- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Interest and Dividend Income Question for NJ nonresident 1040NR and NY 1040

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Interest and Dividend Income Question for NJ nonresident 1040NR and NY 1040

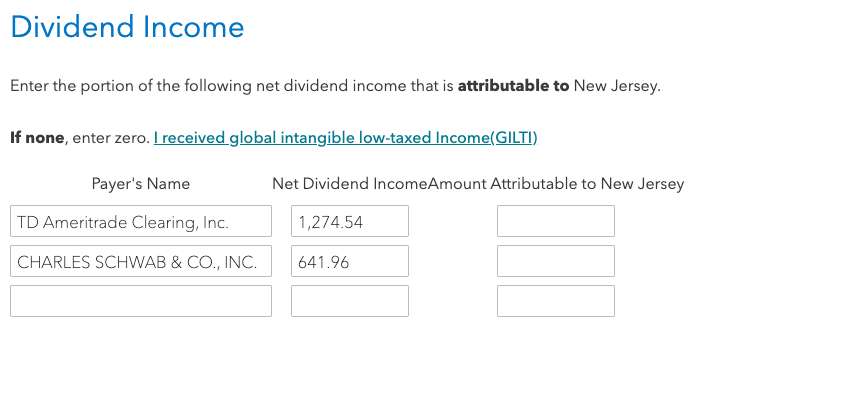

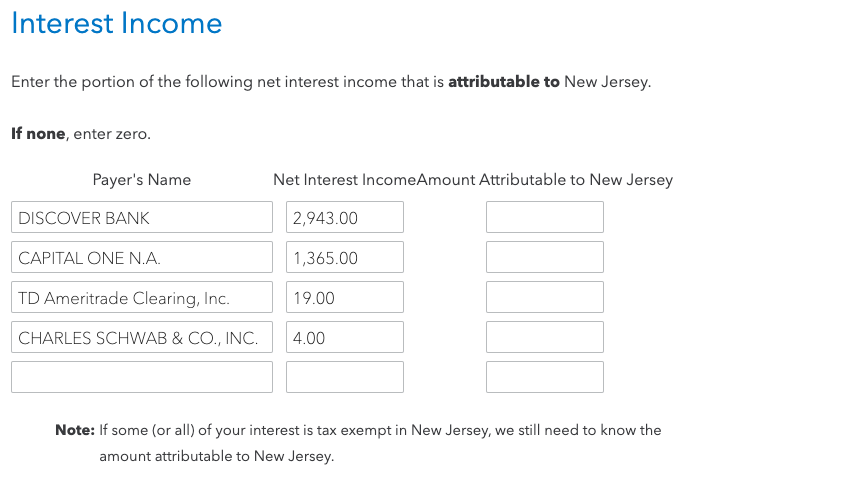

In 2023 I lived in NY the whole calendar year. However, I worked some jobs in NJ. I know I need to file in NJ (NJ 1040NR) and NY (1040). When filling out the NJ section of Interest Income and Dividend Income I am asked to "Enter the portion of the following net interest income that is attributable to New Jersey".

Do I enter the full amount as attributable to New Jersey? Or do I enter "0" and file these under NY?

I am confused if these accounts (Saving, CD interest, and Brokerage Div interest) are attributable to my resident state (NY, the address under file with these accounts) or under my nonresident state? If I file it under the nonresident state will TurboTax recognize this and will I receive a tax credit in NY, rather than be taxed twice?

*Images Below for Reference

Thank You.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Interest and Dividend Income Question for NJ nonresident 1040NR and NY 1040

Your interest and dividend income is only taxable income in the state you resided when you received it. If you didn't live in New Jersey, none of it is New Jersey Income. If you lived in New York all year, it is all New York income. Enter zero for Net Interest Income Attributable to New Jersey.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Interest and Dividend Income Question for NJ nonresident 1040NR and NY 1040

Your interest and dividend income is only taxable income in the state you resided when you received it. If you didn't live in New Jersey, none of it is New Jersey Income. If you lived in New York all year, it is all New York income. Enter zero for Net Interest Income Attributable to New Jersey.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

optca50

Level 3

ryanf312

New Member

CA_Tax_Payer

Level 3

bumjung

Returning Member

wwood12

New Member