- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- how do report a 1099-NEC for completing college classes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do report a 1099-NEC for completing college classes?

My local County Office of Education has a program where they give you a stipend for completing college classes towards an education degree. They also give a lump sum when you complete an associates or bachelors degree.

This money goes to me not to my college so they sent me a 1099-NEC.

I'm a full time student living at home (dependent) and seem to owe a lot of taxes on this both Federal and State.

I'm trying to work out if I've entered this correctly. I don't work for them. I submit an application, send in my grades and they send me a check.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do report a 1099-NEC for completing college classes?

Yes. If you have form 8615 you are paying kiddie tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do report a 1099-NEC for completing college classes?

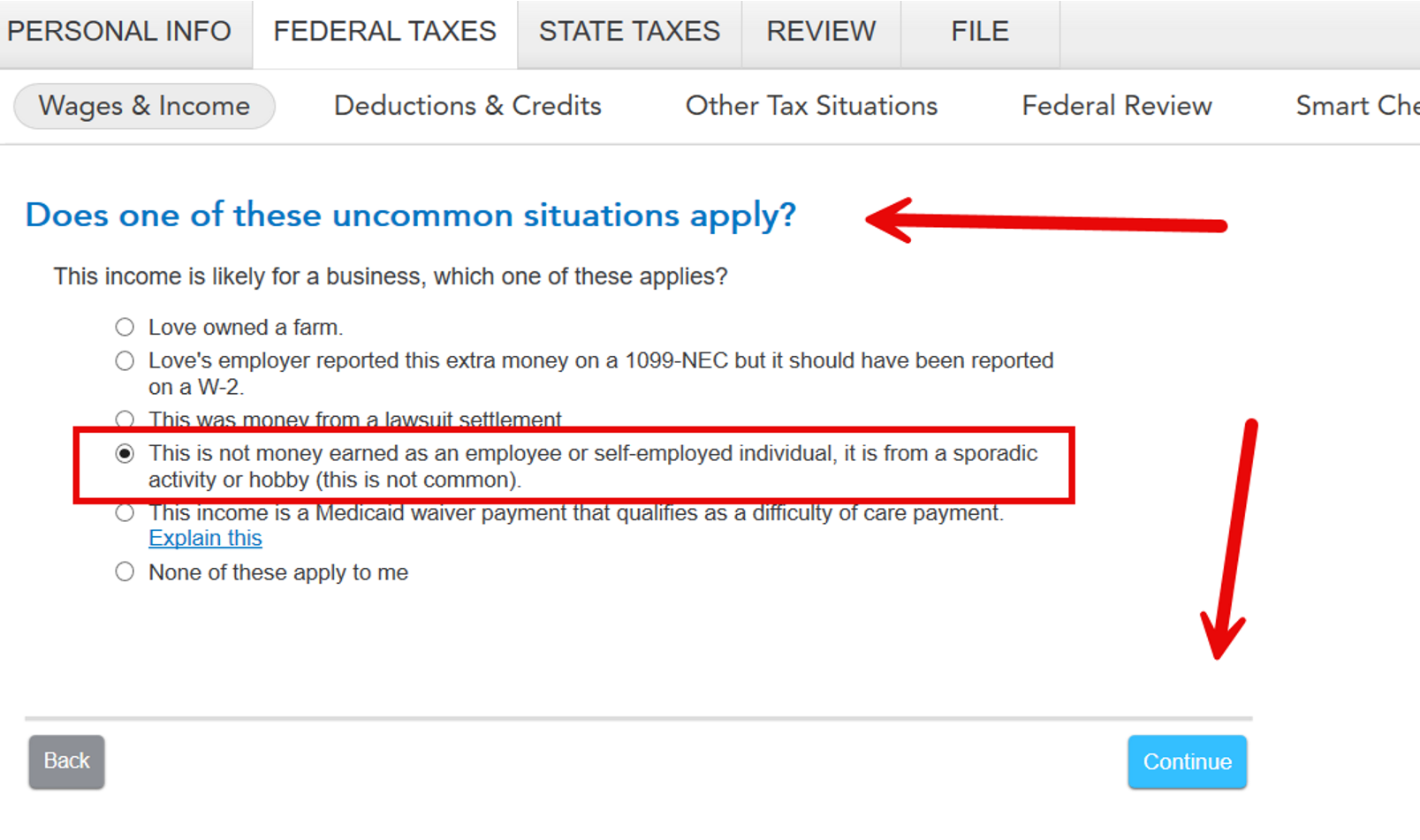

It sounds like you may be being taxed as self-employment income on this 1099-NEC. Since you did not work for them, when you enter the 1099-NEC, you will come to questions afterwards. Select this was received for Sporadic Activity or a hobby. This will change this income from self-employment income to Other Income which is how it should be reported.

Note, this is not a question on the tax form, it just tells TurboTax where to report it.

Having it treated as other income will not avoid the taxes altogether, however, it will avoid the 15.3% self-employment taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do report a 1099-NEC for completing college classes?

I have picked sporadic activity or hobby. It's still taxing that income as self employment income on both Federal and California State. Is this because I'm being claimed as a dependent on my parents taxes or an error in TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do report a 1099-NEC for completing college classes?

What makes you say it is being treated as Self-=Employment income?

Does your return include Schedule C, Schedule SE, and tax listed on Schedule 2 line 4 and also on your 1040 line 23?

Here is how to preview your 1040 using TurboTax Online

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do report a 1099-NEC for completing college classes?

It appears they are taxing it at 15% based on the following numbers.

1099-NEC $6950

All other W2 Income - $3617

1099-Interest - $764

Federal Tax Due $1,342

California State Tax Due $430

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do report a 1099-NEC for completing college classes?

Based on your numbers you are correct. You should delete the 1099-NEC that you have entered and try re-entering it as a new 1099-NEC.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do report a 1099-NEC for completing college classes?

I've tried using TurboTax a few different times for this return and I'm ready to switch to another platform because this is crazy. Removing and adding back makes no difference.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do report a 1099-NEC for completing college classes?

Delete the erroneous 1099 AND DELETE the Schedule C that was accidentally started when the 1099 was entered the first time. Leave only the one 1099-misc you have marked as sporadic (not self-employment) income.

How to delete forms in TurboTax Online

How to delete forms in TurboTax Desktop

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do report a 1099-NEC for completing college classes?

I deleted the Schedule C and the 1099-NEC.

I then re-entered the 1099-NEC and the same tax obligation shows up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do report a 1099-NEC for completing college classes?

It looks like self employment tax is in there, which is wrong. I think at this point you may have a piece of data stuck. So let's do a few things.

- Delete the form 1099-NEC - see How to Delete

- Log out of your return and try one or more of the following:

It is not business income so let's go through the steps. Online and desktop have a little difference but this should get you through either one.

- Open your return to the federal income section

- Select income from Form 1099-NEC

- Enter the information from your form

- Continue

- Describe the reason

- Continue

- Does one of these uncommon situations apply?

- Select not earned, sporadic, hobby - the screenshots different -

- online, select hobby

- desktop chooses sporadic

- Continue

- See the NEC summary

- Done

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do report a 1099-NEC for completing college classes?

I have done 5 different returns to try and make this work. As long as I am being claimed as a dependent on my parents tax return I end up owing almost $2k.

Do I really have to pay self employment taxes just because I'm a dependent or is there an issue with the TurboTax desktop software?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do report a 1099-NEC for completing college classes?

Did you use this money for education expenses? Did you see any mention of a kiddie tax? Did it ask you anything about your parents income? Does the amount you owe change when you say you are not a dependent?

You do NOT have to pay Self-Employment taxes because your parents claim you, that has NO affect on whether or not your ay self-employment tax. However, if you have UNEARNED income, and your parents are claiming you, you may be paying the Kiddie tax. That means your unearned income would be taxed at your parents tax rate instead of your tax rate.

Do you have form 8615 in your return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do report a 1099-NEC for completing college classes?

Yes there is a Form 8615 when I did a brand new return asking about my parents income. So it sounds like I'm paying kiddie tax and not self employment tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how do report a 1099-NEC for completing college classes?

Yes. If you have form 8615 you are paying kiddie tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.