- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Turbotax desktop software bug - PA non-resident work % calculation not working

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax desktop software bug - PA non-resident work % calculation not working

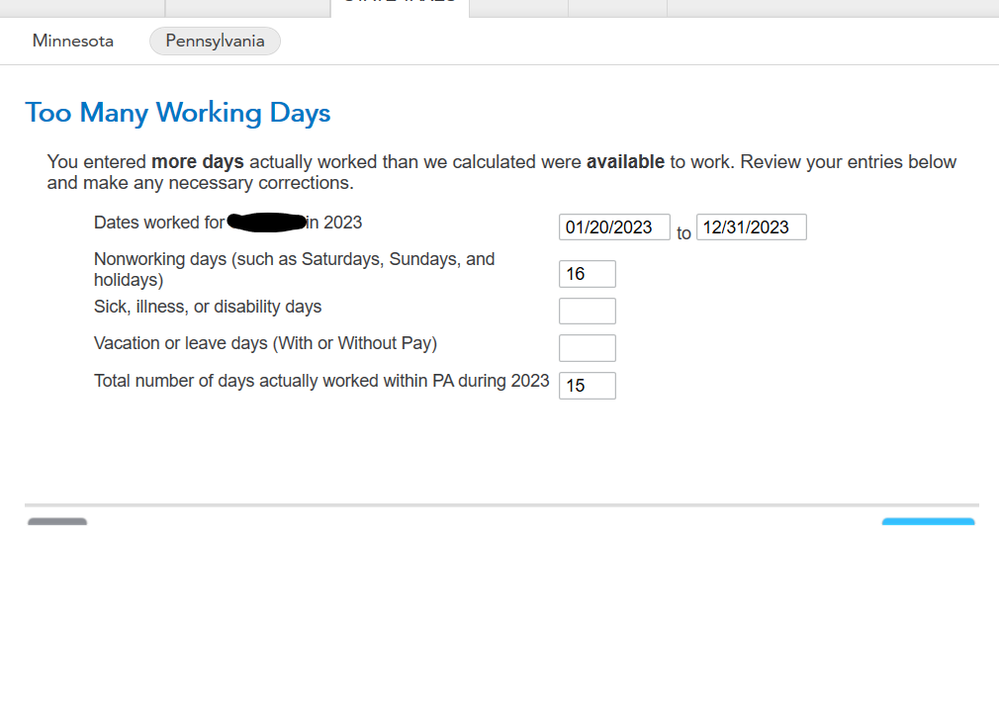

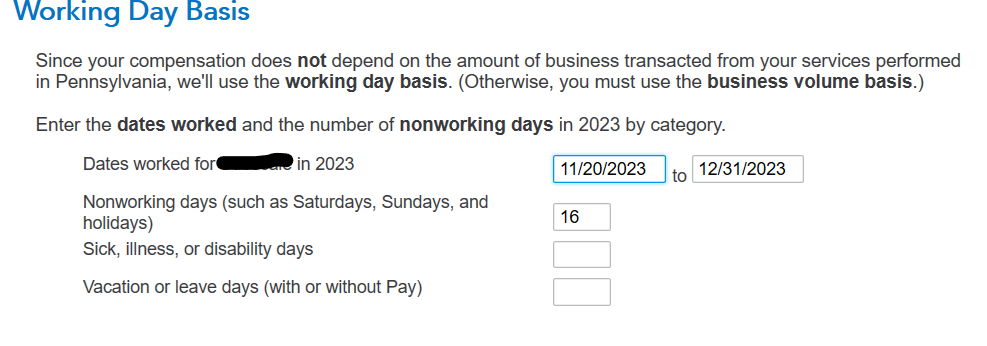

I live in another state and worked in PA in 2023 for about 5 weeks,.. but my PA employer withheld taxes for my resident state. There is a method for calculating the percentage of work days in PA vs total days in Turbo Tax, however it does NOT work. There is a software bug and the software is not calculating correctly; nor am I able to manually enter the correct information direct in the form method. That also is NOT working correctly.

See below for some images of what I'm experiencing.

Below is screen shot of dates worked for company in 2023 in PA and the non-working days = 16.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax desktop software bug - PA non-resident work % calculation not working

I am going to assume you don't actually need to file a PA return. PA has a reciprocal agreement with several states where you don't file a PA return if you live in one of these states Indiana, Maryland, New Jersey, Ohio, Virginia, or West Virginia.

See Which states have reciprocal agreements? - TurboTax Support

Your employer would / should have included PA pay and tax otherwise.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax desktop software bug - PA non-resident work % calculation not working

thanks for your response. I live in Minnesota, which unfortunately does not have a reciprocity agreement with PA.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

gholness

New Member

AwKidd

New Member

merrymary

New Member

capable_reader

Level 1

johndebt

New Member