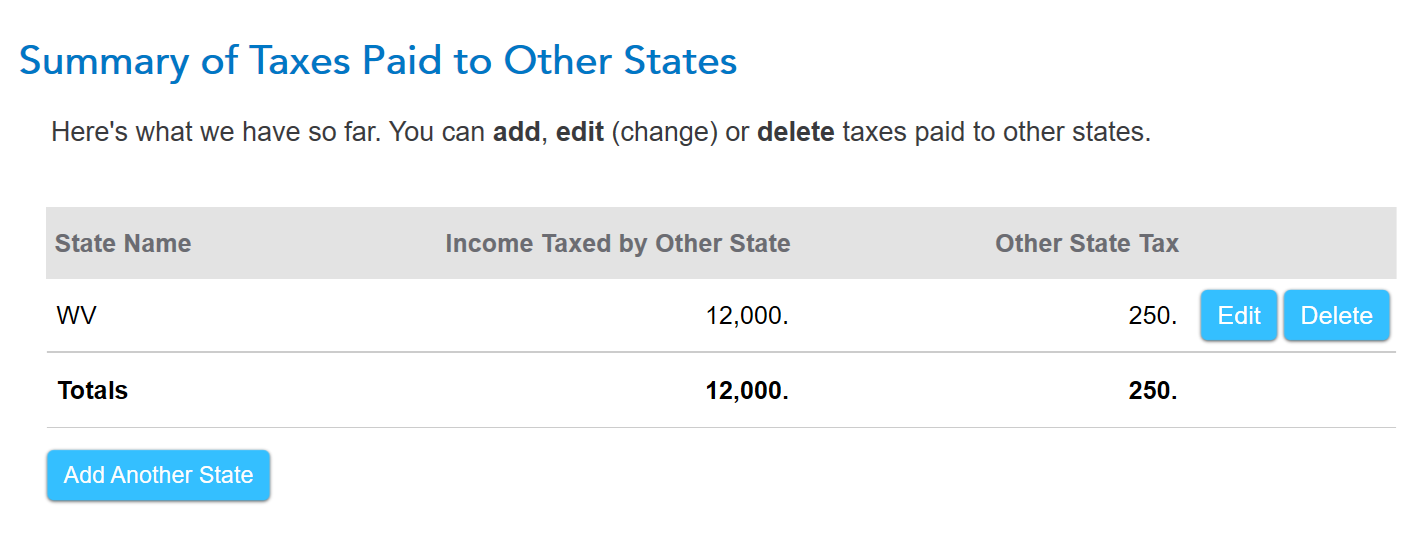

The IT 140 is correct. The Ohio must be filed since you are a resident. OH does not have a Sch A. You should have all income as taxable with a credit for the tax paid to WV. You are filing in the correct order with WV filed first.

View your tax forms and see what OH is showing on the tax forms. You should see your income.

To see your forms:

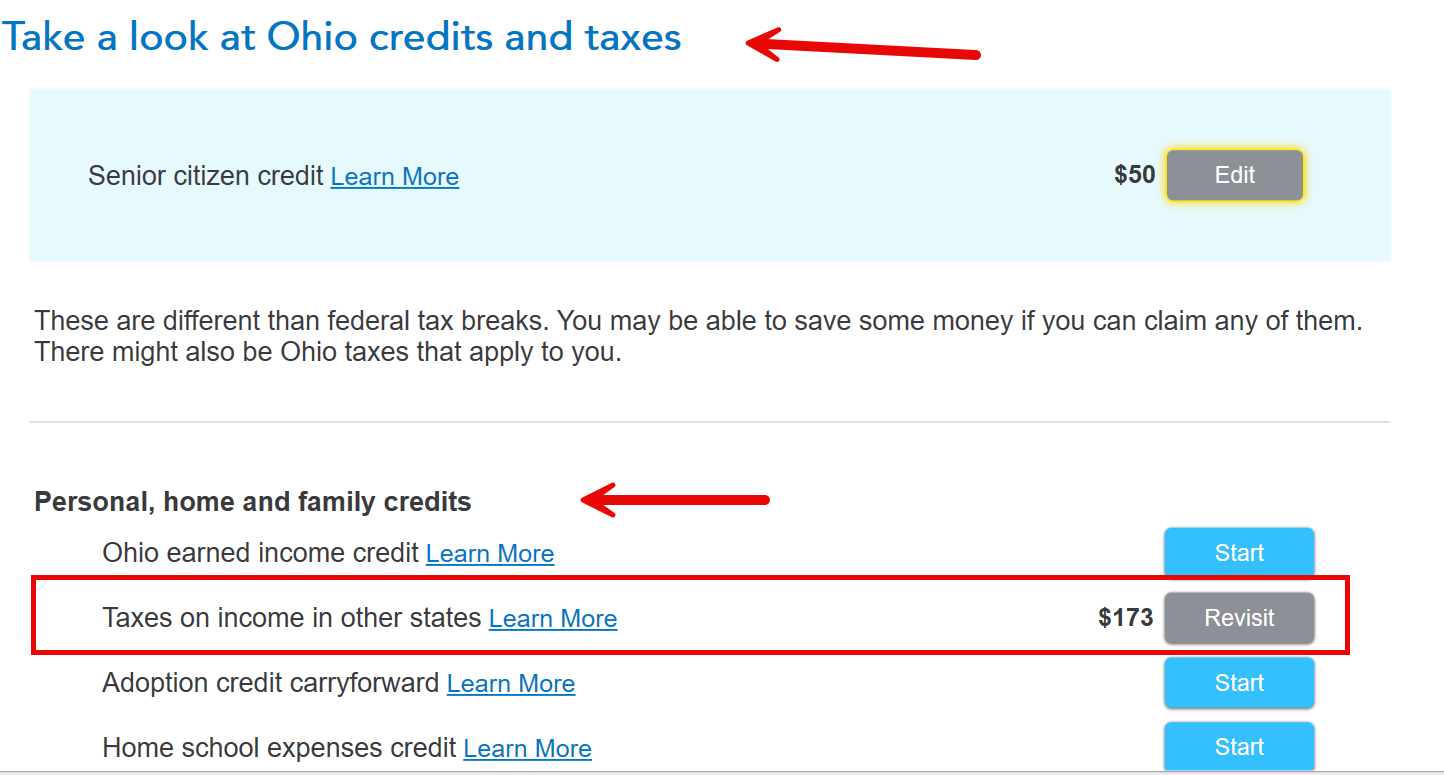

Go back through your Ohio return to the credits and taxes section. Revisit/ Edit the taxes on income in other states section.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"