Dear @DanaB and Turbotax Team,

I’m hoping you can confirm that I correctly entered my information into Turbotax for my

- Backdoor Roth of $6000 (converted in March 2023 for tax year 2022)

- and for the nondeductible IRA that I contributed $6500 to in March of 2024 for tax year 2023 (which I immediately converted into backdoor Roth)

- I started with a zero balance in my traditional IRA and ended with a zero balance in my traditional IRA by converting it all to a Roth, and my IRA value was $0 as of December 31st of each year. All contributions to my traditional IRA have been non-deductible, due to MAGI.

- I followed the Turbotax directions for entering a backdoor ROTH conversion, completing

- Step 1: Enter the Non-Deductible Contribution to a Traditional IRA, for the backdoor ROTH of $6500 that I converted in March 2024 (for tax year 2023).

- I entered my 2023 1099-R and completed Step 2: Enter the Conversion from a Traditional IRA to a Roth IRA, for the backdoor ROTH of $6,000 that I converted in March of 2023 (for tax year 2022).

- I followed the steps for "If your conversion contains contributions made in 2023 for 2022", and answered the questions about the basis from line 14 of 2022 Form 8606 ($6000) and the value of all traditional, SEP, and SIMPLE IRAs ($0).

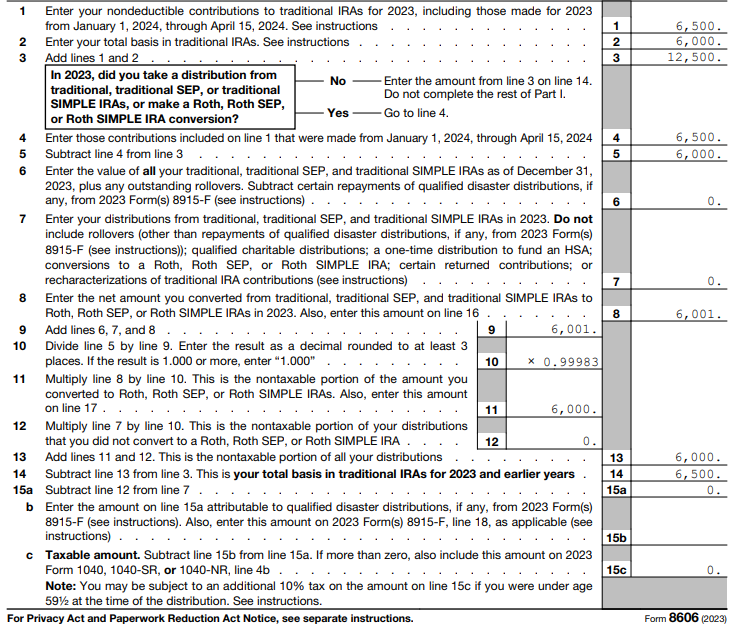

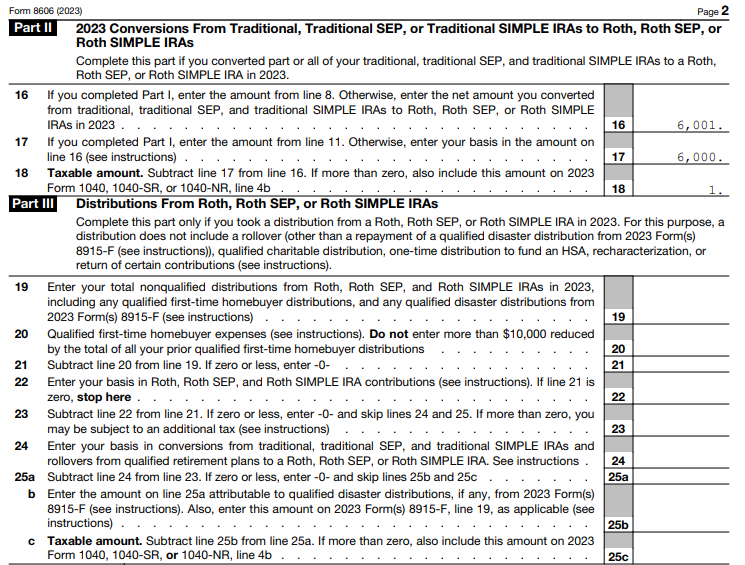

Here is my current 2023 form 8606. Can you please tell me if my form looks correct based on the above information, or if there is anything I need to change?

I believe my form 8606 correctly shows that I:

1) have a basis of $6,500 to carry over to tax year 2024 (from my March 2024 non-deductible IRA contribution and conversion to ROTH for Tax Year 2023) and

2) $1 of my March 2023 conversion for Tax Year 2022 is taxable (in the day between contributing/converting, the value of my contribution increased in value by $1). Thanks!