- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- K-1 smart worksheet appears to overlay prior year information for Tax Loss Carry-Forward

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 smart worksheet appears to overlay prior year information for Tax Loss Carry-Forward

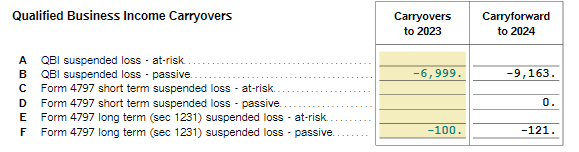

I have several K-1 PTP's and each seem to have this same issue. Box 1 is a passive loss and seems to create a tax loss carry-forward properly in the 2023 Tax Return. As I view the "Carry Forwards to 2023 Additional Info for Section 199A Deduction, I see the following for this PTP, which is the correct information carried forward into 2023 from the prior tax year:

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 smart worksheet appears to overlay prior year information for Tax Loss Carry-Forward

We have confirmed the experience you reported and submitted this to our tech support team for investigation. We aren't expecting any updates before the filing deadline, however.

You may wish to make note of this for next year. The carryover information will be included if you save your return in PDF format. This will allow you to refer to the correct carryover amounts when you start a new return next year and make adjustments as necessary.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 smart worksheet appears to overlay prior year information for Tax Loss Carry-Forward

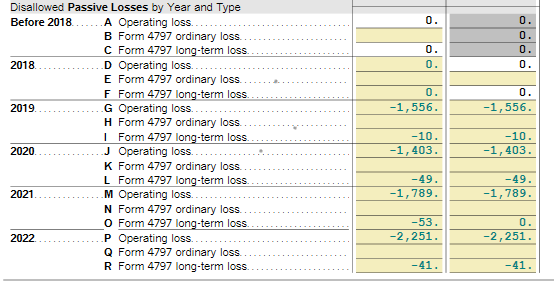

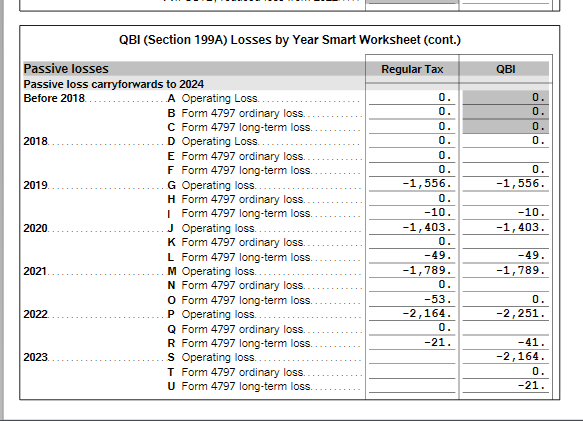

As you can see by this screen, the "QBI suspended loss - passive" is correct and agrees to the first screen and the "Carryforward loss to 2024" is correct at -9,163. However, in the second screen above, the 2023 detail overlays the 2022 data and the total is now short by the 2022 loss. Is there a way to fix this information in TT or must the carryforward be adjusted in next years' filing? Anyone have any ideas? Is anyone else experiencing this issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 smart worksheet appears to overlay prior year information for Tax Loss Carry-Forward

It would be helpful to have a TurboTax ".tax2023" file to test this issue further.

If you would be willing to send us a “diagnostic” file that has your “numbers” but not your personal information, please follow these instructions:

In TurboTax Desktop, open your return and go to Online in the TurboTax header. (On a Mac computer, choose File >> Share.)

- Choose Send Tax File to Agent.

- You will see a message explaining what the diagnostic copy is. Click Send on this screen and wait for the Token number to appear.

- Reply to this thread with your Token number and tag (@) the Expert requesting the token from you.

- Please include any States that are part of your return.

We will then be able to see the same experience you are having. If we are able to determine the cause, we'll reply here and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 smart worksheet appears to overlay prior year information for Tax Loss Carry-Forward

PatriciaV

Token # 1225649

K-1 smart worksheet appears to overlay prior year information for Tax Loss Carry-Forward

NY state is included.

Thank you for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 smart worksheet appears to overlay prior year information for Tax Loss Carry-Forward

We have confirmed the experience you reported and submitted this to our tech support team for investigation. We aren't expecting any updates before the filing deadline, however.

You may wish to make note of this for next year. The carryover information will be included if you save your return in PDF format. This will allow you to refer to the correct carryover amounts when you start a new return next year and make adjustments as necessary.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

gardineiro

New Member

potentilla

Level 3

MD-Taxpayer1

Returning Member

willisjw

New Member

curtisd2

New Member