- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- For 2018, Residential Energy Credits were awaiting legislation and Form 5695 was not generated for 2018. Tried amending 2018 -- did not allow credit. How can I get 2018?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 2018, Residential Energy Credits were awaiting legislation and Form 5695 was not generated for 2018. Tried amending 2018 -- did not allow credit. How can I get 2018?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 2018, Residential Energy Credits were awaiting legislation and Form 5695 was not generated for 2018. Tried amending 2018 -- did not allow credit. How can I get 2018?

TurboTax is planning an update to the 2018 program but it has not been released yet. I don’t know when, and it keeps getting delayed. But, you will have until April 15, 2022 to file an amended return so there is plenty of time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 2018, Residential Energy Credits were awaiting legislation and Form 5695 was not generated for 2018. Tried amending 2018 -- did not allow credit. How can I get 2018?

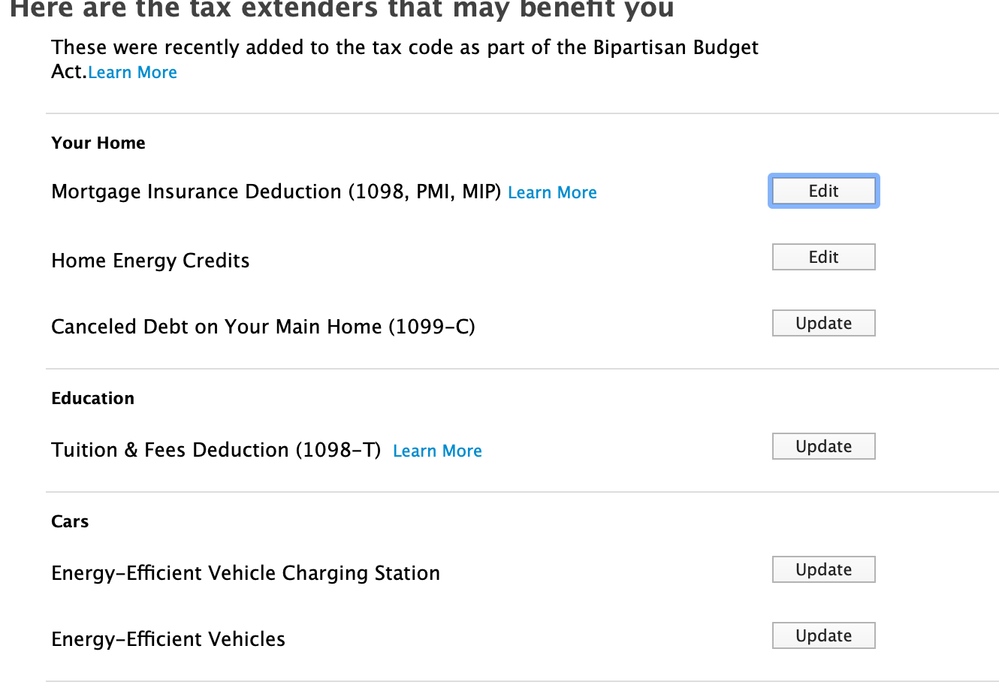

Thank you for your response. It is hard to believe Turbo Tax hasn't been updated yet. When I go into an amended 2018 return, I am able to access the below screen. Are you sure this hasn't been updated? It gives me a result of zero credit. I believe I am entitled to a $450 credit but the program doesn't allow it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 2018, Residential Energy Credits were awaiting legislation and Form 5695 was not generated for 2018. Tried amending 2018 -- did not allow credit. How can I get 2018?

The budget act passed in December 2019 contained many provisions that not only effective 2019 but we’re also retroactive to 2018. TurboTax prioritized getting the 2019 program up-to-date and then with the coronavirus emergency I’m sure they are not able to work as efficiently as before.

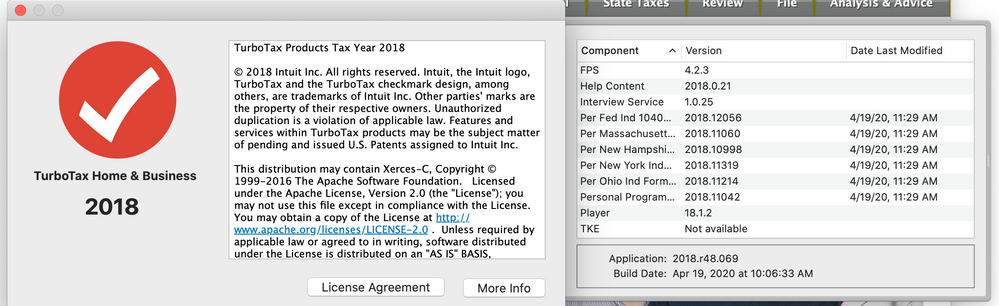

Check your version number. On a Mac you would go to the apple menu and look at about TurboTax. I’m not sure how to get the version number on a PC. Let me know what it says. I have been checking myself because I also need to amend for mortgage insurance, and I have not seen an update installed on my computer.

What items did you install in 2018 that are eligible for the credit? The credit for solar power, geothermal, and wind power never expired and was always in the 2018 program. The credit for energy efficient doors and windows, air conditioning, furnaces, and similar items had expired at the end of 2017 and was only renewed at the end of 2019, but was made retroactive.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 2018, Residential Energy Credits were awaiting legislation and Form 5695 was not generated for 2018. Tried amending 2018 -- did not allow credit. How can I get 2018?

Hers is the FAQ. You can sign up to be notified when the 2018 program is ready.

https://ttlc.intuit.com/community/tax-topics/help/2018-extenders-passed-under-taxpayer-certainty-and...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 2018, Residential Energy Credits were awaiting legislation and Form 5695 was not generated for 2018. Tried amending 2018 -- did not allow credit. How can I get 2018?

This is a screen shot of the version information. I am trying to get a credit for an air conditioner and a hot water tank installed in 2018. I appreciate all your input!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 2018, Residential Energy Credits were awaiting legislation and Form 5695 was not generated for 2018. Tried amending 2018 -- did not allow credit. How can I get 2018?

r48 is the latest version from last fall, and does not include the credits you need. You can sign up for notification when the update is ready. Remember, you can amend for 3 years, and the IRS is likely to have a huge backlog, so you might want to hold off a bit anyway.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 2018, Residential Energy Credits were awaiting legislation and Form 5695 was not generated for 2018. Tried amending 2018 -- did not allow credit. How can I get 2018?

Thank you for your help with this. I guess I will hold off until I hear more. I did sign up to receive updates from TurboTax. Thanks for letting me know how to do this.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

vesta

Level 2

vesta

Level 2

Anonymous__

Returning Member

walter-morton

Level 2

otisandowsley

New Member