Are you sure you are calculating the standard deduction correctly? It should be 15% of your Maryland adjusted gross income as listed on line 16 of your Form 502. However, it is a minimum of $1,700 and $3,450 and maximum of $2,550 and $5,150, depending on whether you are filing single or married-joint. Per the instructions for MD Form 502:

MD Form 502 Instructions

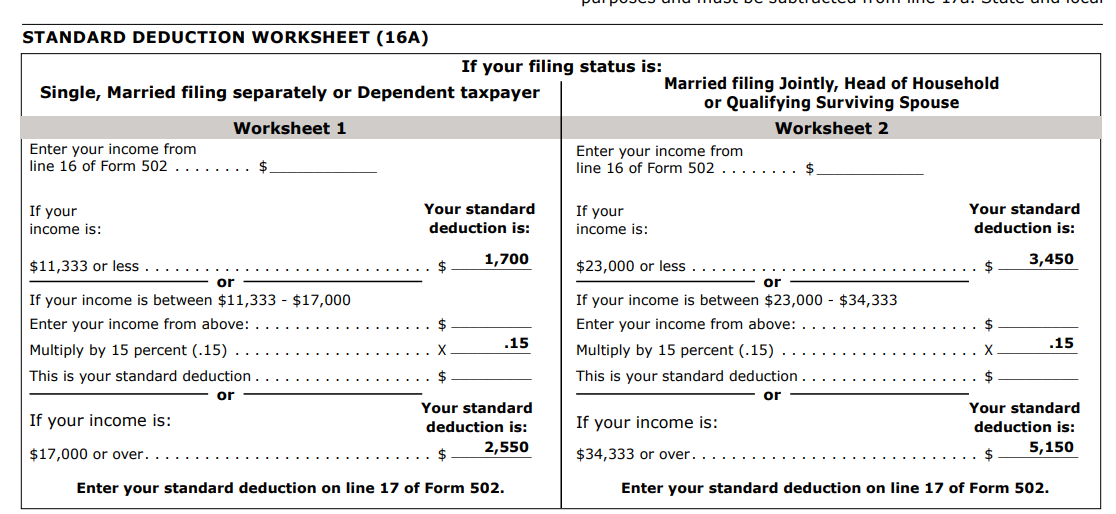

You can use the standard deduction worksheet on page 12 of the instructions to get an accurate calculation of your standard deduction:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"