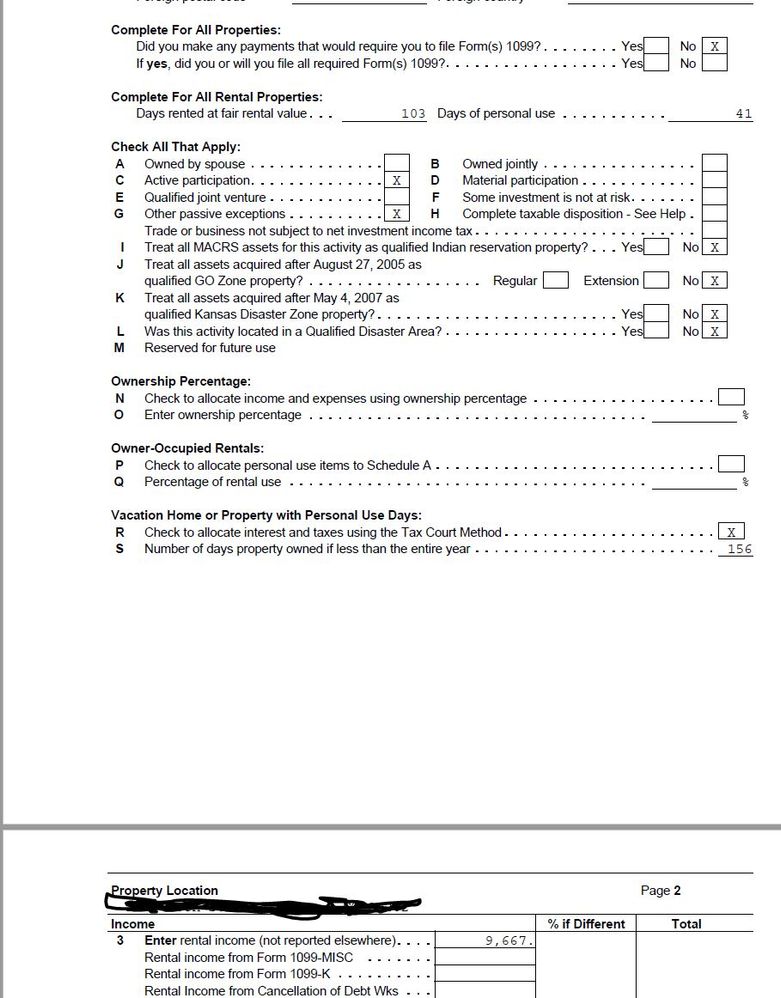

Rental and Personal Use Limiting Loss

I have been renting condos and also using them for over 20 years. I have always understood the tax code to be that I cannot take a loss on a rental property if I use that property for personal use more then 14 days per year. Turbo Tax has always acted that way as well.

This year I had two properties that I owned and rented this way. One property was new so it was only owned for 156 days this year.

Property 1:

Owned: 365 days

Rented: 274 days

Used: 90 Days

Property 2:

Owned 156 Days

Rented: 102 Days

Used: 46 Days

When I enter the info using the interview it limits my losses to 0. This is what I expect to happen.

I then went back and added some expenses I forgot during the interview.

Now it is saying I have a loss. I opened a support case and the Turbo Tax support person said it looks like a bug and submitted it to another group at Intuit. They responded saying it was not a bug and here is there response:

Read the rules for passive losses in IRS Publication 527 Residential Rental Property, starting a page 13 - https://www.irs.gov/pub/irs-pdf/p527.pdf#page=13

I asked if they would be responsible if the IRS disagreed and they said no it is my responsibility.

So I believe Turbo Tax is doing this wrong and support is saying it is done correct and I do not know how to force Turbo Tax to do it the way I believe is correct.

Can anyone help by explaining why I might be allowed a loss or suggest how I can enter it correctly?

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental and Personal Use Limiting Loss

There are a few things that could create a loss, but based on the number of days you rented it, that may not be the case.

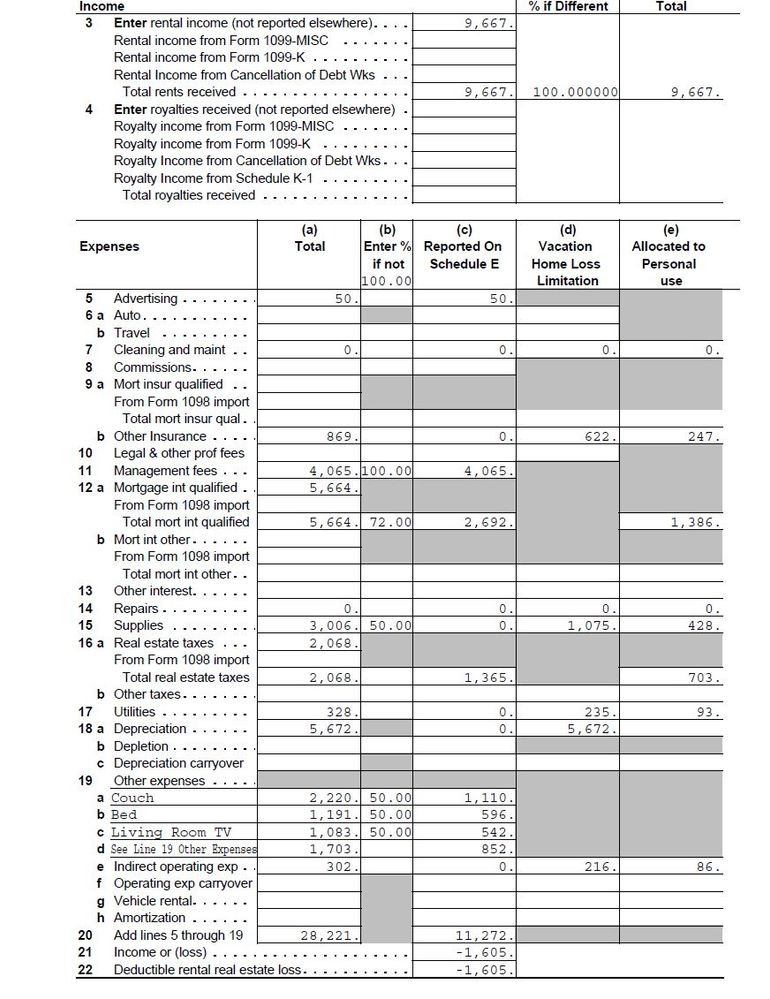

Could you post a picture of your "Schedule E Wks" for the rentals that are showing the loss? Of course, please remove any private information before posting it here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental and Personal Use Limiting Loss

Here you go:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental and Personal Use Limiting Loss

Move the items on Line 19 (Couch, Bed, TV, etc.) to "Supplies" (or "Repair and Maintenance").

There are some things that CAN create a loss. The most common are (1) mortgage interest, (2) real estate taxes, and (3) rental-only items (such as adverting and management fees). If you notice to the right of those lines, "Vacation Home Loss Limitation" is grayed out because those are 'forced' to be deducted, even if there is a loss.

By entering the items on Line 19, you are 'forcing' them to be deducted. So take them off of Line 19 and move them somewhere else (such as "supplies").

A few other notes to consider: (1) Why are you using the "Tax Court Method"? It looks the IRS method would give better results. (2) Why are you stating 50% business usage for many of the items (and 72% for mortgage interest) rather than using the 'default' method based on days? (3) For depreciation, I don't think the program allocates that using the ratio of "days", so I think you need to make sure you enter the correct Business Percentage for those "assets" in the "asset" section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental and Personal Use Limiting Loss

Hi AmeliesUncle,

Thanks for your response it helps a lot.

To answer your Tax Court vs IRS method, I get more with IRS because of how these are treated. It appears I can only take Mortgage Interest and Taxes off if I file a Schedule A and do not use the Standard Deduction. At this point (I am not finished my taxes yet) I may not have enough Schedule A items to make it worth while to take itemized deductions. I noticed when I ticked tax court my refund went down.

As for rental expenses this is rather complicated on one of my properties. I both rent my place 100% part of the year and live and rent to room mates the other part of the year. Turbo Tax cannot deal with this so I I have to break my expenses down based on when they occur and only take the portion that is allowed at that time.

The easiest way I can do this and some CPAs have suggested this is to calculate the number of days by using the percentage of a day based on my use. For example if I am there six months and rent 50% of the property those days I would treat that day as 50% rented and 50% used. So if I used it 180 days and it was rented 100% 185 days I would put it as rented 275 days and used 90 days. As long as I stay there long enough to cause the too much personal usage limit on the deduction the expenses should work out the same as if I broke everything down exactly.

The reason I put the items on line 19 was because I am using the "Under $2,500" to treat these as expenses instead of capitol assets. Turbo Tax said to use line 19 for those items. If I move those to Supplies could that trigger an audit since it would be an unusually large number for supplies?

So if they are forced to be deducted on line 19 and that is where you are suppose to put them using the "under 2500 rule" would that create an exception to the not allowed to take a loss rule on personal use?

Finally I am aware that I have to put the % in on depreciation and have been doing that in the past. I also adjust the percentage each year the asset is not fully depreciated to the percentage for that year. Turbo tax does now suggest the percentage when you are using days and go to fill that in manually.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental and Personal Use Limiting Loss

@Bill372 wrote:Hi AmeliesUncle,

The reason I put the items on line 19 was because I am using the "Under $2,500" to treat these as expenses instead of capitol assets. Turbo Tax said to use line 19 for those items. If I move those to Supplies could that trigger an audit since it would be an unusually large number for supplies?

So if they are forced to be deducted on line 19 and that is where you are suppose to put them using the "under 2500 rule" would that create an exception to the not allowed to take a loss rule on personal use?

There is no specific place that they are "supposed" to go. Although Line 19 would technically be acceptable, TurboTax has Line 19 set up to 'force' the deduction which should NOT be the case for those items. So if TurboTax is telling you to put them on Line 19, that is just one of MANY areas where it gives you faulty information.

And no, putting them as "Supplies" should not trigger a 'red flag' for an audit. But 'forcing' a bunch of deductions that should not be 'forced' is wrong, and THAT is more likely to cause an audit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental and Personal Use Limiting Loss

I ended up using repairs. Its weird in that it still gives me a loss but only $1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental and Personal Use Limiting Loss

TurboTax does guarantee the accuracy of their calculations, by the way. If you answer the questions in TurboTax accurately, and the IRS adjusts your tax and assesses interest and penalties, TurboTax will pay them for you if it is determined there was something wrong with the calculations in the program.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

knownoise

Returning Member

obeteta

New Member

jawship-gmail-co

New Member

ddubs82

Level 2

ddubs82

Level 2