- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- I published a book in 2020 & last posted videos on YouTube in 2022. I earn royalties but have no expenses. What do I enter for source of royalties on 1099- misc?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I published a book in 2020 & last posted videos on YouTube in 2022. I earn royalties but have no expenses. What do I enter for source of royalties on 1099- misc?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I published a book in 2020 & last posted videos on YouTube in 2022. I earn royalties but have no expenses. What do I enter for source of royalties on 1099- misc?

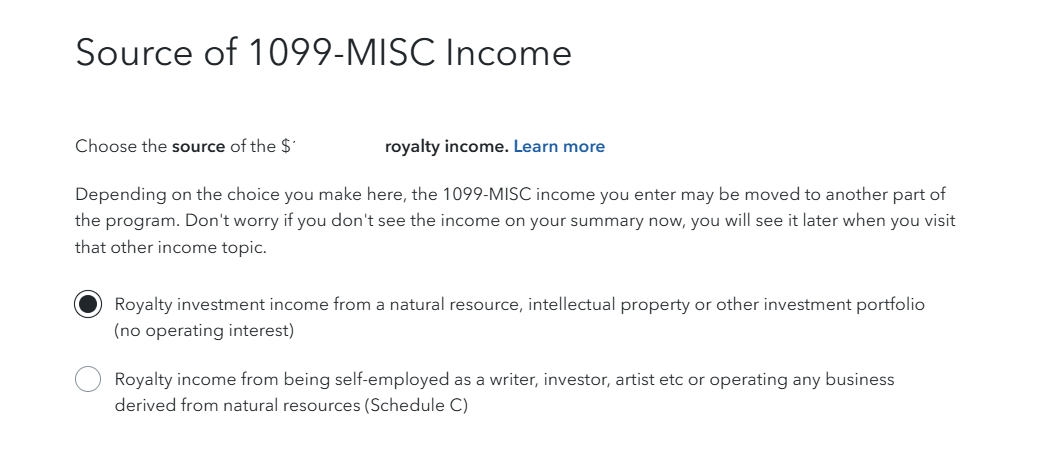

From the information you provided, the income from the royalties received on the sales of your book/videos should be reported on Schedule E, so you would choose the first option when entering your 1099-MISC "Royalty investment income from a natural resource, intellectual property or other investment portfolio." Depending on which option you choose, the income will be reported on a different schedule on your tax return. The first option, "natural resource or intellectual property" will flow to Schedule E, while the second option, "being self-employed as a writer, inventor, artist" will flow to Schedule C.

Here are the instructions for reporting How do I enter a 1099-MISC for royalty income?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cbusbee47

New Member

idowalls1737

New Member

Sdubois10

New Member

lkooken

New Member

lexilink

New Member