- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- "California employee classified as a federal independent contractor" section

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

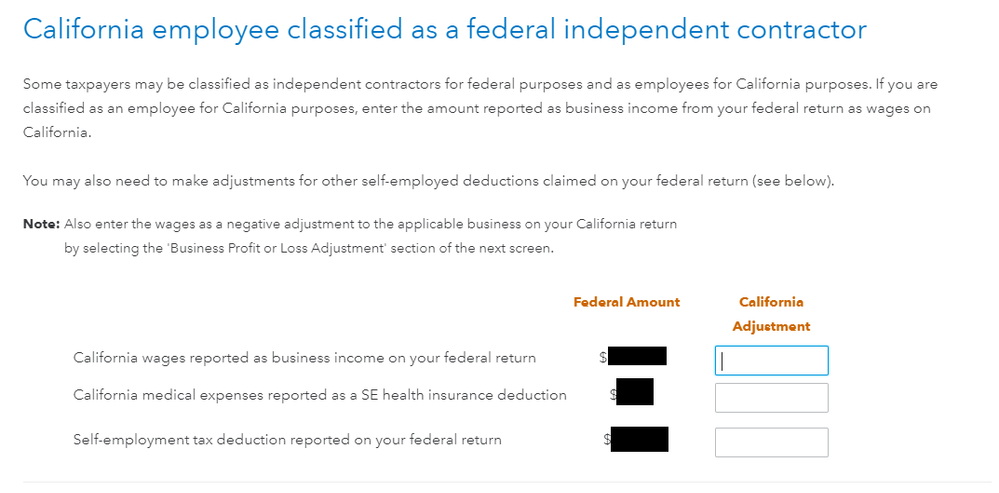

"California employee classified as a federal independent contractor" section

Hello,

I am not sure want I am suppose to do on this section. I am working as independent contractor for a foreign company. I do not receive any forms from them so obviously I am self employee on federal level.

But according to below, there is possibility that I am employee in California? The question is how am I suppose to determine that?

The section also says that " if you are classified as employee for California purposes, enter the amount reported as business income from your federal return as wage on California". But the turbo tax seems to enter the amount for me under "Federal Amount". So does that mean I am a employee in California?

I also notice the wage/income under "Federal Amount" does not take my business expense into account. Should I put the expense in "California Adjustment"?

And what adjustment should I put on medical expense and self-employment tax deduction? Is there a guide on how to find the right adjustment?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"California employee classified as a federal independent contractor" section

Under California law, some workers are classified as employees when some states might consider them independent contractors.

In September of 2019, Governor Newsom signed Assembly Bill (AB) 5 into law. The new law addresses the “employment status” of workers when the hiring entity claims the worker is an independent contractor and not an employee.

See this California FTB webpage for common questions and answers about this law.

If you work in California and believe you are correctly classified as an independent contractor, then you don't need to enter any adjustments in the California column on this screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

casraecav

New Member

1c98707ce2ff

New Member

ataguchi

Level 1

BRB99

New Member

a351e928e6cb

New Member