- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: california mortgage interest adjustment after refinance

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

california mortgage interest adjustment after refinance

Here is instruction an adjusting the average balance.

If you are not able to take all the interest on the Federal return, you will add the additional interest to your state return.

Do not alter the 1098. Enter the 1098(s) as reported. Box 2 should not be blank. Box 2 is the balance of the loan on 01-01-2019 OR the balance on the day the loan was taken out in 2019. Answer the interview questions carefully.

If you get an error concerning the balance, please follow these directions:

ONLINE USERS:

Please go back to the Home Mortgage Interest section:

Click Federal on the left side-bar

Click Deductions & Credits along the top

Scroll down to “Mortgage Interest and Refinancing (Form 1098)” Click Edit/Add

Scroll down the “Here’s your 1098 info” screen and click Done.

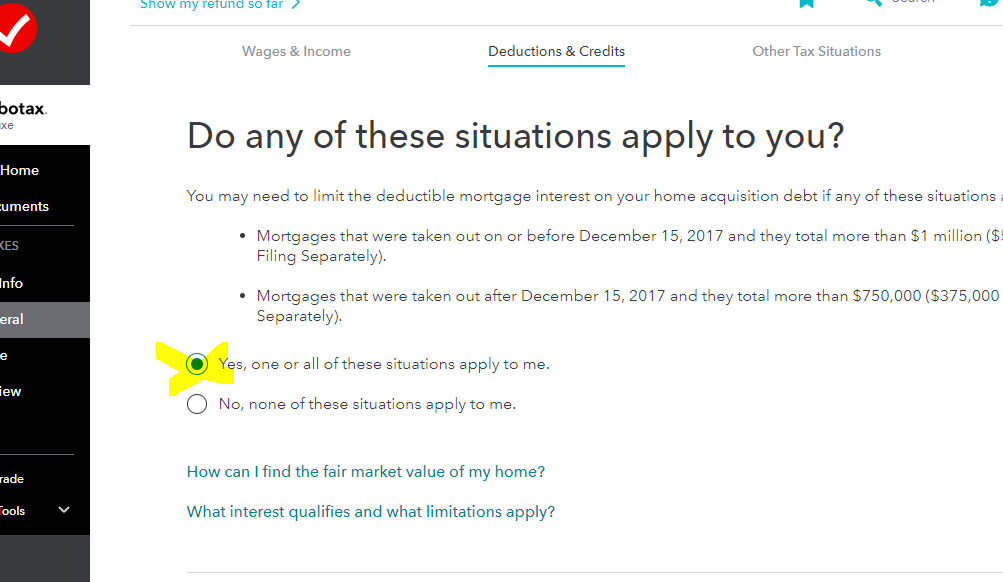

Next screen asks “Do any of these situations apply to you?” Select “Yes, one or all of these situations apply to me.” and Continue.

On the following screen, you will see the “Original amount”.

Enter the amount you can claim as a Home Mortgage Interest deduction in the “Adjusted amount” box. The Adjusted amount cannot be larger than the original amount or you will receive an error when trying to file. Instructions on who needs to adjust interest and how to calculate are available by clicking the blue “Help me figure this out” link.

DESKTOP USERS:

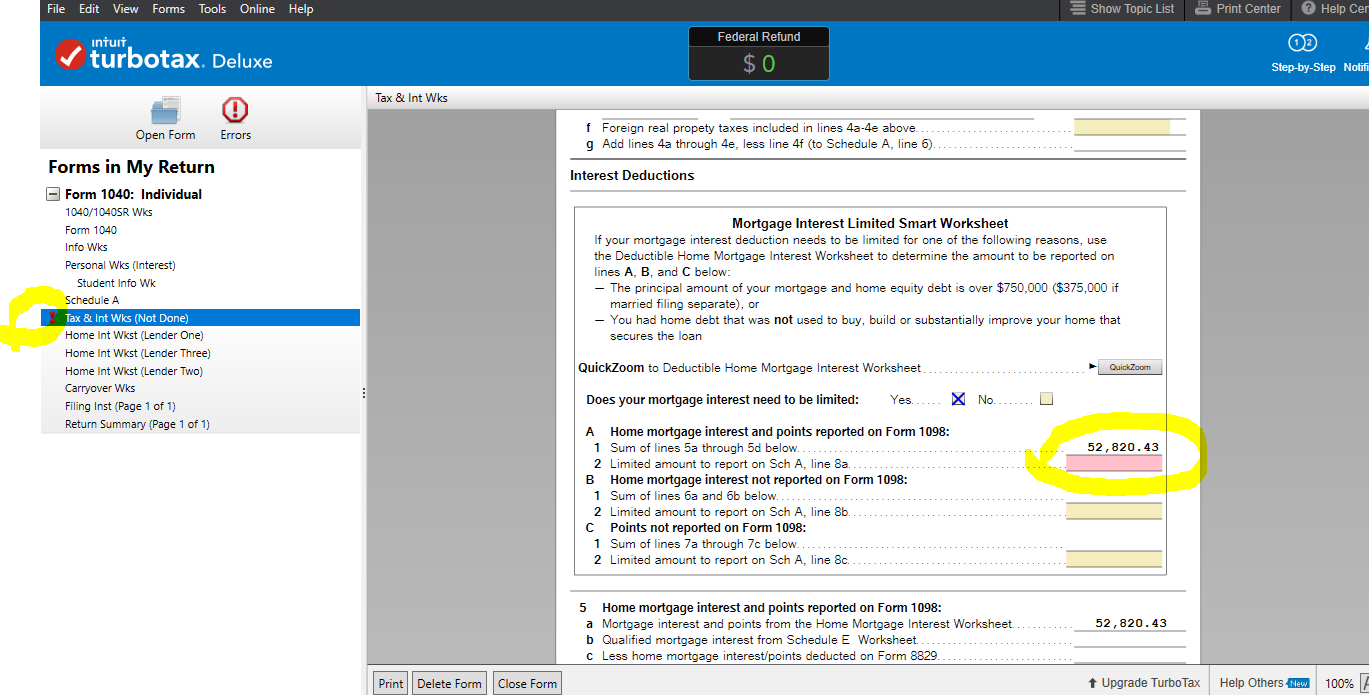

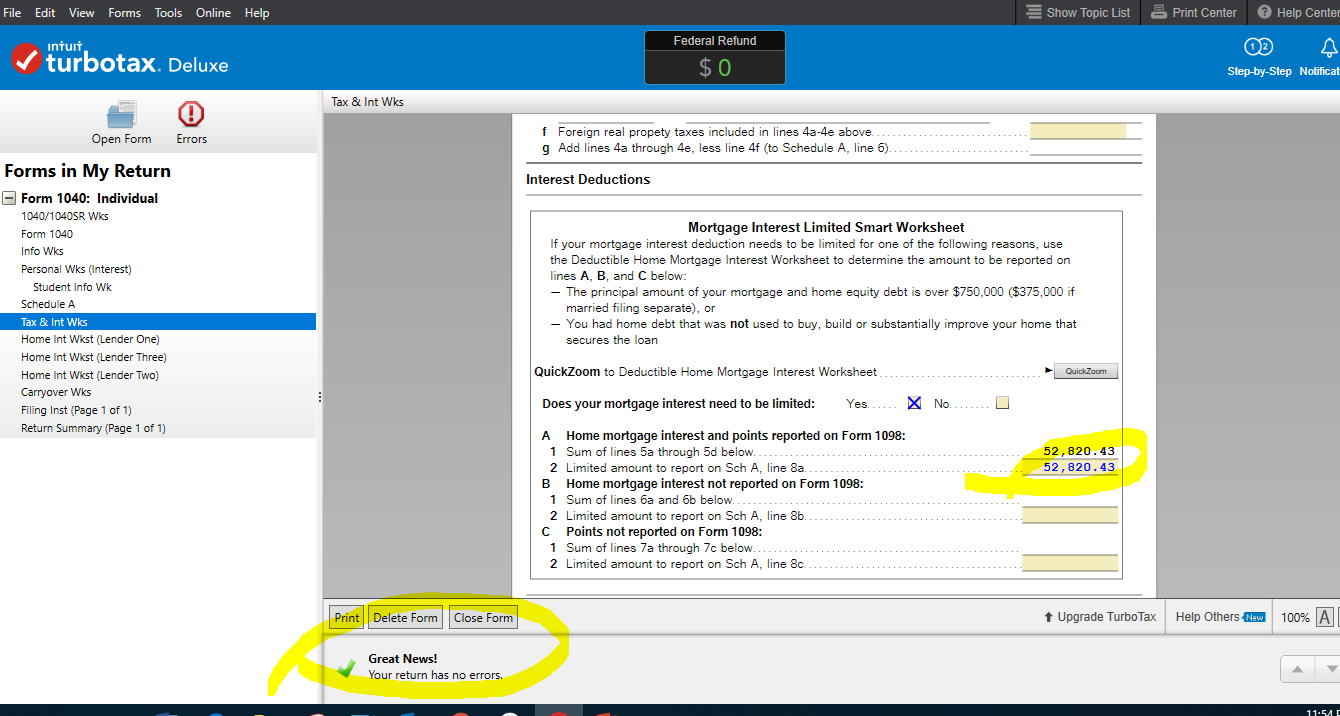

Go into Forms (top right)

Enter the amount on Tax & Int Wks

Mortgage Interest Limited Smart Worksheet section

Line A2

OR

Step by Step

Federal

Deductions & Credits

Mortgage Interest, Refinancing and Insurance Click Update

Click Done

Click Yes, one or both of these situations apply to me. And Continue

Enter the Adjusted amount and Continue

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

california mortgage interest adjustment after refinance

The following screen does not pop up for me:

Next screen asks “Do any of these situations apply to you?” Select “Yes, one or all of these situations apply to me.” and Continue.

How do I get it to show this option?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

california mortgage interest adjustment after refinance

@gheekim Go through CA until you reach Here's the income that CA handles differently. locate Mortgage Interest Adjustment and click Edit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

california mortgage interest adjustment after refinance

I am still unable to correct the worksheet where this incorrect assumption is made that my average balance on home acquisition debt is greater than $1M. I don't get the screens described in the solutions above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

california mortgage interest adjustment after refinance

[Responding to AmyC] This is not useful advice by someone labelled as an "Expert" on the forums. The recommendation to fix a TT issue is to answer incorrectly on the TT questionnaire even if your mortgage is > 750K limit? How is that a reasonable solution? We can't say "No" to "Does your mortgage interest need to be limited" when the instructions are very clear that it should be a "Yes" and should be limited, if your mortgage debt is above the threshold of 750K - a LOT of folks in California fall into this category. Can you guys just fix this obvious issue in the software? And asap? Tax deadline is next week and thousands of TT customers may be out thousands of dollars b/c of this without even realizing it with so much heads up re: this issue in the forums..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

california mortgage interest adjustment after refinance

This is really big problem. TurboTax is doing it incorrectly and making errors in the thousands of dollars (in terms of taxes I have to pay). There is no excuse for not fixing this, especially so close to the deadline (tomorrow!).

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Bob in Plano

Level 3

karlameyer

Level 1

zomboo

Level 6

g213

Level 1

hbondra

Returning Member