- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Is this a bug? SE Tax Deduction calculation rounding error causing bug with max Individual 401(k) contribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is this a bug? SE Tax Deduction calculation rounding error causing bug with max Individual 401(k) contribution

I hope this gets in front of a TurboTax software engineer...

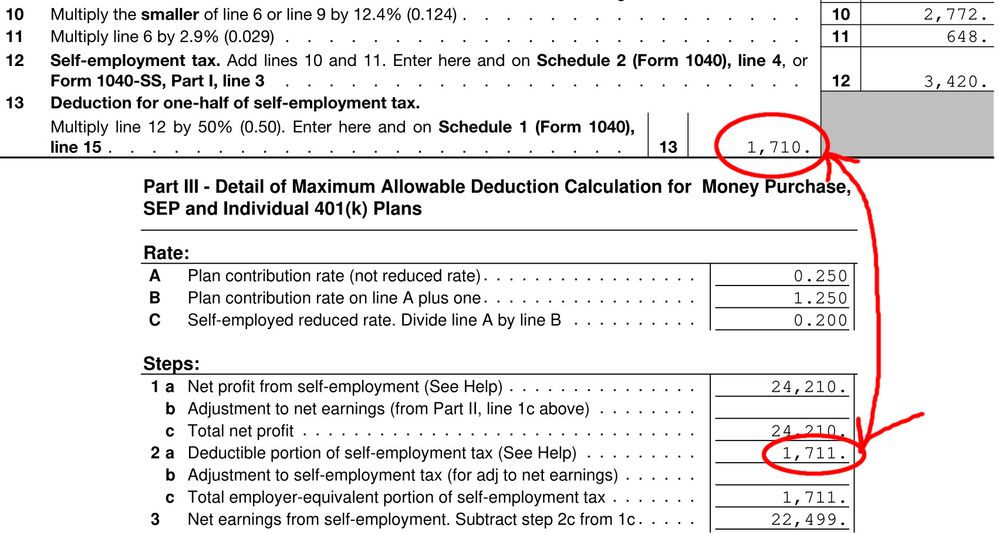

My SE income in 2023 was $24,210. So my SE tax is calculated by taking 92.35% of that, rounded, or $22,358, and then calculating 12.4% and 2.9% of that, both values rounded, then summed, which yields $2,772 and $648 for a total of $3,420. Thus my 1/2 SE Tax deduction is 1/2 of that, or $1,710. As a result, my maximum allowable Individual 401(k) contribution should be $24,210 - $1,710 = $22,500! However, TurboTax is calculating my maximum allowable contribution as only $22,499! Grrr!

I discovered on the Keogh, SEP and SIMPLE Contribution Worksheet in Part III, Line 2a that the value of the "Deductible portion of self-employment tax" was $1,711! One dollar off. This may or may not be related, but I'm guessing somewhere in the bowels of the TurboTax code, something is being rounded early. My guess is someone is taking the 92.35% value, and multiplying it by 15.3% and rounding just once, yielding $3,421, and when taking half of that, $1,710.50 gets rounding to $1,711 when they calculate the SE Tax deduction. The irony is that Schedule SE has it right, but somewhere else it's wrong, which is impacting the max Individual 401(k) contribution. Help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is this a bug? SE Tax Deduction calculation rounding error causing bug with max Individual 401(k) contribution

Seriously?

Exactly how will that $1 impact your tax liability?

$1 x 15% = 15 cents which would be rounded in any tax calculation

$1 x 35% = 35 cents which would be rounded in any tax calculation

Rounding happens all the time, up and down.

Ok, the time value of that $1; may increase or it could potentially decrease where ever it is invested.

Time to finish your tax return and move on.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is this a bug? SE Tax Deduction calculation rounding error causing bug with max Individual 401(k) contribution

This is just one of many rounding oddities throughout TurboTax that Intuit has chosen to deem insignificant, caused by TurboTax loosely interpreting the rounding rules.

Is it just a coincidence that the precise amount of net earnings from self employment exactly matches the maximum permissible regular elective deferral for 2023 of $22,500? If the $24,210 amount was artificially chosen (although I don't know why one would do that since that amount doesn't accommodate making any employer contribution after maximizing the regular elective deferral), just increase it to $24,211 to get the deductible portion of SE tax to agree between Schedule SE and the Keogh, SEP and SIMPLE Contribution Worksheet, resulting in a full $22,500 of SE retirement deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is this a bug? SE Tax Deduction calculation rounding error causing bug with max Individual 401(k) contribution

Thanks @dmertz, I confirmed that increasing the net profit to $22,411 (by decreasing my expenses by $1) causes TurboTax to correctly calculate the maximum Individual Retirement Plan Contribution as $22,500. But isn't this perverse? For all of TurboTax's grandiose claims of 100% Accuracy blah-blah-blah, the best advice is that I should "fudge" my numbers in order to get TurboTax to do the right thing? I realize this is an edge case, but edge cases are where software bugs so often show up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is this a bug? SE Tax Deduction calculation rounding error causing bug with max Individual 401(k) contribution

In case this helps, here's a screenshot illustrating the bug.

The top is from Schedule SE with $1,710 (the correct value), but then on the Keogh, SEP and SIMPLE Contribution Worksheet has $1,711 (the incorrect value) which impacts the max Individual 401(k) contribution.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Andy_W

Level 1

sgeremia

Returning Member

dlj56

New Member

happyguy

New Member

mpsekhon

Level 2