- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Schedule K-1 1065 Income Tax Withheld

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 1065 Income Tax Withheld

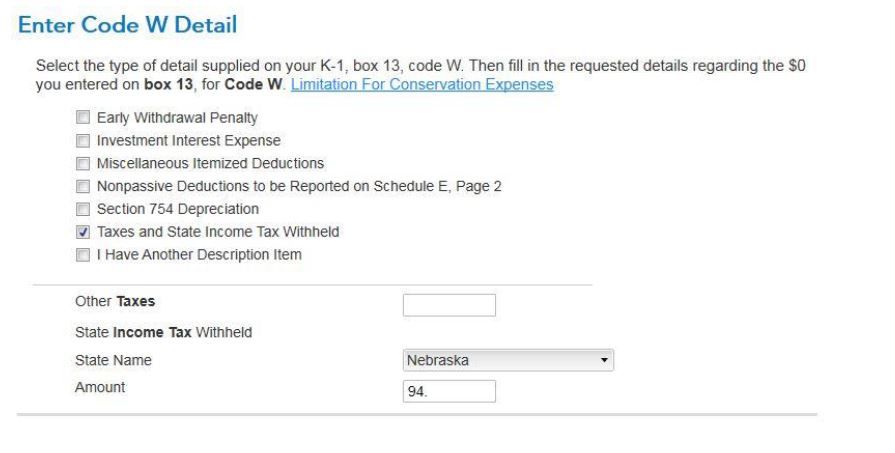

As of last filing, I was able to enter my income tax withheld by checking box 13 and then drop down to W- Other Deductions. Leaving that blank and clicking continue, it took me Enter Code W Detail (image below) with an option below for a check box of Taxes and State Income Withheld.

This year there is no W - Other Deductions. Does anyone know where that option is now? Or where I can enter the information? Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 1065 Income Tax Withheld

The IRS made extensive changes to Schedule K-1 for tax year 2023. Box 13 Code W is now often reported as Box 20 Code ZZ. Where this credit is entered is to be determined by the taxpayer, based on Additional Information provided by the partnership.

In the case of pass-through entity tax (PTET), the estimated payment is not be entered on the federal return. Instead, this is information for the state return and should only be entered there. In most cases, you will find this under Other Credits / Uncommon Credits or Business Income Adjustments for Schedule K-1. The exact entry point depends on the state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 1065 Income Tax Withheld

The IRS made extensive changes to Schedule K-1 for tax year 2023. Box 13 Code W is now often reported as Box 20 Code ZZ. Where this credit is entered is to be determined by the taxpayer, based on Additional Information provided by the partnership.

In the case of pass-through entity tax (PTET), the estimated payment is not be entered on the federal return. Instead, this is information for the state return and should only be entered there. In most cases, you will find this under Other Credits / Uncommon Credits or Business Income Adjustments for Schedule K-1. The exact entry point depends on the state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ccacioppo

Level 1

Jama2

Level 1

jiillll

New Member

cabg

New Member

joycesyi

Level 2