- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- Should a passive loss reported on a K-1 offset 1099-Misc income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should a passive loss reported on a K-1 offset 1099-Misc income?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should a passive loss reported on a K-1 offset 1099-Misc income?

A form 1099-MISC would report either rental, royalty or other income. The default treatment of all of these types of income would be passive income. Income from straddles would be better entered as investment sale income where it will be considered investment income that is non-passive income.

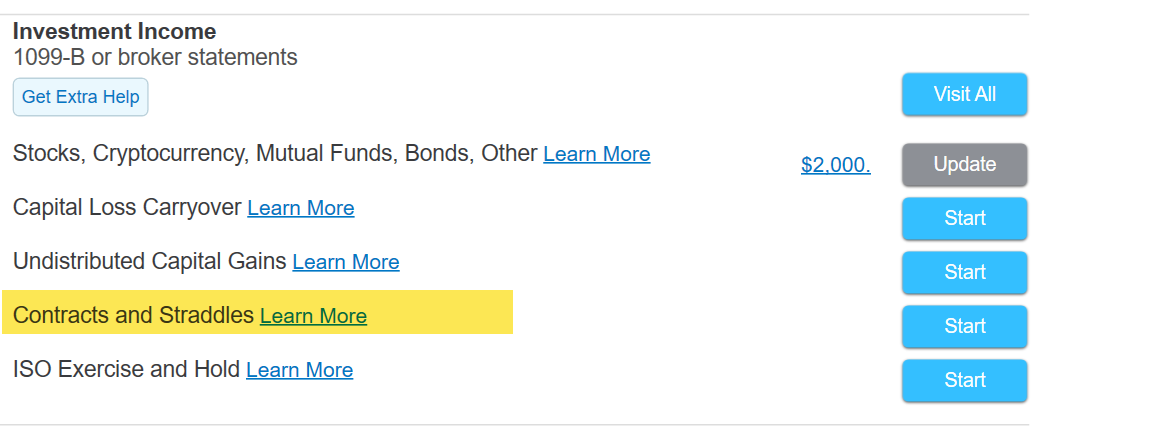

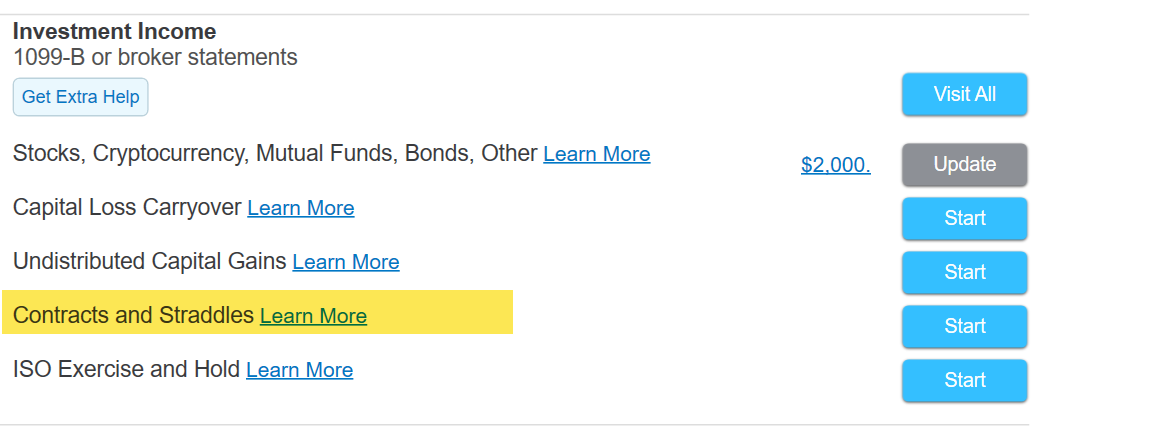

You enter income from straddles in the Wages and Income section of TurboTax, then Investments Income, then Contracts and Straddles:

You can enter the Form 1099-MISC so it will correspond with the copy the IRS receives. You then need to enter a negative amount to "other income" to cancel out the income as follows:

1. From the Federal menu in TurboTax find Wages and Income

2. Find Less Common Income

3. Choose Miscellaneous Income, 1099-A, 1099-C

4. Choose Other Reportable Income

5. Enter a description of the adjustment and the amount as a negative number

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should a passive loss reported on a K-1 offset 1099-Misc income?

A form 1099-MISC would report either rental, royalty or other income. The default treatment of all of these types of income would be passive income. Income from straddles would be better entered as investment sale income where it will be considered investment income that is non-passive income.

You enter income from straddles in the Wages and Income section of TurboTax, then Investments Income, then Contracts and Straddles:

You can enter the Form 1099-MISC so it will correspond with the copy the IRS receives. You then need to enter a negative amount to "other income" to cancel out the income as follows:

1. From the Federal menu in TurboTax find Wages and Income

2. Find Less Common Income

3. Choose Miscellaneous Income, 1099-A, 1099-C

4. Choose Other Reportable Income

5. Enter a description of the adjustment and the amount as a negative number

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should a passive loss reported on a K-1 offset 1099-Misc income?

Using the online program, TurboTax seems to want straddles reported as a sale.

So using round numbers, if my total 1099-MISC 3. Other Income is $40,000, should I just enter any acquisition date, and sale date, cost basis as 0, and sale price as $40,000?

In my actual brokerage statements, the acquisition and sales are listed, though the cost basis and sale price are the same, so they show as netting out to zero. Could I simply adjust the sales proceeds with the income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should a passive loss reported on a K-1 offset 1099-Misc income?

Thanks. I was able to do this, though initially, TurboTax did not show the negative Other Income entry canceling out the passive loss in the K-1 section. After playing around a bit (not even sure what I did), it eventually did so, so all is good.

I've noticed that more and more of my brokerage statements, including those for my children, are including 1099-MISC Other Income, so hopefully TurboTax will make handling this more straightforward. I guess it's not a widespread problem, as the issue only shows up with K1 passive income/losses.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rhartmul

Level 2

suekidder

New Member

gene529

New Member

weekiltie

New Member