- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: how do I remove the QBI deduction? My business does not qualify

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do I remove the QBI deduction? My business does not qualify

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do I remove the QBI deduction? My business does not qualify

Which version of TurboTax are you using (online or desktop/installed)?

Regardless, you should be able to go back through the interview and change the answers to the relevant questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do I remove the QBI deduction? My business does not qualify

I'm using online. There weren't any questions asking me what type of business the k-1 is from which is generating the qbi credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do I remove the QBI deduction? My business does not qualify

Which type of entity issued the K-1?

If it is an S corporation, 199A income is reported on Line 17. If it is a partnership/multi-member LLC, 199A income is reported on Line 20.

If you have either of those two entries the program will default to the QBI deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do I remove the QBI deduction? My business does not qualify

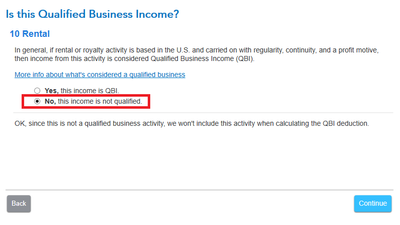

I just have one rental property and didn't realize I needed 250 hours of work with the rental to qualify. Now I want to remove it from my CD installed form. How can I do this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do I remove the QBI deduction? My business does not qualify

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do I remove the QBI deduction? My business does not qualify

Remember the 250 hours is a safe harbor given by the IRS and not the law. The IRS says that if you are over the 250 you are safe but if you are under you may still qualify to take the deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do I remove the QBI deduction? My business does not qualify

I agree with @ZTaxPro - you may still qualify, technically at least.

The problem is simply that, unless you comply with the safe harbor requirements, the IRS can challenge the deduction.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

BenedictaIris

New Member

sparksj337

Returning Member

katehailey

New Member

discover98

Returning Member

malvinchip

Level 1