- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- K1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1

This year my K1 includes a Line 20Z Information entry. My group provided IRC Section 199A QBI Deduction computations, including Ordinary Business Income, W-2 Wages and Unadjusted Basis of Assets $ values and totals. However, it doesn't include how to calculate the deduction using the values provided. And there is no Schedule A provided with the K1. Our company provides no tax advisor. Does anyone know how to determine the correct line entry for Line 20Z Information?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1

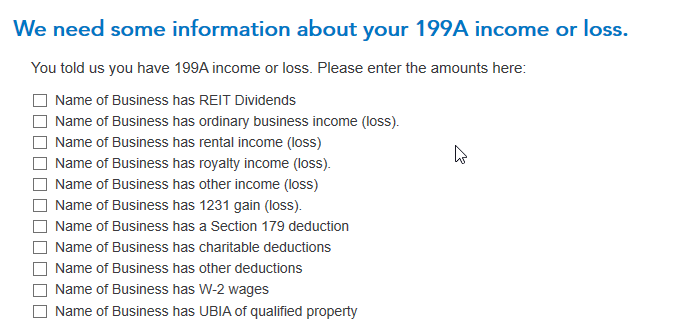

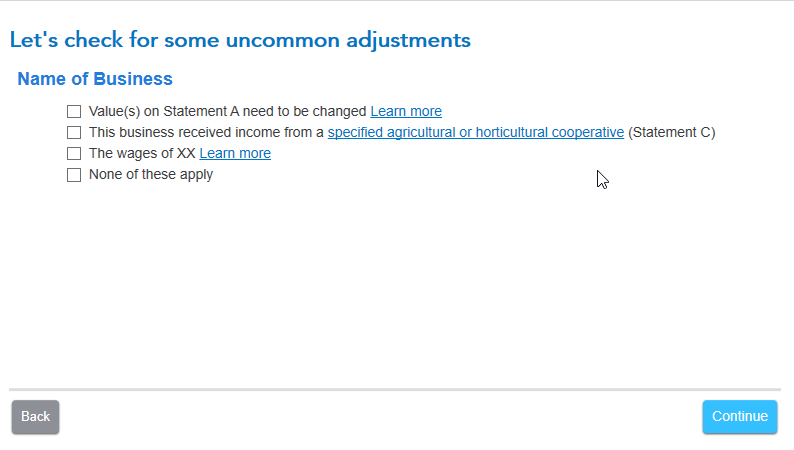

Enter the code Z when you enter the K-1 box 20 screen, but you don't need to enter an amount on that screen. Continue on, and you'll eventually find the screen "We need some more information about your 199A income or loss". When you check the box next to a category on that screen, a place will open up to enter the amounts from the Section 199A statement that came with your K-1 (that's what TurboTax is calling a Statement A). The applicable category (or categories) on this screen (and the following "Let's check for some uncommon adjustments" screen, if applicable) must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

Note that UBIA is an acronym for Unadjusted Basis In Assets.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here are the "We need some information about your 199A income or loss" and "Let's check for some uncommon adjustments" screens where you enter the information from your K-1 Section 199A Statement/STMT:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jeannie67deas

New Member

seanmitchell1021

New Member

seshadri1

Level 2

coralwealth

New Member

Amakia

New Member