- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- SOOO confused about nonresident taxes paid to other state

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SOOO confused about nonresident taxes paid to other state

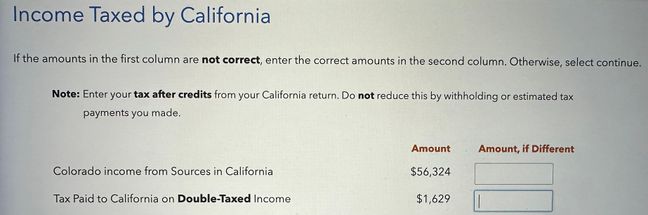

I live in CO and work two jobs. One is in person in CO and one is remotely in CA. I am trying to complete my taxes online using TurboTax and I am very confused about this one section (see pics). Thank you to anyone willing to clarify this for me.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SOOO confused about nonresident taxes paid to other state

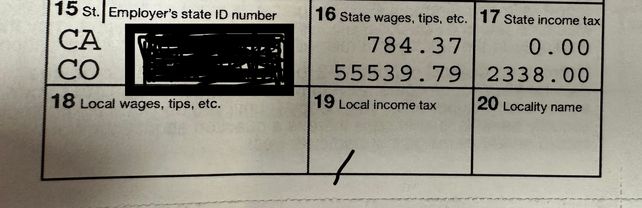

Your Colorado Income from 'California Sources' is the $784.37 shown on your W-2. This the only income CA will tax you on as a Non-Resident. You paid $0 tax to CA on this amount.

Here's more info on How to File a Non-Resident State Return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SOOO confused about nonresident taxes paid to other state

Thank you so much for your help. Just to clarify, I would correct the following then?

Colorado income from sources in California $56,324 --> Corrected to be $784.37

Tax paid to California on double-taxed income $1,629 --> Corrected to be $0

It is concerning to me that TurboTax uploaded these other figures because it is so different. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SOOO confused about nonresident taxes paid to other state

Yes, you would make the corrections stated which is exactly what is shown on your W-2. You may want to check your federal W-2 entry to make sure you have two states by using 'Add another state'. Regardless, the correct information is provided by @MarilynG1 and your understanding is correct:

- Colorado income from sources in California $56,324 --> Corrected to be $784.37

- Tax paid to California on double-taxed income $1,629 --> Corrected to be $0

@jnfrancis

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Florida_Res_2024

New Member

Mlemusme

New Member

ParkNYC

Level 4

hbrighter22

New Member

chj2029

New Member