- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self employed

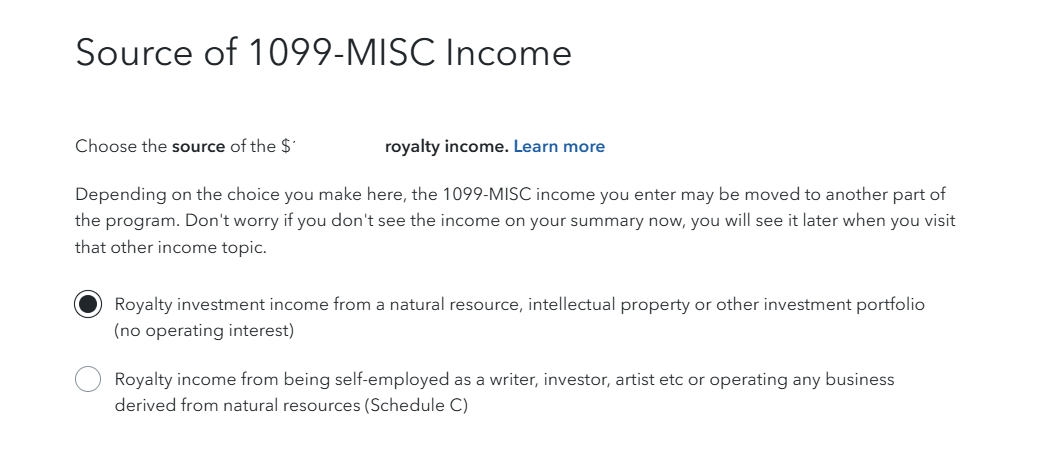

From the information you provided, the income from the royalties received on the sales of your book/videos should be reported on Schedule E, so you would choose the first option when entering your 1099-MISC "Royalty investment income from a natural resource, intellectual property or other investment portfolio." Depending on which option you choose, the income will be reported on a different schedule on your tax return. The first option, "natural resource or intellectual property" will flow to Schedule E, while the second option, "being self-employed as a writer, inventor, artist" will flow to Schedule C.

Here are the instructions for reporting How do I enter a 1099-MISC for royalty income?

February 5, 2025

6:07 AM