- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- NJ Return - Pension, Annuities, & IRA Withdrawals Worksheet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ Return - Pension, Annuities, & IRA Withdrawals Worksheet

I am hung up on the wording in Section 1 - IRA Withdrawals, Part B, Line 6: "Taxable contributions" made to IRA during current tax year.

I made $7000 non-deductible contribution to T-IRA in 2019. Non-deductible, so contribution was made using taxed dollars. Line 6 wording of "taxable contributions' is confusing. At what point are they considering the contribution taxable? At time of contribution (i.e. a nondeductible contribution has been taxed) or later when withdrawn (a deductible contribution will be taxed at withdrawal)? Is my $7000 nondeductible contribution considered a "taxable contribution?" TIA for clarifying.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ Return - Pension, Annuities, & IRA Withdrawals Worksheet

New Jersey does not allow a deduction for retirement contributions, so all IRA contributions are "taxable contributions" for New Jersey.

You should enter the amount of your IRA contributions for 2019.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ Return - Pension, Annuities, & IRA Withdrawals Worksheet

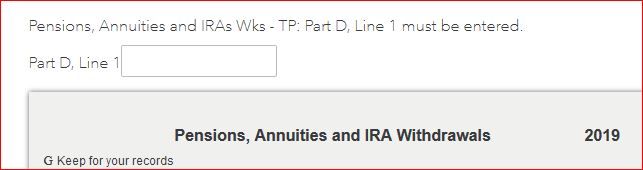

My issue in this area is that I am taking my RMDs and Defined Benefits and am just trying to wrap up this NJ tax filing. I am stuck! See screen shot Where and what do I put in this box and box 2. I cannot finish this tax form unless I complete these points. Very frustrating. Call my Annuity dept? or find the info in my paperwork on hand? Assist please.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

mimithecat6

New Member

GrPoten00_18

New Member

gpep248911

New Member

mgfrobozz

Level 3

Wmtemple

New Member