- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How to correct reporting sale of second home from main home to second home? Sale was at a loss.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correct reporting sale of second home from main home to second home? Sale was at a loss.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correct reporting sale of second home from main home to second home? Sale was at a loss.

@dnaue wrote:

When I did what you suggest the only difference I saw was that the word 'main' was taken off of the IRS Form 8949 with the Form D looking exactly the same. Do you think that this is correct?

Yes, it should be correct. Please understand that there is virtually no difference between the two types of transactions since you cannot recognize (deduct) a loss on personal use property, like a second home.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correct reporting sale of second home from main home to second home? Sale was at a loss.

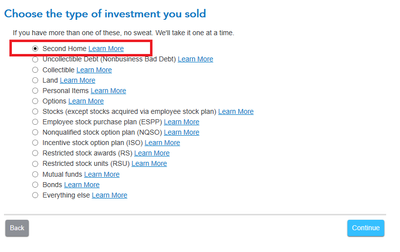

If you mistakenly entered a sale of your second home as your main home, simply delete the sale from the Sale of Home (gain or loss) section and enter the sale of your second home in the Stocks, Mutual Funds, Bonds, Other section and check Second Home on the following screen (see screenshot).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correct reporting sale of second home from main home to second home? Sale was at a loss.

When I did what you suggest the only difference I saw was that the word 'main' was taken off of the IRS Form 8949 with the Form D looking exactly the same. Do you think that this is correct? The sale of the home was a loss sale. What forms do I need to send to the IRS since this would be amended return for 2018?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correct reporting sale of second home from main home to second home? Sale was at a loss.

@dnaue wrote:

When I did what you suggest the only difference I saw was that the word 'main' was taken off of the IRS Form 8949 with the Form D looking exactly the same. Do you think that this is correct?

Yes, it should be correct. Please understand that there is virtually no difference between the two types of transactions since you cannot recognize (deduct) a loss on personal use property, like a second home.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

lydiagp7090

Returning Member

fcbdc

Returning Member

Ariadne II

Returning Member

king2434

Level 1

Dave-500

New Member