- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- IRA Losses + Late Backdoor Roth IRA Conversion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Losses + Late Backdoor Roth IRA Conversion

Background:

- Step #1- In December 2022, I converted all of my Traditional IRA balance (inclusive of prior Traditional IRA contributions) to a Roth IRA (i.e., a backdoor Roth IRA). Part of the converted amount was “deductible”, and part wasn’t. However, because the total “deductible” contribution was lower than the total loss incurred from inception of the Traditional IRA account to the “conversion”, TurboTax seems to not be including any taxes for my conversion, not even for the “deductible” portion of that conversion to a Roth IRA. Said in other words, it seems like TurboTax’ pro-rata rule calculation generates a 0% taxable basis due to the losses in my Traditional IRA account thefore offsetting the “deductible” contributions.

- Step #2- After doing the conversion, certain small amount of interest (about $10) was generated into my Traditional IRA that I had fully zeroed-out with Step #1 described above.

- Step #3- In January 2023, I did another conversion of that small interest described in Step #2 to the Roth IRA account (i.e., another backdoor Roth IRA). However, I have not received a Form 1099-R for that yet an I will not receive it before the April 18th deadline.

Questions:

- Question #1 – Does it make sense that a loss in a Traditional IRA can offset the tax of a prior “deductible” contribution? Basically, what I describe in Step #1.

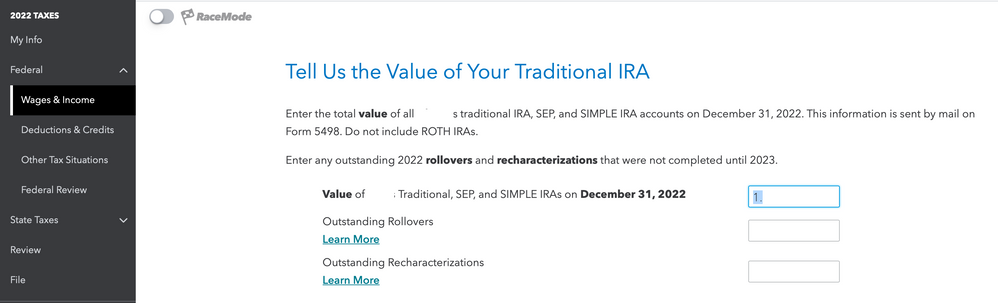

- Question #2 - Now in my 2022 tax return, I was wondering how to report the $10 of interest that I converted. The option in the screenshot below only seems to accommodate “rollovers” and “recharacterizations”, but not “conversions”. Should I then go ahead and say that the value of my Traditional IRA account was $10 in 31 December 2022, or assume that the “conversion” took place for the 2022 tax returnb and report $0 as the value of my Traditional IRA account in 31 December 2022?

Thanks in advance!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Losses + Late Backdoor Roth IRA Conversion

Question 1 Yes, if you had losses and therefore converted less than your basis then you won’t have any taxable conversion. For example, if your basis was $7,000 and you converted $6,500 (traditional IRA was empty) then this conversion won’t be taxable, and you will have a $500 basis left on line $14 to use for future years.

Question 2 Yes, the value of your traditional IRA account was $10 on 31 December 2022, and you will enter this on the “Tell us your value of your traditional IRA” screen. The $10 conversion happened in 2023 and therefore will be reported next year on your 2023 tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Losses + Late Backdoor Roth IRA Conversion

Question 1 Yes, if you had losses and therefore converted less than your basis then you won’t have any taxable conversion. For example, if your basis was $7,000 and you converted $6,500 (traditional IRA was empty) then this conversion won’t be taxable, and you will have a $500 basis left on line $14 to use for future years.

Question 2 Yes, the value of your traditional IRA account was $10 on 31 December 2022, and you will enter this on the “Tell us your value of your traditional IRA” screen. The $10 conversion happened in 2023 and therefore will be reported next year on your 2023 tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Losses + Late Backdoor Roth IRA Conversion

As DanaB27 said, the $10 Roth conversion is a 2023 distribution from the traditional IRA, so it goes on your 2023 tax return, not on your 2022 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Losses + Late Backdoor Roth IRA Conversion

Thank you very much @DanaB27 and @dmertz , very helpful!

The only quick follow-up question I have is related to @DanaB27's response, specifically to the part that says "...(traditional IRA was empty)..." What does that relate to? I mean, would anything change if, as you said, the basis was $7,000 but I only converted $6,500 out of the total $6,510 thus leaving the $10 in the Traditional IRA (instead of converting $6,500 out of a total $6,500)? Apologies if I am misunderstanding this.

Thanks in advance!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Losses + Late Backdoor Roth IRA Conversion

With $7,000 in basis, a $6,500 conversion and a $10 year-end balance in traditional IRAs, $6,500 of the basis is applied to the conversion to make it nontaxable and the traditional IRAs end up with $500 of basis remaining to go with the $10 value.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

knownoise

Returning Member

koonsup

Level 1

bhJogdt

Level 2

VAer

Level 4

frankiestylez

Level 2