- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self employed

A form 1099-MISC would report either rental, royalty or other income. The default treatment of all of these types of income would be passive income. Income from straddles would be better entered as investment sale income where it will be considered investment income that is non-passive income.

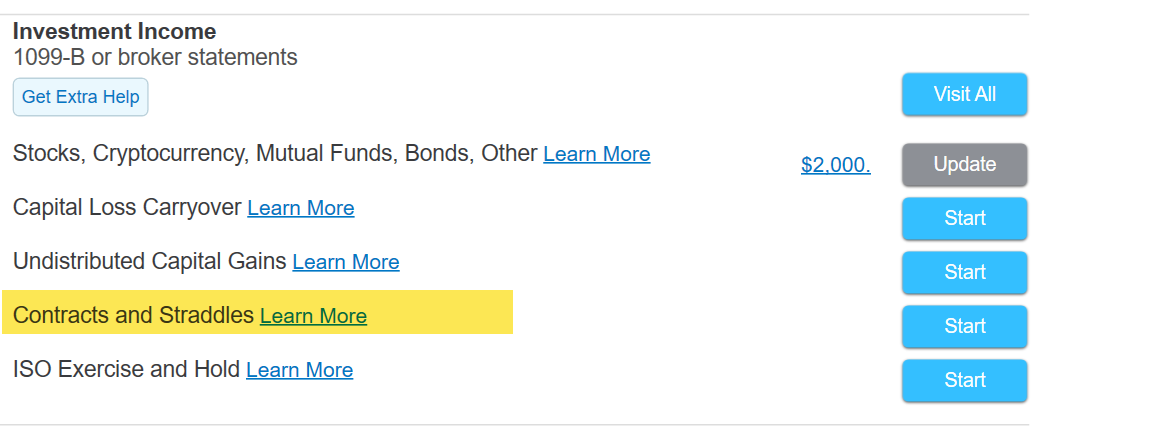

You enter income from straddles in the Wages and Income section of TurboTax, then Investments Income, then Contracts and Straddles:

You can enter the Form 1099-MISC so it will correspond with the copy the IRS receives. You then need to enter a negative amount to "other income" to cancel out the income as follows:

1. From the Federal menu in TurboTax find Wages and Income

2. Find Less Common Income

3. Choose Miscellaneous Income, 1099-A, 1099-C

4. Choose Other Reportable Income

5. Enter a description of the adjustment and the amount as a negative number

**Mark the post that answers your question by clicking on "Mark as Best Answer"