- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- 2020 Iowa macrs calculatioin on form 4562A

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Iowa macrs calculatioin on form 4562A

I am having trouble with the macrs calculation on Iowa form 4562A. Does not autofill & I can;t efile until I enter the correct amount.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Iowa macrs calculatioin on form 4562A

Need to enter the total Fed depreciation taken since asset purchased. It should have populated the Iowa Depreciation. You need to go to the Fed depreciation schedule and enter the total amount of MACRS depreciation taken by asset. The difference will be an adjustment to income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Iowa macrs calculatioin on form 4562A

Thanks for the info. Iowa doesn't calculate macro the same as federal. I'm still working on it. I even marked asset as gone & it still wants a number to e-file. Such a pain

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Iowa macrs calculatioin on form 4562A

did you ever figure out how to fix this? running into same issue now please help me [phone number removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Iowa macrs calculatioin on form 4562A

The MACRS adjustment for Iowa is on IA 4562A and IA 4562B Iowa Depreciation Adjustment schedule. The instructions begin on page 4 showing when it is necessary to make an adjustment. Once you start for an asset, you must continue each year for that asset until depreciated. The instructions explain how to look at your forms and determine the adjustment.

For help with MACRS, you can use Publication 946 (2023), How To Depreciate Property

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Iowa macrs calculatioin on form 4562A

Hey 🙂 Thank you for responding ma'am would you mind giving me a call and helping me? Every amount that is supposed to be correct that ive tried does not work, ive spoken to 3 representatives who werent sure what the issue was either would greatly appreciate it!

Its an imac purchase price of $1750 placed in service 12/31/2022 last year was when i initially reported it on the form and nothing i try works :(

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Iowa macrs calculatioin on form 4562A

[PII removed]🙂 wont let me post the number

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Iowa macrs calculatioin on form 4562A

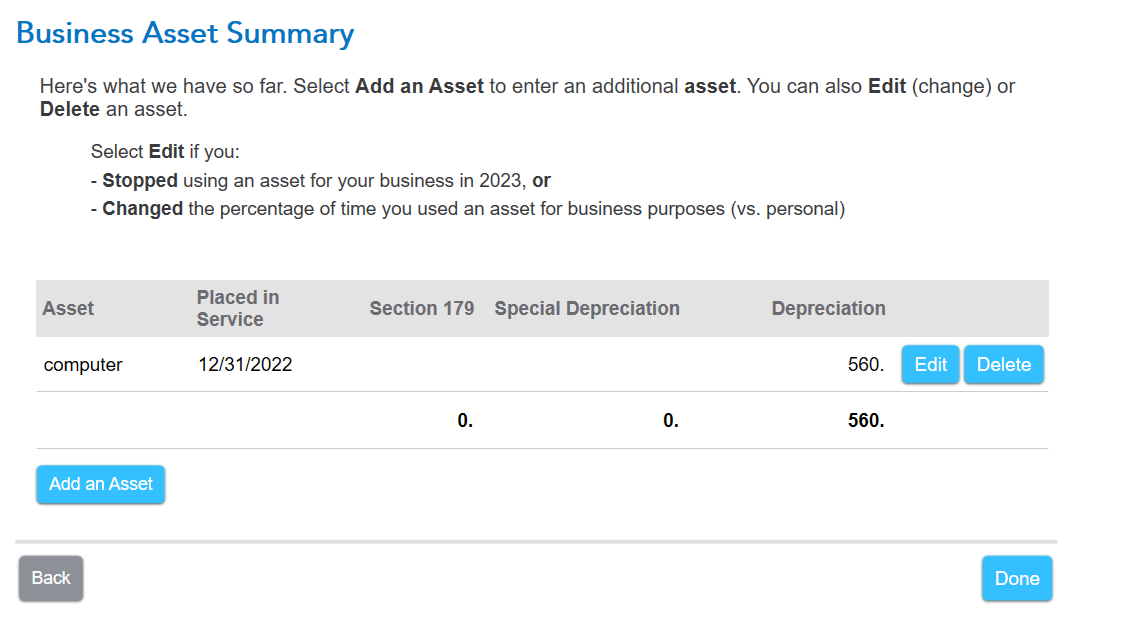

I am trying to recreate your issue. I don't know if you wrote off the computer, did a sec 179 or just put it in as an asset and let it be.

This is my federal using MACRS. I went through Iowa answering questions and didn't even get asked about the adjustment. So, I pulled it up. I don't have any errors or issues since I did not make any special claims. No bonus deduction, no sec 179. What did you do and how much did you deduct for 2022?

Is it possible that you don't need to make an adjustment?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.