- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Other state tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Other state tax

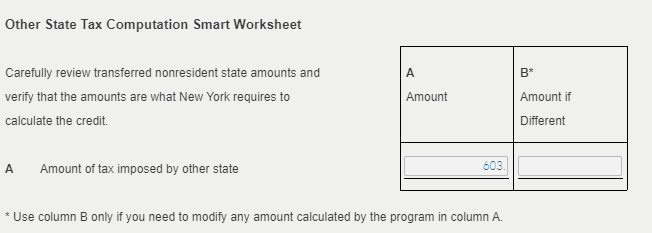

Where do I get the numeric value for the "amount of tax imposed by other state" on my w2?

I live in NY but worked in NJ. Is the "other state" in this case referring to NJ?

I would then be looking at the state tax imposed by NJ not NY correct?

I believe this is boxes16-19 on my w2 but I am unsure.

posted

3 weeks ago

last updated

April 14, 2024

8:01 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

2 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Other state tax

My token number is 1239987 NY

3 weeks ago

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Other state tax

Yes. You should do the NJ return first to create the tax liability Then you would file the NY return.

Follow these steps to locate your tax liability for NJ and enter in NY

- Log into your return

- Select state taxes

- Enter the non-resident NJ for which you need the liability

- On the left, go to Tax Tools

- Select Tools

- Select View Tax Summary

- You will see Summary of your NJ Return at the top.

- Locate the line that says Taxable Income

- Locate the line that says Total Tax

- Note those numbers

- Return to your resident NY return and enter that number where it asks for the liability for NJ

- Some states tax income the federal does not. For example: NJ taxes money you set aside in your retirement plan. Each state has different rules.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

3 weeks ago

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Budman7226

Level 1

bobbie4582

New Member

Slosbc

Returning Member

e-wlawrence

New Member

dperrett1

New Member