- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Can I claim the Energy-Efficient Vehicle credit and the Energy-Efficient Vehicle Charging station credit in the same year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim the Energy-Efficient Vehicle credit and the Energy-Efficient Vehicle Charging station credit in the same year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim the Energy-Efficient Vehicle credit and the Energy-Efficient Vehicle Charging station credit in the same year?

The only cap on the credits is the amount of your tax liability. Other tax credits will reduce the amount available for the Charging Station Credit. Total credits cannot exceed your tax before credits.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim the Energy-Efficient Vehicle credit and the Energy-Efficient Vehicle Charging station credit in the same year?

I have the exact same situation. Doesn't seem right....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim the Energy-Efficient Vehicle credit and the Energy-Efficient Vehicle Charging station credit in the same year?

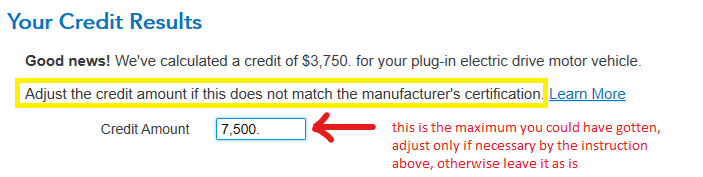

Be sure that you do not change the maximum credit amount shown on the screen, otherwise the calculation will not be correct.

TurboTax will calculate your maximum credit based on the details entered for your vehicle and any applicable phase-out based on the purchase date.

On the screen where it shows the amount of credit you qualify to receive, the box at the bottom of the page is showing the maximum credit that would have been allowed for your vehicle had a phase-out not applied. Your credit may be limited by the phase-out. If you change the number on that screen, your credit will not be calculated correctly.

The information on the screen says this field is for adjusting the amount of maximum credit it is does not match the manufacturer's specification. The number entered here will be the maximum credit that you may receive prior to any limitation being applied. If you change it, your credit will be based on the number entered.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.