I am struggling big time with my partial-year resident state tax returns. Here's the info:

Me:

- Lived & worked in MN 1/1/23 to 9/8/23

- Moved, live & work in NC 9/9/23 to current

- Same company - just now working remote

- From my understanding, I pay taxes in the state in which I was physically located in. So starting 9/9/23, my income should be taxable to NC.

Husband:

- Lived & worked in NC 9/9/23-current

This is where I get confused:

- My withholding switched over correctly from MN to NC.

- However, the in-between paycheck was reported on my W2 as BOTH MN and NC, it should've ONLY been MN income since that's where it was earned. Withholding was correct though and didn't double-withhold.

- My 2 states now total MORE than my federal income on my W2...Payroll told me I can make that up when I go to file my taxes as far as credits go. I pushed back on this and told them literally one of my paychecks was NOT taxable to NC so why did they list it that way? And it was all because they put my future move in the system which created a line item for both states.

I have been filling out my returns in Turbo Tax and I cannot figure out the best way to do this.

Minnesota Return:

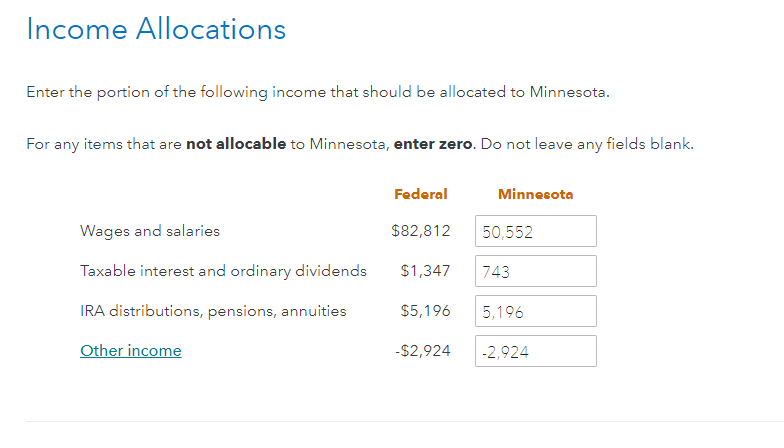

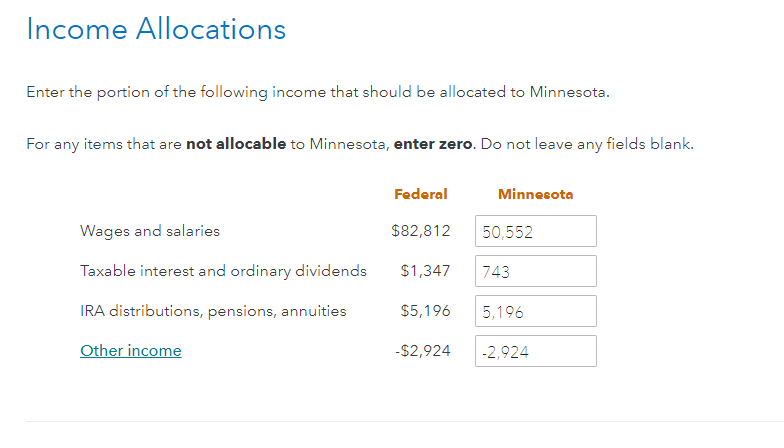

- MN asks for which income is allocated to MN. This was straight-forward and I filled it out as such:

- I also have the option to select Credit for Taxes Paid to Other States: This says "Did you pay state income taxes to MN and to another state on the same income?" - Is this true based on the middle paycheck being reported on my MN and NC wages? Taxes haven't been paid on it yet though so I'm confused. I did not select anything here yet.

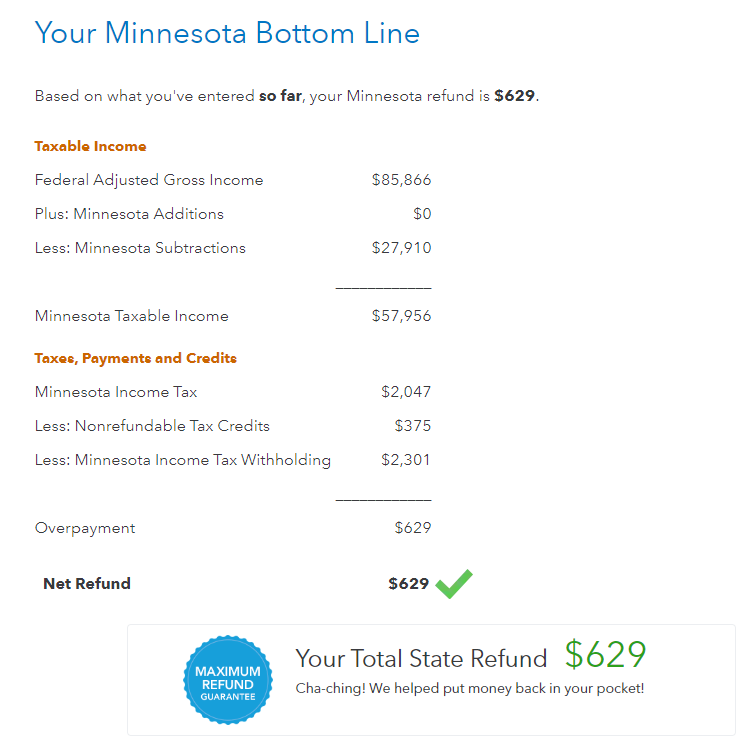

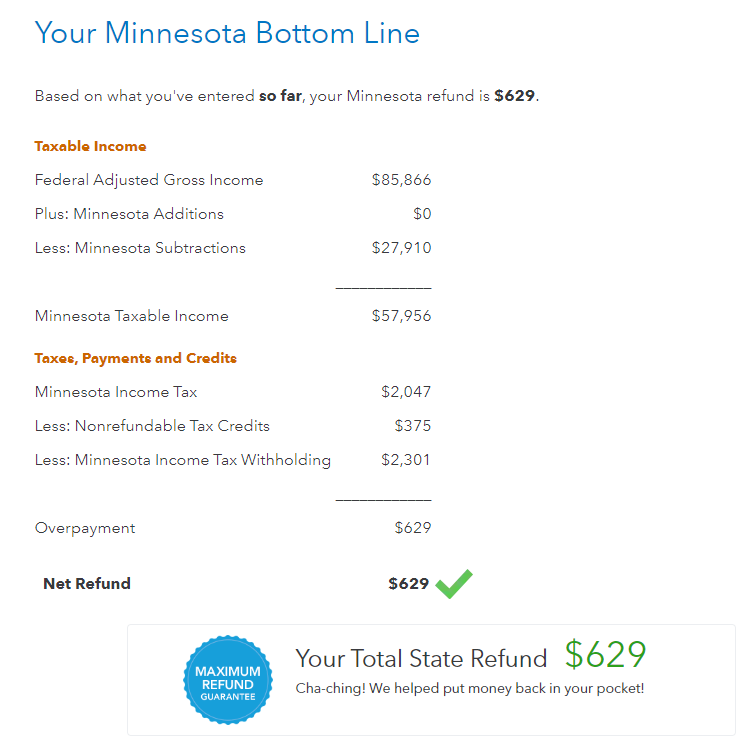

- I keep clicking through and on my MN refund summary they appear to tax my entire Federal AGI...not just my MN portion:

North Carolina:

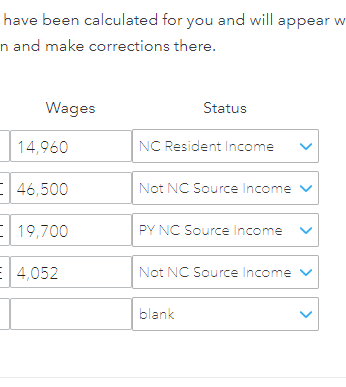

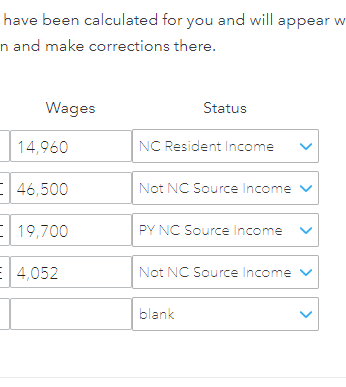

- For NC, first I have to allocate my wages. Keep in mind, this pulls through from the Federal Return. Most importantly, my NC W2 wages are INCORRECT because it counts my final MN paycheck as both MN and NC. So is this where I'm supposed to correct it? NC should read $17,300, not $19,700. The screen says if any calculations need to be changed, they should be corrected under my Federal W2 inputs - which I don't want to do because that won't line up with my W2 and could trigger an audit.

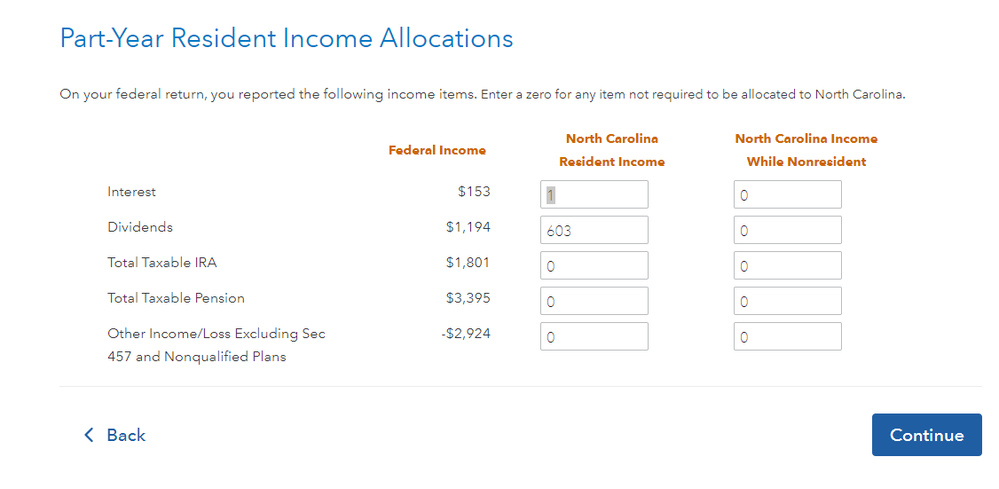

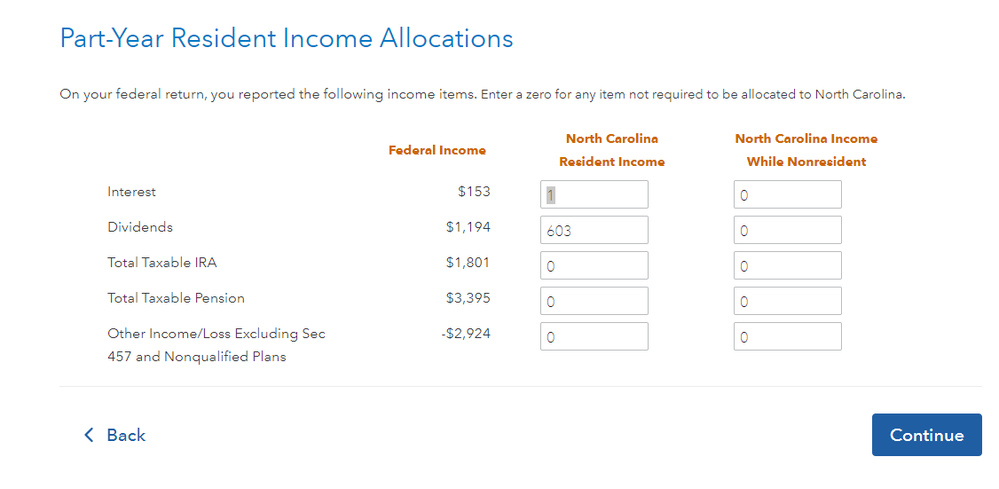

- Then I have to allocate part-year resident income allocations on other categories, which was just dividends for us:

- Then for the NC Credits Section:

"If you are a North Carolina resident and paid taxes to another state or country on income earned in or derived from sources within that state or country, you may receive a tax credit on your North Carolina return. That way, you won't be taxed twice on the same income.

Nonresidents are not entitled to this tax credit.

To get the credit, you need to complete the tax return for the other state first."

- Is this where I list that one paycheck that was throwing everything off? Or since MN seems to be taxing my Federal AGI, do I adjust EVERYTHING from MN off this credit section on the NC return? Any direction would be so helpful - Thank you in advance!