- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Worked in New Jersey for 6 months but lived in New York the whole time

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worked in New Jersey for 6 months but lived in New York the whole time

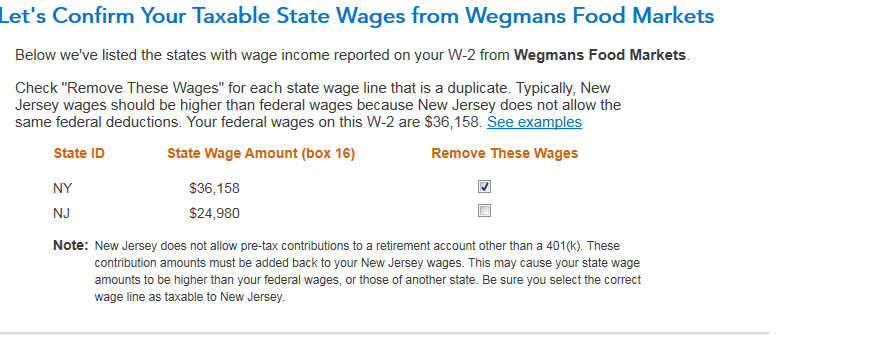

I worked in New Jersey for 6 months but lived in New York the whole time. When filing New Jersey state taxes both New York and New Jersey incomes are listed which total more than my federal income. Do I just keep New Jersey or the bigger of the two?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worked in New Jersey for 6 months but lived in New York the whole time

Yes. On NJ non-resident return, check the box to remove NY wages.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worked in New Jersey for 6 months but lived in New York the whole time

When you are adding your State Returns, add your New York state return first and then add your New Jersey return. This triggers the state questions to be asked in the correct order for TurboTax to make sure that your return(s). To make sure these are added in the correct order, delete your state returns by following these steps.

- While in your Tax Home,

- Select State,

- Select Continue,

- Select Delete next to the State of New York,

- Follow the same procedure for the State of New Jersey.

Add your state returns by following these steps:

- While in your Tax Home,

- Select State,

- Select Continue,

- Select Add a state.

- Add New York first, answer the on-screen prompts to get through this section.

- Add New Jersey next, answer the on-screen prompts to get through this section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worked in New Jersey for 6 months but lived in New York the whole time

but everything I read says do non resident state first then do your resident state second

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worked in New Jersey for 6 months but lived in New York the whole time

I recommend you prepare the non-resident state first. This ensures that the resident state will properly calculate any credit for taxes paid to the other state, that you may be eligible for. This prevents you from being double-taxed on the same income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worked in New Jersey for 6 months but lived in New York the whole time

So on my non resident new jersey taxed I should drop NY with a check mark to delete it from my new jersey calculations?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Worked in New Jersey for 6 months but lived in New York the whole time

Yes. On NJ non-resident return, check the box to remove NY wages.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

mahimahimom

Level 3

ylma663338

New Member

spartatrl-msn-co

New Member

lakean00000

New Member

abby8price

New Member