- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- EV Credit for Tesla 3

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EV Credit for Tesla 3

Hope TurboTax team will read this - the form needs to calculate the tax credit as follows:

7,500 for Tesla's put in use before 2018 Dec, 31.

3,750 for Tesla's put in use between 2019 Jan, 01 and 2019 June, 30

1,875 for Tesla's put in use after on or after 2019 July, 1

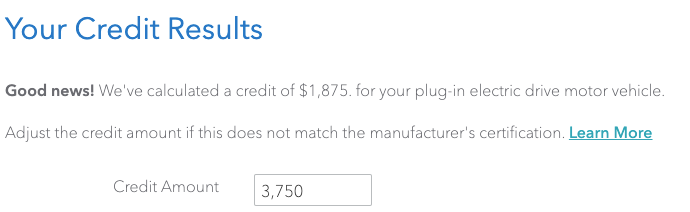

I got one on June 27, 2019. The initial version of TurboTax calculated the credit with 7,500 (to high), after the update from today (2020 Feb 20) it calculates it too low - 1,875.

Seem it just can't do it right for the time from 2019 Jan 1 until June 30.

Hope the update tomorrow will get it right so that I can finally submit my updated return without getting it rejected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EV Credit for Tesla 3

To fix that, when you can adjust the credit put the full $7,500, it will automaticly make it 25% whcih is the $1875

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EV Credit for Tesla 3

Make sure you have a total of 7,500 in the box the pops up after entering EV information. It should calculate afterwards. I refiled last-night, unfortunetly I was rejected again. I just filed for the 3rd time, hoping it goes through since my preview shows the 1,875 as EV credit, not 7,500. Fingers crossed. PS. TurboSucks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EV Credit for Tesla 3

It still isn't working! If you purchased between January and June you should get 3750 and it is only giving 1750. THIS ISN'T RIGHT!!!! I would love to file if the software can be fixed. This is really frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EV Credit for Tesla 3

Seem it just can't do it right for the time from 2019 Jan 1 until June 30.

>> I agree.

Mine had rejected even though I manually overrode the number to $3,750 (purchased mine in March 2019). Doing this override before today's "fix" adjusted my Federal appropriately, but trying to use the override after the latest release doesn't make any difference; it defaults it to $1,875, which is NOT correct.

What's the point of this adjustment field if I can't use it to correct an obvious error in the system? Is this really going to be fixed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EV Credit for Tesla 3

The fix isn't scheduled until 2/21/20 EST. That hasn't happened yet. Give it another try in 5 hrs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EV Credit for Tesla 3

I resubmitte with the proper calucation about 4 hours ago. Within 30 min federal and state ws accepted.

Good luck all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EV Credit for Tesla 3

You have to change the box amount to $7,500. It will deduct the difference based on your vin. You will see it update right away.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EV Credit for Tesla 3

@rprewer I have this same exact problem, except I'm working on refiling this now. I also updated the line to 1875 and now it's saying I'm only going to get 469 (1875 * 0.25 = 469). I got some help and they told me to just put in 7500 for the credit so that I get the full 1875 but that seems so counterintuitive, I believe this is post their calculation fix too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EV Credit for Tesla 3

I'm having the same problem. I bought my Model 3 on June 24, 2019, and it's giving $1875 now for the credit instead of the correct amount, $3750.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EV Credit for Tesla 3

Is this resolved?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EV Credit for Tesla 3

Yes, it is. What you have to do is put $7500 in the box no matter whether your actual credit is that amount or $3750 or $1875. Then it automatically adjusts the number to the right one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EV Credit for Tesla 3

Thanks for the suggestion to put in $7,500 for my 04/2019 Model 3, I'll resubmit now and see what happens. I'm extremely disappointed in Intuit about this. You'd think for one of the leading tax softwares, they'd have their stuff together better than this. Huge hassle.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EV Credit for Tesla 3

Maybe I am misunderstanding how these credits work.

Purchased AND HAD DELIVERED a brand new Tesla model 3 PRIOR to the June 31st cutoff for 50%....

But now I am being placed in the 25%?

Is this still some "glitch"? It is saying I have other deductions... I do not. Where is my other 25% of this credit going?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EV Credit for Tesla 3

was able to get it calculated right today and submitted/accepted. the issue really is that the input screen in TurboTax is missleading. When you get to that screen enter your data (Make, VIN, purchase date and service date ...). In the box at the bottom put 7,500. It will then fill out the form 8936 correctly (generate the pdf file and check) - that is it will put 7500 in line 4a, it will calculate the phase-out percentage (50% or 25%) in line 4b based on your other input and it will show the correct tax credit amount in line 4c.

Seems there's still one issue: The phase-out percentage should be calculated based on the 'service' date, but TurboTax actually does based on the purchase date.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

nickbare4201

New Member

Edge913

New Member

ba4f97382165

New Member

janinecox60-

New Member

3f32ca3a9063

New Member