Box 8 shows substitute payments in lieu of dividends or tax-exempt interest received by your broker on your behalf as a result of a loan of your securities. Report on the “Other income” line of Schedule 1 (Form 1040).

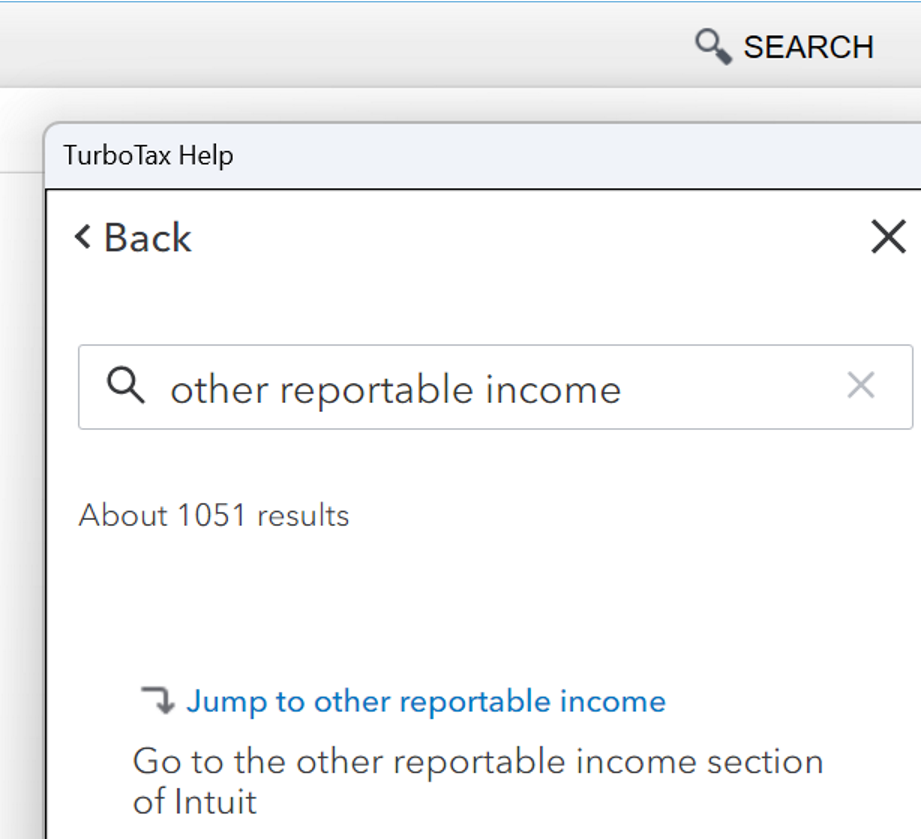

You can search for other reportable income (use that exact phrase) and use the Jump to other reportable income link in the search results. Or you can go through the interview screens - Here's how to enter it into TurboTax:

- With your return open, go to Federal then Wages & Income

- Open the Less Common Income section and select Start or Revisit next to Miscellaneous Income, 1099-A, 1099-C

- On the next screen, select Start or Revisit the very last entry, Other Reportable Income

- Answer Yes on the Any Other Taxable Income? screen

- On the next screen, enter a description and then enter the total USD amount

- Select Continue then Done

OR

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"