- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I am permanently disabled and wondering if I can deduct my solar battery installed primarily to backup power for medical equipment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am permanently disabled and wondering if I can deduct my solar battery installed primarily to backup power for medical equipment

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am permanently disabled and wondering if I can deduct my solar battery installed primarily to backup power for medical equipment

A solar battery backup system can be deducted as a medical expense on Schedule A Itemized deductions.

The IRS allows all taxpayers to deduct their qualified unreimbursed medical expenses that exceed 7.5% of their adjusted gross income. You must itemize your deductions on IRS Schedule A in order to deduct your medical expenses.

You need to have clear proof that your physical or mental condition demands a solar battery power backup. A letter from your medical care provider stating the reason for needing a solar-powered backup for power outages should be kept with your records.

To enter your whole-home generator and any other itemized deductions follow these steps:

- Sign in to your TurboTax account.

- Enter itemized deductions in the search box.

- In the results, box click on jump to itemized deductions.

- Follow the screen prompts to enter your solar battery power backup expenses and any other itemized deductions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am permanently disabled and wondering if I can deduct my solar battery installed primarily to backup power for medical equipment

A solar battery backup system can be deducted as a medical expense on Schedule A Itemized deductions.

The IRS allows all taxpayers to deduct their qualified unreimbursed medical expenses that exceed 7.5% of their adjusted gross income. You must itemize your deductions on IRS Schedule A in order to deduct your medical expenses.

You need to have clear proof that your physical or mental condition demands a solar battery power backup. A letter from your medical care provider stating the reason for needing a solar-powered backup for power outages should be kept with your records.

To enter your whole-home generator and any other itemized deductions follow these steps:

- Sign in to your TurboTax account.

- Enter itemized deductions in the search box.

- In the results, box click on jump to itemized deductions.

- Follow the screen prompts to enter your solar battery power backup expenses and any other itemized deductions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am permanently disabled and wondering if I can deduct my solar battery installed primarily to backup power for medical equipment

Awesome and thanks

so additional questions:

1. if I get a credit do I just subtract that from the total cost or can I submit the total cost

2: Can I charge this to my health savings account after I get the letter from my provider?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am permanently disabled and wondering if I can deduct my solar battery installed primarily to backup power for medical equipment

To answer in reverse order,

Yes

you may charge this to an HSA which is a great idea

Whatever credit you receive, be it from the HSA or if you receive an energy tax credit, that credit must be subtracted from the total cost of the battery and installation before entering as a medical expense.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am permanently disabled and wondering if I can deduct my solar battery installed primarily to backup power for medical equipment

Sorry:

I also need to know if the increased solar panels I added can be charged as well.

I also have a small generator as backup in-case of power down too long and solar not generating enough power.

I am assuming I need my provider to put (Battery, Solar upgrades, Generator) in the letter and follow your responses.

So best option is after deducting credits, put in the balances as medical expenses. Do not use HSA as I want the deduction on tax year. (Save HSA for other costs)

FYI: cases where this makes sense for me: 1: we lost power 5 times last year. 2: if we have major earthquake, and power out for extended period (I had 2 week outage from 1989 Loma Prieta earthquake).... Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am permanently disabled and wondering if I can deduct my solar battery installed primarily to backup power for medical equipment

Although the URS doesn't specifically address this, you can make a case for declaring the increased solar panels as a medical expense, as well as an energy credit. The fact you are disabled and if the backup generator isn't sufficient, then you can say that you installed the extrA solar panels to protect yourself in case if you should endure a catastrophic storm or other cataclysmic event.

This subject is a gray area within the tax law so you might request a statement from your medical provider stating the increased solar panels are necessary so you can sustain life or a quality of life that is necessary for survival.

Without this, the IRS may think you installed these to increase the value of your house and that you are trying to take advantage of an added deduction. Yes, you will need the information to put (Battery, Solar upgrades, Generator) in the letter and follow your responses given above by KrisD15 and PattiF.

You are correct in not using HSA to report this. You may need HSA for other medical expense.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am permanently disabled and wondering if I can deduct my solar battery installed primarily to backup power for medical equipment

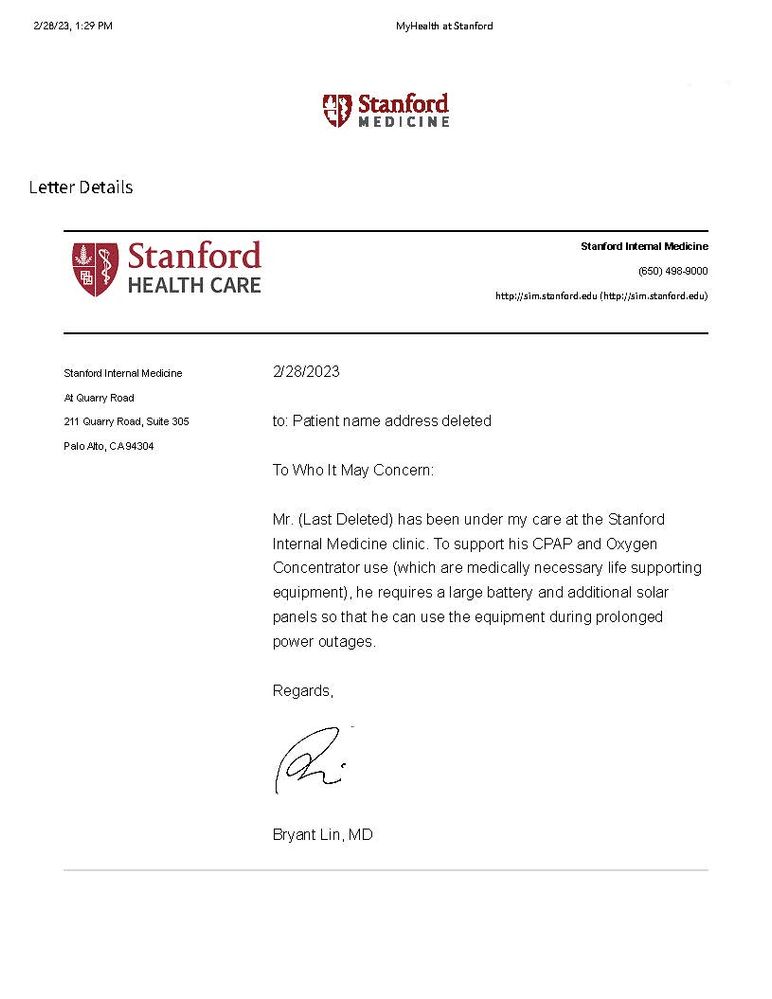

Here is letter from Stanford, and I deleted my name and specifics

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am permanently disabled and wondering if I can deduct my solar battery installed primarily to backup power for medical equipment

Yes, that would be good back up to keep handy in case you run into issues later on in supporting your medical expense itemized deduction for these solar panel and battery usage.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

chill63b-yahoo-c

New Member

plindsay77

New Member

jimbrandt2000

Level 2

specialmonkey

Level 1

findjerry

Returning Member