- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Down to the wire....in the filing section...this is the 1st year Dependent is filing as an Independent

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Down to the wire....in the filing section...this is the 1st year Dependent is filing as an Independent

Down to the wire....in the filing section...this is the 1st year Dependent is filing as an Independent, so doing their own taxes. The questions that TT poses for which clarification is requested.

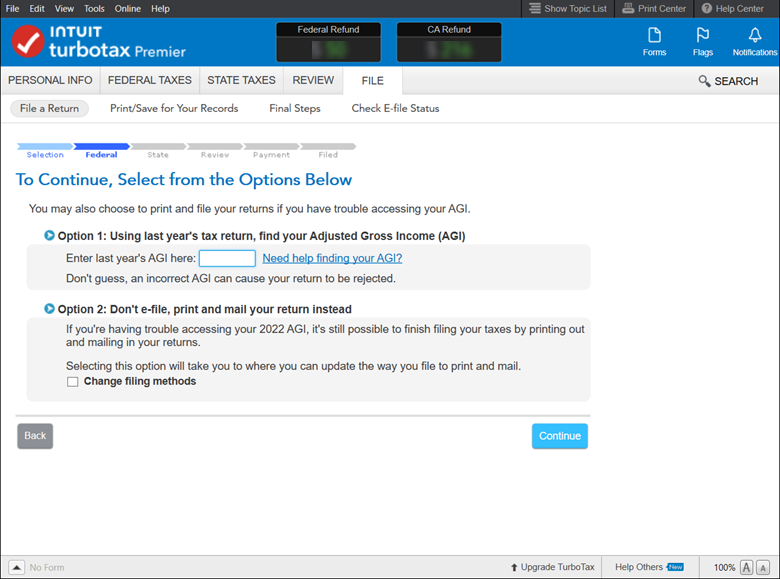

1. Did you or someone on your behalf file 2022 tax return with the IRS?

So, I selected the box, Yes (as the child was a dependent on my taxes).

2. On the next screen, the software is asking for AGI, so just wondering, do I put my AGI from 2022 as the child was my dependent. I just don't want the e-file to get rejected and bounced back?

Thank you for your assistance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Down to the wire....in the filing section...this is the 1st year Dependent is filing as an Independent

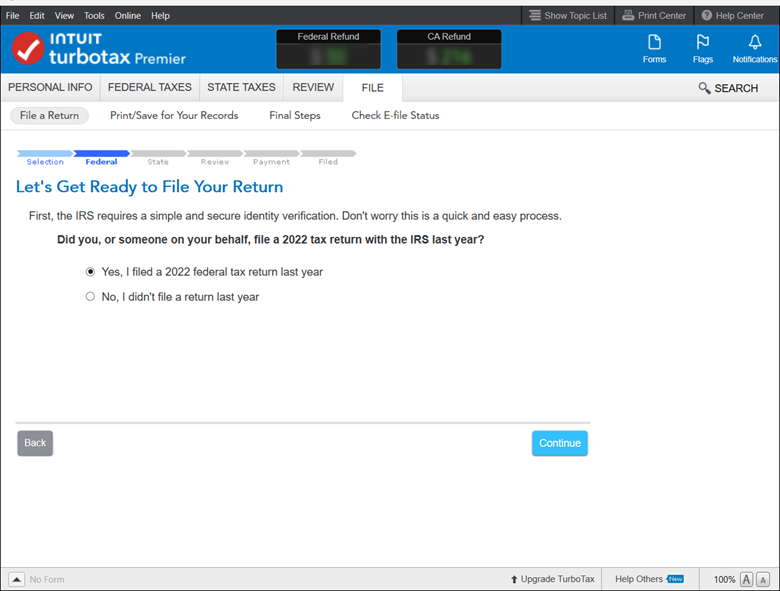

You misunderstood the question.

- I expect that you're preparing your child's return.

- It is asking if they had filed a return on their own in 2022.

- The answer would be NO.

- The good news is that the AGI question will go away. If it requires a number, it will be zero.

Please contact us again with any additional questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Down to the wire....in the filing section...this is the 1st year Dependent is filing as an Independent

John,

Thank you for your response. You are correct, tax return is for my child and this is the first time they will be filing on their own (previous year, the child was a dependent on my taxes).

Appreciate the clarification and thank you once again.

Best regards and a Happy Easter.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

sherri2020

New Member

lindsayjo_b

New Member

tbduvall

Level 4

hmharvey0312-gma

New Member

chris-gon7731

New Member