- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Why does nonresident state reflect interest earned from principal state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does nonresident state reflect interest earned from principal state?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does nonresident state reflect interest earned from principal state?

When you're doing the returns you need to do the nonresident state first. Wisconsin has all of the income allocated to it automatically and you need to go through the step by step interview and manually allocate all of the non-Wisconsin income to the home state. Once you've done that then you can start on your resident state return.

For interest income in the Wisconsin return you need to go to the Miscellaneous section and click 'Wisconsin NonTaxable Income and enter the interest amount there. It will remove it from your return at that point.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does nonresident state reflect interest earned from principal state?

The nonresident tax return may reflect interest income from your resident state if the interest income wasn't allocated to your resident state. There should be an apportionment schedule that you can complete in the nonresident tax return where you can apportion the income that should be taxed in that state.

For additional information, review the TurboTax articles Multiple States—Figuring What's Owed When You Live and Work in More Than One State.

Instructions to delete state tax returns in TurboTax Online

- Login to TurboTax

- Select State Taxes, then Review/Edit

- Select the trash can next to the state that you want to delete, then Delete

- You can add the states back on the next screen

Review the TurboTax Help article How do I delete my state return in TurboTax Online? for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does nonresident state reflect interest earned from principal state?

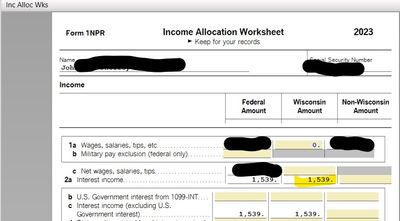

Thank you for the reply. I cannot find anywhere in the software where I can allocate/reallocate the interest income to the my primary/resident state (MN). TurboTax is automatically pulling in the interest income to the 'Income Allocation Worksheet' for the nonresident state WI form (1NPR) and I am unable to make any changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does nonresident state reflect interest earned from principal state?

To clarify,

Did you import or type in the 1099-B

Was there any state tax listed on the 1099-B?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does nonresident state reflect interest earned from principal state?

Thank you for the reply KrisD15.

I manually typed in the 1099-B (1099-INT) information from my broker. There is no State designation anywhere on the document - other than in my name & address at the top of the document, which shows my primary residence state (MN).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does nonresident state reflect interest earned from principal state?

When you're doing the returns you need to do the nonresident state first. Wisconsin has all of the income allocated to it automatically and you need to go through the step by step interview and manually allocate all of the non-Wisconsin income to the home state. Once you've done that then you can start on your resident state return.

For interest income in the Wisconsin return you need to go to the Miscellaneous section and click 'Wisconsin NonTaxable Income and enter the interest amount there. It will remove it from your return at that point.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

g213

Level 1

razor5

Level 3

kb115_

Level 2

BM85

Returning Member

Cespitia88

New Member