- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I have the desktop Turbo program and a Sch K1, Form 1120-S. I have to file a RI resident form and the state version of the K1 has a $ on Sec. II, Line 3 and Sec. VI, Line 2. Both indicate a tax paymen...

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

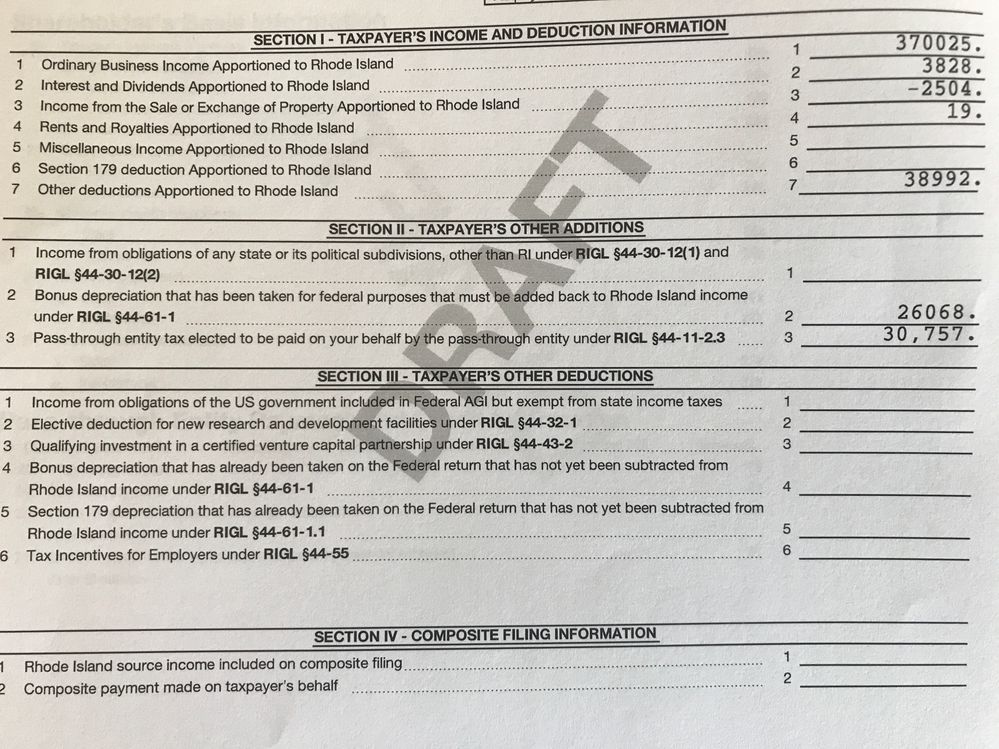

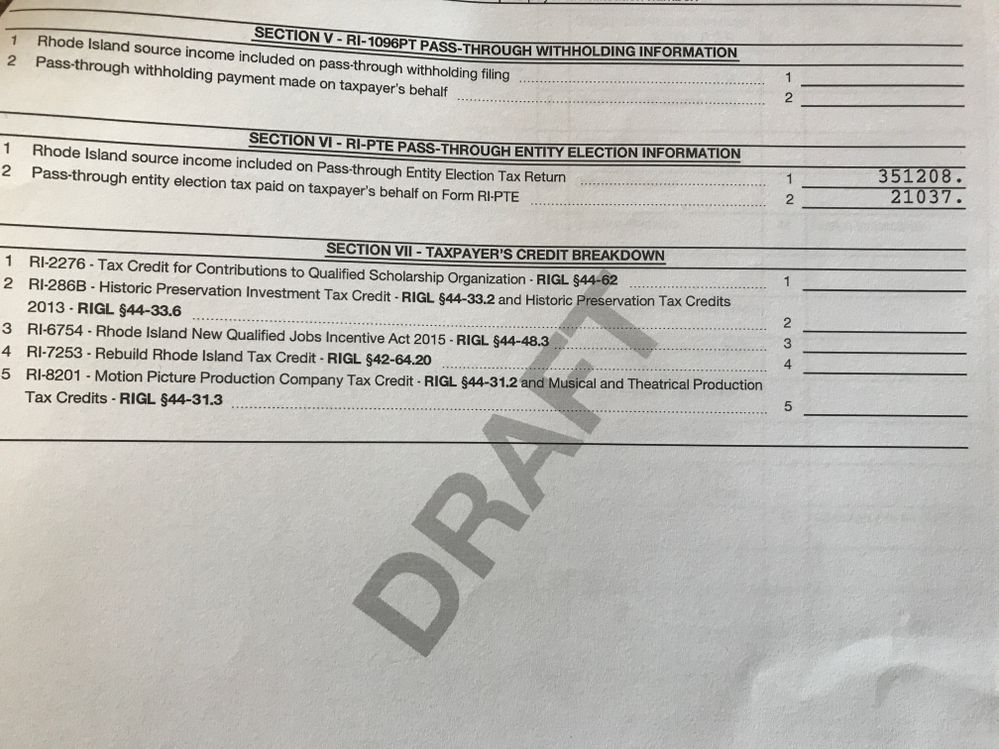

I have the desktop Turbo program and a Sch K1, Form 1120-S. I have to file a RI resident form and the state version of the K1 has a $ on Sec. II, Line 3 and Sec. VI, Line 2. Both indicate a tax payment on taxpayer's behalf. How does that get entered?

posted

April 13, 2021

11:32 AM

last updated

April 13, 2021

11:32 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

2 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have the desktop Turbo program and a Sch K1, Form 1120-S. I have to file a RI resident form and the state version of the K1 has a $ on Sec. II, Line 3 and Sec. VI, Line 2. Both indicate a tax payment on taxpayer's behalf. How does that get entered?

If you mean an estimated tax payment was made under your social security number, you will enter that in TurboTax by following these steps:

- Deductions and Credits

- Estimates and Other Taxes Paid

- Estimates

- Choose the category of estimated tax paid and enter the amount

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 13, 2021

7:26 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have the desktop Turbo program and a Sch K1, Form 1120-S. I have to file a RI resident form and the state version of the K1 has a $ on Sec. II, Line 3 and Sec. VI, Line 2. Both indicate a tax payment on taxpayer's behalf. How does that get entered?

Thank you, I did enter them under tax payments, but wasn't sure that was appropriate since there aren't any dates on them. I've attached a photo of the two pages from the RI version of the K1. Am I right to enter both $30,757 from Line 3, Section II and $21,037 from line 2, Section VI?

April 14, 2021

6:37 AM

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Grubbles

New Member

ja19584

New Member

Flash24

Level 1

Militaryspouse

New Member

AllApplicableUserIDsTaken

Level 1