- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Mortgage Interest Deduction for Multiple Mortgages during the year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction for Multiple Mortgages during the year

Hi,

I've seen several posts on how Turbo-Tax computes mortgage interest deduction, but I don't see a good conclusion. Here's my situation with two mortgage balances over the year (I've simplified the numbers for make the calculations easier):

| Month | Mortgage-A (pre-2017) | Mortgage-B (2023) |

| 1 | 400,000.00 | |

| 2 | 400,000.00 | |

| 3 | 400,000.00 | |

| 4 | 400,000.00 | |

| 5 | 400,000.00 | |

| 6 | 400,000.00 | |

| 7 | 400,000.00 | 1,800,000.00 |

| 8 | 800,000.00 | |

| 9 | 800,000.00 | |

| 10 | 800,000.00 | |

| 11 | 800,000.00 | |

| 12 | 800,000.00 | |

| Total Interest Paid | $7000 | $20,000 |

Here are the applicable documents I've found from IRS and Googling:

The second reference describes two methods -

A simplified method that is similar to the method used by Turbo-Tax or the worksheet in IRS Pub 936.

"Under the simplified method, interest on all secured debts is multiplied by a fraction, the numerator of which is the adjusted purchase price of the qualified residence and the denominator of which is the sum of the average balances of all secured debts. Since enactment of OBRA 1987 the $1,000,000 acquisition indebtedness limitation and the $100,000 home equity indebtedness limitation must be substituted for the adjusted purchase price."

An exact method which seems to be the right thing do to for most folks who have multiple mortgages like the above -

"Under the exact method, the amount of qualified residence interest is determined on a debt-by-debt basis by comparing the applicable debt limit for the debt to the average balance of each debt."

If I use the exact method to the situation above, then I would proceed as follows:

- [A] For the pre-2017 mortgage, all of the $7K interest is qualified because the average mortgage balance ($400K) is within the pre-2017 limit (which is $1M).

- [B] For the new 2023 mortgage, the average mortgage balance is $966K and only the fraction ($750K/$966K = ~78%) is allowed due to the TCJA $750K limit. This comes to $20K * 78% = $15517.

So, the total allowed deduction is $7000 + $15517 = $22517.

Can a TT expert confirm that this is the right way do approach this situation? If so, how do I massage Turbo-Tax so this get e-filed correctly without any ambiguity?

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction for Multiple Mortgages during the year

No, the mortgage interest deduction limits are not applied separately to each loan. If all of the debt is acquisition debt and the average of mortgage A (pre-2017) is $400,000 and the the average of mortgage B (post-2017) is $966,000, the limit on the combined mortgages is $750,000. So the percentage of your deductible interest is $750,000/($400K + $966K) = 54.9% of $27,000 = $14,823.

It appears that your example is selling a home and paying off the old mortgage and buying a new home with a new mortgage. This situation sucks the most for mortgage interest deductions. For 2023, you have two separate loans limited to 54.9%. Next year you will one loan limited to 93.8% ($750,000/$800,000) = 93.8%.

Turbo Tax uses the beginning and ending balance method to calculate the average balances. This is one of the averaging methods in pub 936 but generally yields a slightly less deduction. In the past they just used the ending balances without averaging at all and not rounding the result to three decimal places to figure the percentage. This method is no where to be seen in pub 936 but generally yields higher deductions. The averaging method you used is the statement balance method on page 12 of pub 936.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction for Multiple Mortgages during the year

Thanks @zomboo for the reply. But, this seems counter-intuitive in many ways. For example, if I only report the second mortgage-B (average balance $966K and interest $20K), I get a deduction of $15.5K which is higher than the case with both mortgages reported ($14.8K), but I suppose that I don't have a choice here and I need to report both of them as potentially qualified interest deductions?

What about the case where I refinanced a (post-2017) 750K mortgage in the middle of the year and I receive 2 1098s (one from each lender). Does this situation result in my mortgage interest deduction getting slashed by 50% for that year?

It also seems to like the best time to execute a simultaneous sale/purchase (or refinance) is at the end of the year timed such a way that we get exactly one 1098 per year (so that they don't get bunched up in a single year).

A "fair" approach (that also seems intuitive) would be to compute the qualified interest on a month-by-month basis by comparing the per-mortgage average balance at the end of each month summed together against the corresponding debt limit, and then sum the monthly qualified interest together to compute the qualified interest for the year. Does anyone know if IRS allows this detailed approach?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction for Multiple Mortgages during the year

Yes, unfortunately, you must report both mortgages. If you refinance a post-2017 $750K mortgage in the middle of the year and receive two 1098s (one from each lender) it is treated as a single mortgage over the months the mortgages are held. The refinancing mortgage assumes the debt of the refinanced loan. The interest deduction is not slashed by 50% for that year. This is not the case when you sell one home and buy another. In that case, the old loan is paid off and not assumed by the new loan.

The only way to execute a sale/purchase so that you only have one mortgage in each year is to sell the old house in the current year, move to grandma’s house into the new year and then buy a new home.

The fairest approach, in my opinion, is to simply treat sale/purchase as a refinance which in effect combines the monthly balances of the two loans, summing the monthly totals, and dividing by the number of months the two loans span (usually 12).

Do you mean by “fair’ approach it would be fairer to compute the deductible interest for each loan separately by first calculating the average balance by summing the monthly balances and dividing the total by the applicable number of months and then subjecting this average to the limit for that loan to get the percentage of deductible interest for each loan? Then add the deductible interest from each to get the total deductible interest. This does seem fairer but it allows taxpayers to exceed the overall mortgage deduction limits set out in pub 936. So the answer to your question is no, the IRS does not allow this approach. Although your method of computing the average balance is allowed and, I believe, results in a slightly higher deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction for Multiple Mortgages during the year

@zomboo wrote:The fairest approach, in my opinion, is to simply treat sale/purchase as a refinance which in effect combines the monthly balances of the two loans, summing the monthly totals, and dividing by the number of months the two loans span (usually 12).

What I was proposing is probably similar to the above. Basically, execute Table-1 Instructions in Pub 936 on a month-by-month basis and add the qualified interest deduction per month (line-15) to get the yearly deduction. Even if I follow the more conservative approach, this certainly seems like a question to ask IRS for clarification (unless they've already clarified).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction for Multiple Mortgages during the year

Are you proposing running through Table 1 twelve times, once for each month of the year? This would allow 100% of the interest on the $400,000 loan in months 1-6 and approximately 98.8% of the interest on the $800,000 loan in months 8-12. For month 6, the deductible interest would be $750K / ($1.8M + $400K) = 34.1% of the interest for that month. So that would be ($1,000 X100% X 6) + ($2,760 X 98.8% X 5) + ($7,200 X 34.1% X 1) = $6,000 + $13,634 + $2,455 = $22,089 which is 81.8% of the total interest paid. Yeah that's fairer alright but a whole lot of work and don't bother getting clarification from the IRS on this method. That would be a big waste of time.

The fairer method I proposed would get you 100% of the total interest as a deduction but this also is not allowed by pub 936 as far as I can tell. Although I am exploring possible loopholes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction for Multiple Mortgages during the year

@zomboo wrote:Are you proposing running through Table 1 twelve times, once for each month of the year?

Yes. That's exactly what I was suggesting. Yes, it is a whole lot of additional work but saves several thousands in deductions. And, it is fair (meets the spirit of the law).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction for Multiple Mortgages during the year

Wouldn't this proposal be the same as you originally posted in your initial post? That would be an easier way to calculate the fair deduction you want.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction for Multiple Mortgages during the year

I am in similar situation as yours and I am not tax expert but I believe I found solution to this in Pub 936.

Search for " Interest paid divided by interest rate method" for calculating average balance of each mortgage in Pub 936.

This seems to work great for me.

Pls let me know if you disagree with " Interest paid divided by interest rate method" for calculating average balance of each mortgage in Pub 936 for any reason.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction for Multiple Mortgages during the year

The interest paid divided by the interest method in Pub 936 applies to mortgages held throughout the year. With that said, this method, and everything else in Pub 936, does not make sense when you sell your existing main home and purchase a new one in the same year. This method when applied to a mortgage held less than 12 months, approximates the 12 month average with $0 balance inserted for months the mortgage was not held.

The IRS concluded in memorandum [removed] (2012) concluded that tax payers could use any reasonable method to determine the amount of deductible interest. I don't know how relevant the memo is today, but we all know Pub 936 is not reasonable in the case of selling and buying a main home in the same year.

You can only have one main home at a time during the year. I think it is reasonable to treat your sold and bought homes as one aggregate main home. Both the 'interest paid divided by the interest rate' and the '12 month average' averaging methods will work for this. In order to be really reasonable, you should replace the interest and balance for one of the mortgages with $0 in the months the two mortgages overlap.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction for Multiple Mortgages during the year

Hi @zomboo

Thanks for your response.

I am little confused when you say "Interest paid divided by interest rate method " method can NOT be used for mortgages less than 12 months in duration. I thought "less than a year mortgage duration" was the only reason why this method makes sense.

here's the text from the publication : You can use this method if at all times in 2023 the mortgage was secured by your qualified home and the interest was paid at least monthly.

As you can see, it does not mention whole year mortgage requirement. It does mention "at all times" requirement for securing the mortgage with qualified home.

In my case I simply bought another home last year but didn't sell previous one.

so I have primary (for part of year) & second home (whole year) mortgages and using "Interest paid divided by interest rate method ", it seems to do the right thing.

Pub 936 also talks about another method : "Statements provided by your lender"

I put ** in the relevant text of that method, seems like that method is also meant for cases of less than a year mortgage duration and this method also seems to make sense.

If you receive monthly statements showing the closing balance or the average balance for the month, you can use either to figure your average balance for the year. **You can treat the balance as zero for any month the mortgage wasn't secured by your qualified home.**

For each mortgage, figure your average balance by adding your monthly closing or average balances and dividing that total by the number of months the home secured by that mortgage was a qualified home during the year.

I believe I can use either "Interest paid divided by interest rate method" or "Statements provided by your lender" for my situation and default "Average of first and last balance method" method does incorrect calculations for cases of multiple mortgages with less than year duration.

does this make sense?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction for Multiple Mortgages during the year

For the interest paid divided by the interest rate method, what do you think '... You can use this method if at all times in 2023 the mortgage was secured by your qualified home ...' means?

As for the 'Statements provided by your lender' method, the statement 'You can treat the balance as zero for any month the mortgage wasn't secured by your qualified home' doesn't apply for your primary home for the months the mortgage was not held. This statement applies only to the months the mortgage was held and not secured by a qualified home.

This is what Pub 936 says and it is reasonable when you have one mortgage for less than 12 months or two mortgages for all 12 months. Your situation is an example of when the average balance methods in Pub 936 are not reasonable and would, in my opinion, tweak the sold home/bought home solution I posted earlier.

For the year you either sold your first home and bought another one OR you bought a new home and made the first home your second home, it is reasonable, in my opinion, to calculate a 12 month average for the mortgages held less than 12 months. The tweak is that you don't have to zero out the months for one mortgage in the months that overlap.

You can use the interest paid divided by the interest rate method or the statement balance with zeros in the months the mortgage didn't exist. Even though this is not specified in Pub 936, it is a reasonable approach in this situation. But be prepared to explain how you calculated your deduction in the unlikely event someone asks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction for Multiple Mortgages during the year

@zomboo I would like to get your opinion on how I should calculate how much of my mortgage interest will be deductible in 2024.

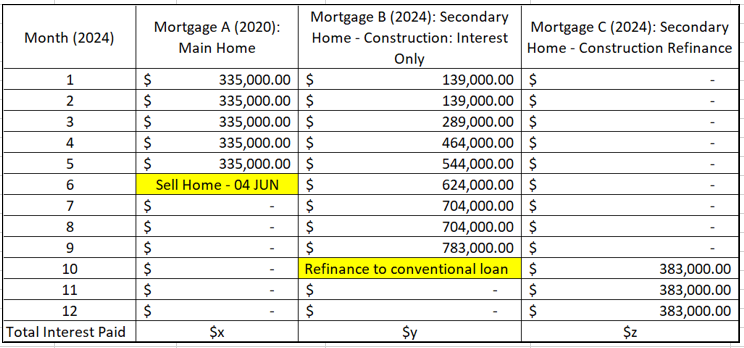

My situation for 2024 is as follows:

1. Primary residence: My wife and I will live in our primary residence from 01 JAN - 04 JUN. Closing date is 04 JUN. Plan to rent Airbnb until the construction of our new home is complete. Secondary home will become primary home after sale.

2. Secondary residence: Construction loan used with variable loan draws starting 12 JAN 24. Anticipate completion of construction ~01 SEP. Upon completion, construction loan will be replaced with a conventional loan using a refinancing action which I intend to put down $400k at closing to reduce the final debt amount.

I used variables in place of the actual interest incurred since those values are not exactly known right now, but I figured you could use them to help convey how best to calculate the average balance for each loan and the estimated % I would be able to deduct.

REQUEST: Can you please help me identify the best option(s) for calculating the average loan balance and the amount of mortgage interest I can deduct in the 2024 tax season?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction for Multiple Mortgages during the year

For 2024, I would designate your current home as your second home and the home under construction as your main home. You are allowed to treat the home under construction as your main home for up to 24 months prior to completion. Then, because this home will be your main home for all 12 months, you can use the monthly statement balance average method for mortgages B and C over all 12 months in 2024, inserting $0 in the months that either mortgage was not held. For mortgage A, you will have to use the beginning and ending balance average method or the statement balance average method over the 5 months it will be held in 2024.

With the numbers you provided, this will result in a total average balance of $796,583 and a deductible interest percentage of $750,000 / $796,583 = 94.2%.

| Month | 2nd Home | Main Home | |

| Loan A | Loan B | Loan C | |

| Jan | 335,000 | 139,000 | 0 |

| Feb | 335,000 | 139,000 | 0 |

| Mar | 335,000 | 289,000 | 0 |

| Apr | 335,000 | 464,000 | 0 |

| May | 335,000 | 544,000 | 0 |

| Jun | 624,000 | 0 | |

| Jul | 704,000 | 0 | |

| Aug | 704,000 | 0 | |

| Sep | 783,000 | 0 | |

| Oct | 0 | 383,000 | |

| Nov | 0 | 383,000 | |

| Dec | 0 | 383,000 | |

| Average | Average | Average | |

| 335,000 | 365,833 | 95,750 |

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ahmad-hashem-net

New Member

karlameyer

Level 1

zomboo

Level 6

g213

Level 1

cashrn-gmail-com

New Member