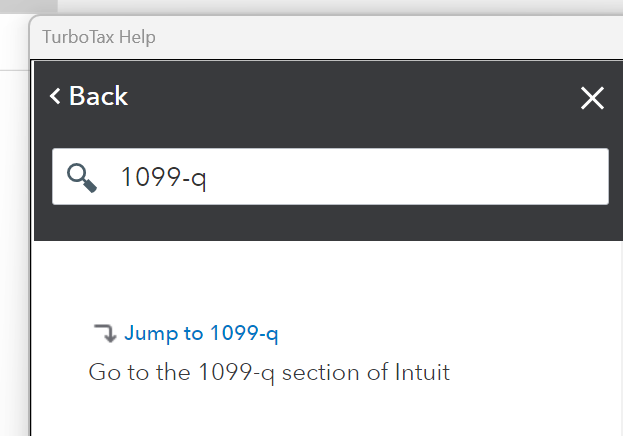

You can search for 1099-Q, then use the Jump to 1099-Q link to be taken back to where you can edit your entries. If you know that the distributions from the 529 plan are not taxable because they were used on qualified expenses, there is no need to enter the 1099-Q form. For most qualified education program beneficiaries, the amounts reported on the 1099-Q aren’t reported on a tax return.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"