- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Deductions for education expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions for education expenses

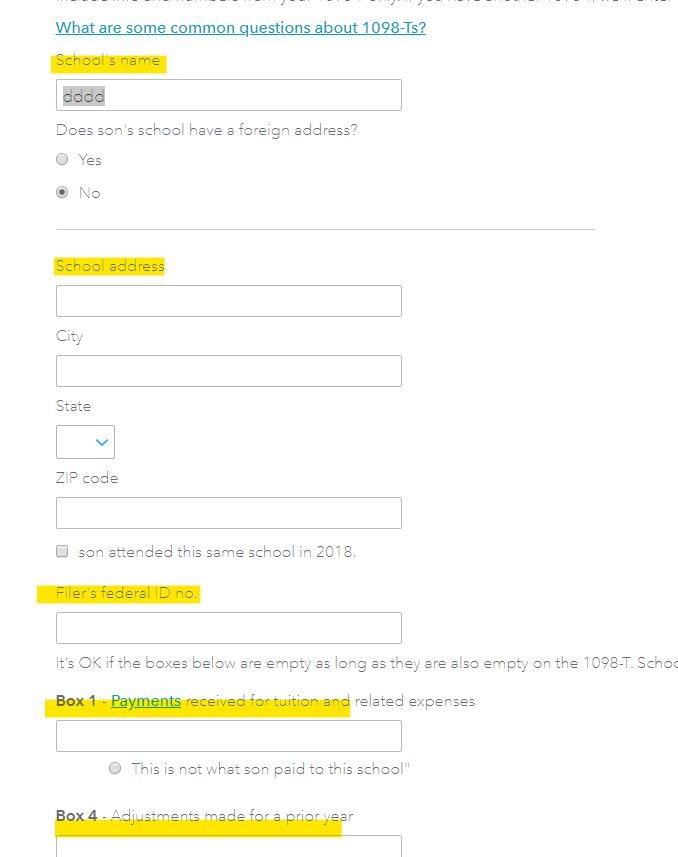

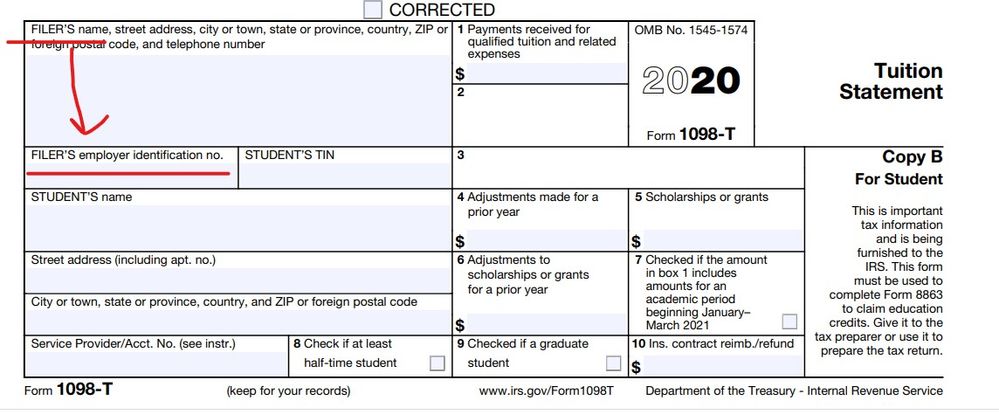

When entering a child's 2019 form 1098-T college tuition info: TT asks for the "Filer's Federal ID #, but the 1098-T only has a box with "employer ID #." Please advise what to do in this situation.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions for education expenses

The program is asking for the info from the 1098-T ... from the issuer of the form ... not for your information ... the Filer's ID and Filer's employer ID is the same thing ... they are interchangeable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions for education expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions for education expenses

So, in answer to my question, you are telling me to "use the Filer's employer ID #. It's confusing b/c TT uses DIFFERENT LANGUAGE and doesn't explain clearly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions for education expenses

The program is asking for the info from the 1098-T ... from the issuer of the form ... not for your information ... the Filer's ID and Filer's employer ID is the same thing ... they are interchangeable.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Keppy

Level 1

vward80

New Member

osgood53

New Member

Irasaco

Level 2

MiniMe

Returning Member