- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Foreign Income Exclusion 2555

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Income Exclusion 2555

Hi,

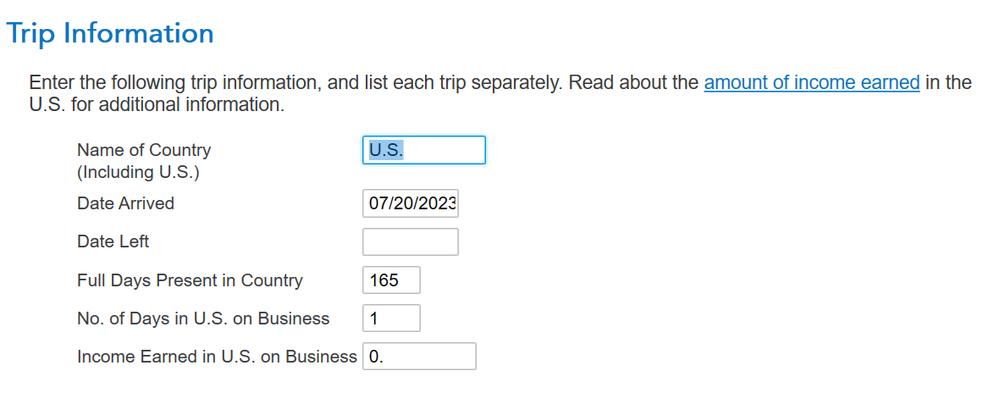

During the smart check at the end of completing my 1040 return. I received two error messages regarding my 2555 Foreign Income Exclusion form. 1. It asked the number of days present in the country on business. It would not accept 0 so I had to enter one, so do I just leave it at one? 2. The program asked the day I left the country but we are still in the U.S. We arrived on 7/19/2023 and won't depart back overseas until 07/29/2024. I must include a date in this field. Do I use 12/31/2023?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Income Exclusion 2555

@SupremeMetalTree having gone through your "other post" and response of my colleague @DaveF1006 for the number of days in US on business use 1 to satisfy the program ( it has been this way for a long time and 1 would not do anything to your total tax liability ).

For when you left the foreign country use the actual date you left the Foreign country in 2023. The details you entered in form 2555 will still work. There are a few more ifs and buts however.

Is there more I can do for you?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Income Exclusion 2555

Hi PK,

I sent DaveF1006 a furthered response to my question and included an additional question.

The issues is not the 330 day physical presence test but the end date of for the tax year 2023. I was preset in the U.S. from 20 July 2023 through the end of 2023 and still in the U.S. as of Mar 2024. My question is how to deal with this input box.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Income Exclusion 2555

@SupremeMetalTree since this last trip was NOT a trip while foreign tax home was valid --- you DO NOT report this last trip back home ( end of assignment) .

Your 12 month test period for purposes of form 2555 ( and exclusion of FEI ), starts 07/20/2022 and ends on 07/20/23. Thus you will get to exclude the foreign income earned in that period in the tax year i.e. 01/01/2023 till 07/20/23.

Does this make sense ?

pk

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Income Exclusion 2555

Hi,

Yes, that makes sense. Thanks for the clarification.

Cheers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Income Exclusion 2555

PK,

Yes, that makes sense. I didn't read the question closely enough and think it through. Thanks for the clarification.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

j-zee

New Member

RShaunSmith

New Member

chr1sp2001

New Member

wolf349982

New Member

Mariatam

Level 1