- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Yes, contributions to the SC Future Scholar 529 plan are...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In 2016 I've made contributions to my daughter's future scholar 529 plan. Are these contributions tax deductible in South Carolina? If yes, where should I enter these co

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In 2016 I've made contributions to my daughter's future scholar 529 plan. Are these contributions tax deductible in South Carolina? If yes, where should I enter these co

Yes, contributions to the SC Future Scholar 529 plan are deductible on your SC return.

If you have already finished the SC return, go back into your state return. (Or, as you go through the return, look for the screen titled “Here’s the income that South Carolina handles differently” and follow the steps from that point below.)

You should see a screen titled “Your 2016 South Carolina taxes are ready for us to check” where there will be four categories of information to revisit. Then follow these steps:

Click edit beside the Income section.

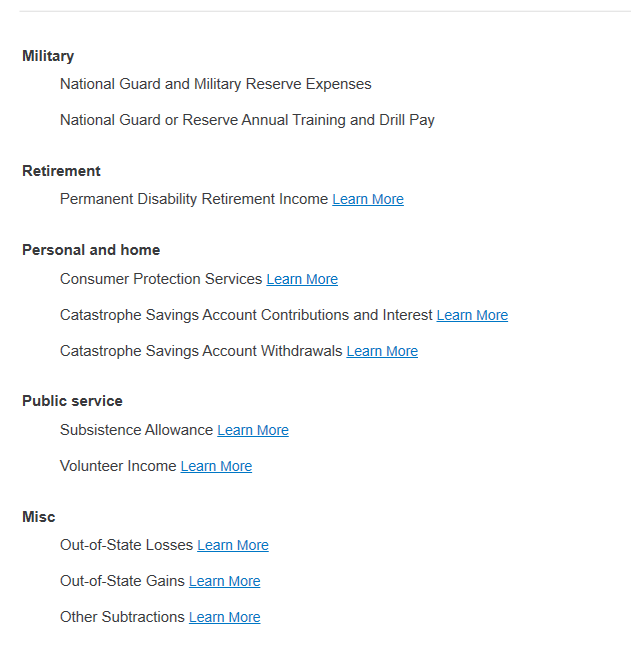

This will show you a screen titled “Here’s the income that South Carolina handles differently.”

As you scroll down the screen, there is a section for Education.

Click Start or Edit beside “College savings and prepaid tuition plan contributions” to go through the section and enter your information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In 2016 I've made contributions to my daughter's future scholar 529 plan. Are these contributions tax deductible in South Carolina? If yes, where should I enter these co

I can't find the section for "education"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In 2016 I've made contributions to my daughter's future scholar 529 plan. Are these contributions tax deductible in South Carolina? If yes, where should I enter these co

South Carolina does not currently offer a tax deduction to residents contributing to out-of-state plans or other types of college savings accounts such as a Coverdell Education Savings Account (ESA) or a UTMA Custodial Account.

Here are the details for the South Carolina 529 plan.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Best-dad

Level 1

TaxableTim

Level 1

NN24

Level 2

trishbal

Level 1

cgervasi

Level 4