- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Trouble reporting Foreign Earned Income on 540NR: Schedule CA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble reporting Foreign Earned Income on 540NR: Schedule CA

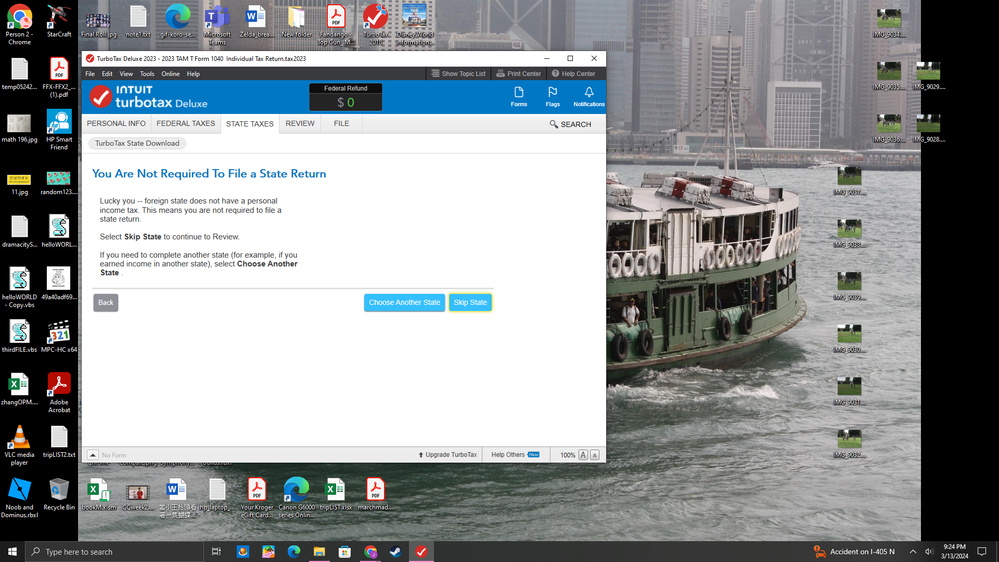

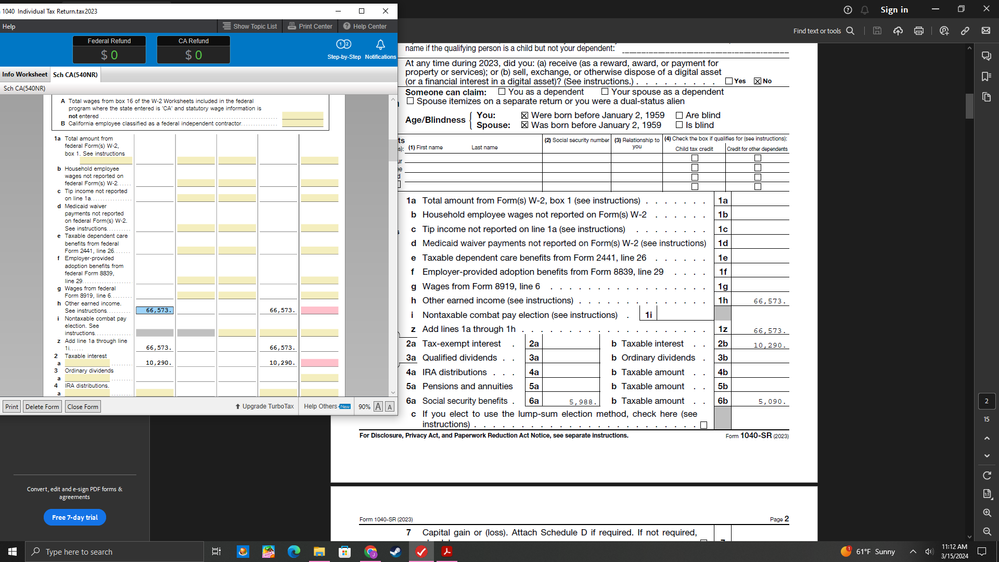

In the past years, Turbo Tax helped me moved the Foreign Earned Income (qualified for exclusion for Federal) to 540NR. But this year, it even told me that I don't need to report CA state tax return. When I insist on adding CA State tax return, it placed the Foreign Earned Income (FEI) into "combat zone foreign earned income exclusion" which is not true. Hong Kong, China was not a combat zone in 2023. So I followed an advice from this community and click on "forms" on the upper right corner to look at the schedule CA. It listed the FEI in column A but I can't edit it to become 0 so that I can move the amount to column C.

What can I do? What should I do? Thanks in advance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble reporting Foreign Earned Income on 540NR: Schedule CA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble reporting Foreign Earned Income on 540NR: Schedule CA

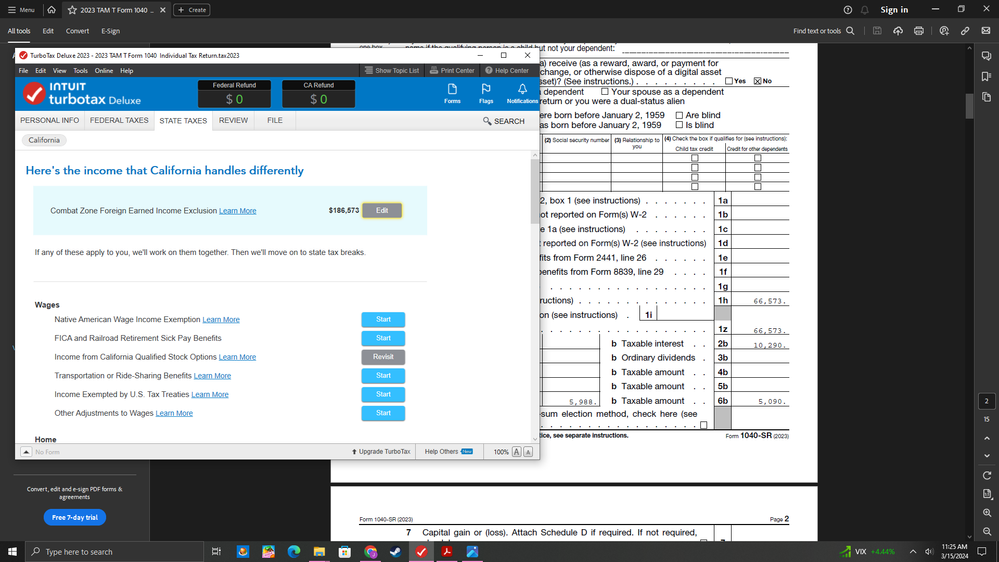

I'm actually confused why it says "combat zone foreign earned income exclusion" is $186,573. Where did they get that number?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble reporting Foreign Earned Income on 540NR: Schedule CA

Never mind. I figure out my mistake now. The FEI does not need to be taxed in CA so it should be in column A. The $183k shown on the "Combat Zone FEI exclusion" is hinting to me that I made a mistake on Form 2555 because I accidentally reported the FEI 3 times. I don't know why Form 2555 line 23 had "NIL" therefore forcing me to put a number there. Once I deleted "NIL", it lets me move on. So now I'm reviewing both 1040 and 540NR again for any mistake before filing. Thank you for reading.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

SoCalRetiree

Level 1

SelenaP

Returning Member

lydiagp7090

Returning Member

futaxes

Returning Member

alexmar

Level 1